Question

Andy, Belinda, and Chris formed a partnership on 1/1/2021. Andy contributed $35659 and is entitled to 25% of capital and 40% and losses. Belinda

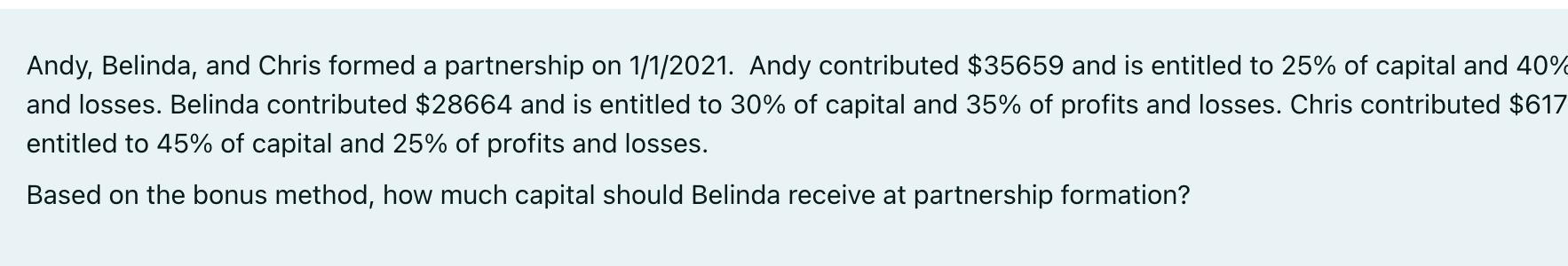

Andy, Belinda, and Chris formed a partnership on 1/1/2021. Andy contributed $35659 and is entitled to 25% of capital and 40% and losses. Belinda contributed $28664 and is entitled to 30% of capital and 35% of profits and losses. Chris contributed $617 entitled to 45% of capital and 25% of profits and losses. Based on the bonus method, how much capital should Belinda receive at partnership formation? Based on the goodwill method, what will Andy's initial capital position be?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Belinda capital at the time of partnership formation The following information was gi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie L. Miller nobles, Brenda L. Mattison, Ella Mae Matsumura

12th edition

9780134487151, 013448715X, 978-0134674681

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App