Angela Green, an investment manager at Horizon Investments, intends to hire a new investment analyst. After conducting initial interviews, Green has narrowed the pool

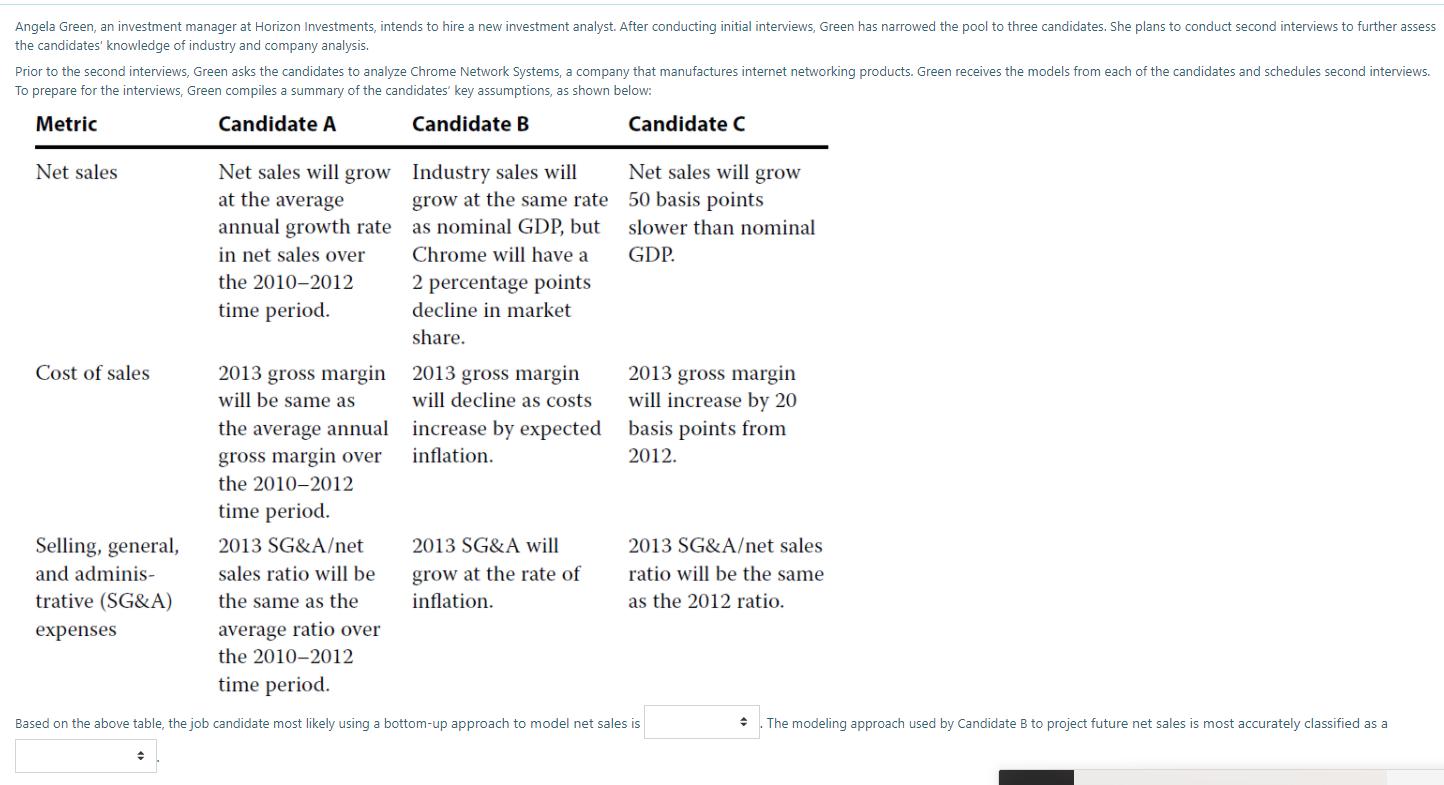

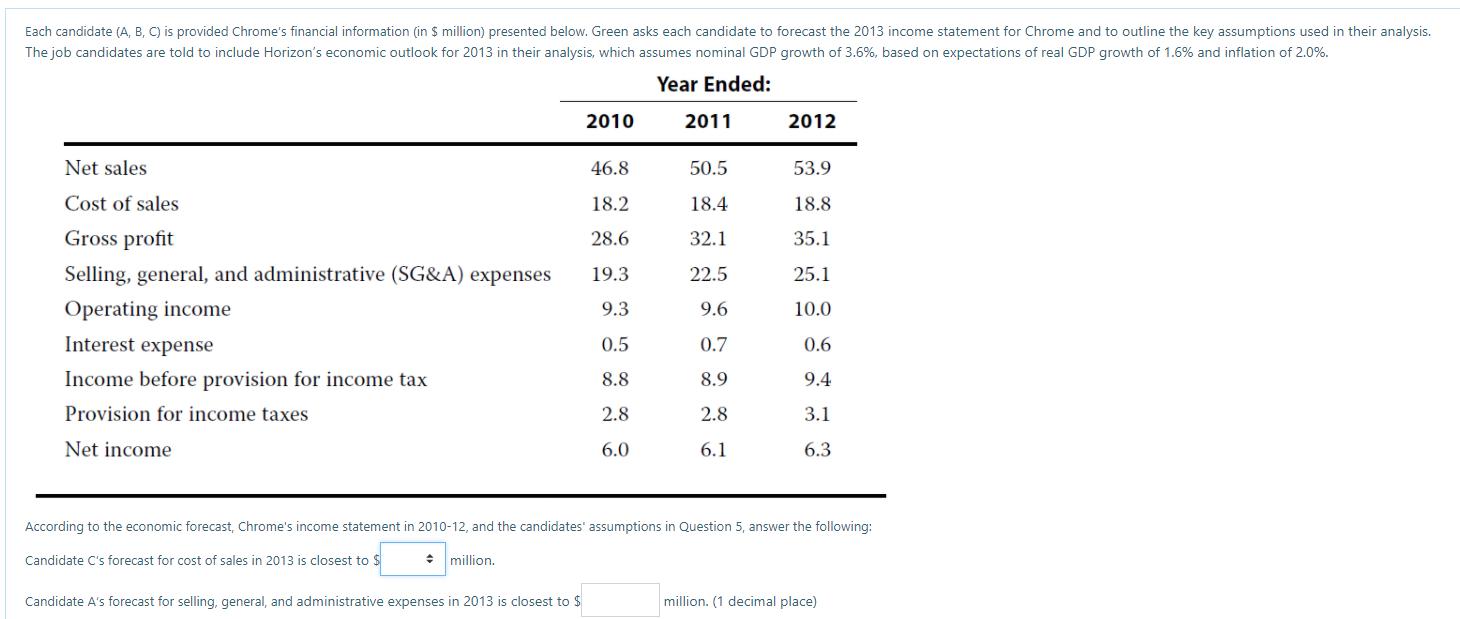

Angela Green, an investment manager at Horizon Investments, intends to hire a new investment analyst. After conducting initial interviews, Green has narrowed the pool to three candidates. She plans to conduct second interviews to further assess the candidates' knowledge of industry and company analysis. Prior to the second interviews, Green asks the candidates to analyze Chrome Network Systems, a company that manufactures internet networking products. Green receives the models from each of the candidates and schedules second interviews. To prepare for the interviews, Green compiles a summary of the candidates' key assumptions, as shown below: Metric Candidate A Candidate B Candidate C Net sales Net sales will grow Net sales will grow Industry sales will at the average grow at the same rate 50 basis points annual growth rate as nominal GDP, but in net sales over slower than nominal Chrome will have a GDP. the 2010-2012 2 percentage points time period. decline in market share. Cost of sales 2013 gross margin will be same as 2013 gross margin will decline as costs 2013 gross margin will increase by 20 the average annual gross margin over the 2010-2012 increase by expected basis points from inflation. 2012. time period. Selling, general, 2013 SG&A/net 2013 SG&A will 2013 SG&A/net sales and adminis- sales ratio will be grow at the rate of ratio will be the same trative (SG&A) the same as the inflation. as the 2012 ratio. average ratio over the 2010-2012 expenses time period. Based on the above table, the job candidate most likely using a bottom-up approach to model net sales is The modeling approach used by Candidate B to project future net sales is most accurately classified as a Each candidate (A, B, C) is provided Chrome's financial information (in $ million) presented below. Green asks each candidate to forecast the 2013 income statement for Chrome and to outline the key assumptions used in their analysis. The job candidates are told to include Horizon's economic outlook for 2013 in their analysis, which assumes nominal GDP growth of 3.6%, based on expectations of real GDP growth of 1.6% and inflation of 2.0%. Year Ended: 2010 2011 2012 Net sales 46.8 50.5 53.9 Cost of sales 18.2 18.4 18.8 Gross profit 28.6 32.1 35.1 Selling, general, and administrative (SG&A) expenses 19.3 22.5 25.1 Operating income 9.3 9.6 10.0 Interest expense 0.5 0.7 0.6 Income before provision for income tax 8.8 8.9 9.4 Provision for income taxes 2.8 2.8 3.1 Net income 6.0 6.1 6.3 According to the economic forecast, Chrome's income statement in 2010-12, and the candidates' assumptions in Question 5, answer the following: Candidate C's forecast for cost of sales in 2013 is closest to $ : million. Candidate A's forecast for selling, general, and administrative expenses in 2013 is closest to $ million. (1 decimal place)

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The cost of sales in 2013 is 193 million The SGA expense in 2013 is 255 million Solution Part 1 Cand...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started