Answered step by step

Verified Expert Solution

Question

1 Approved Answer

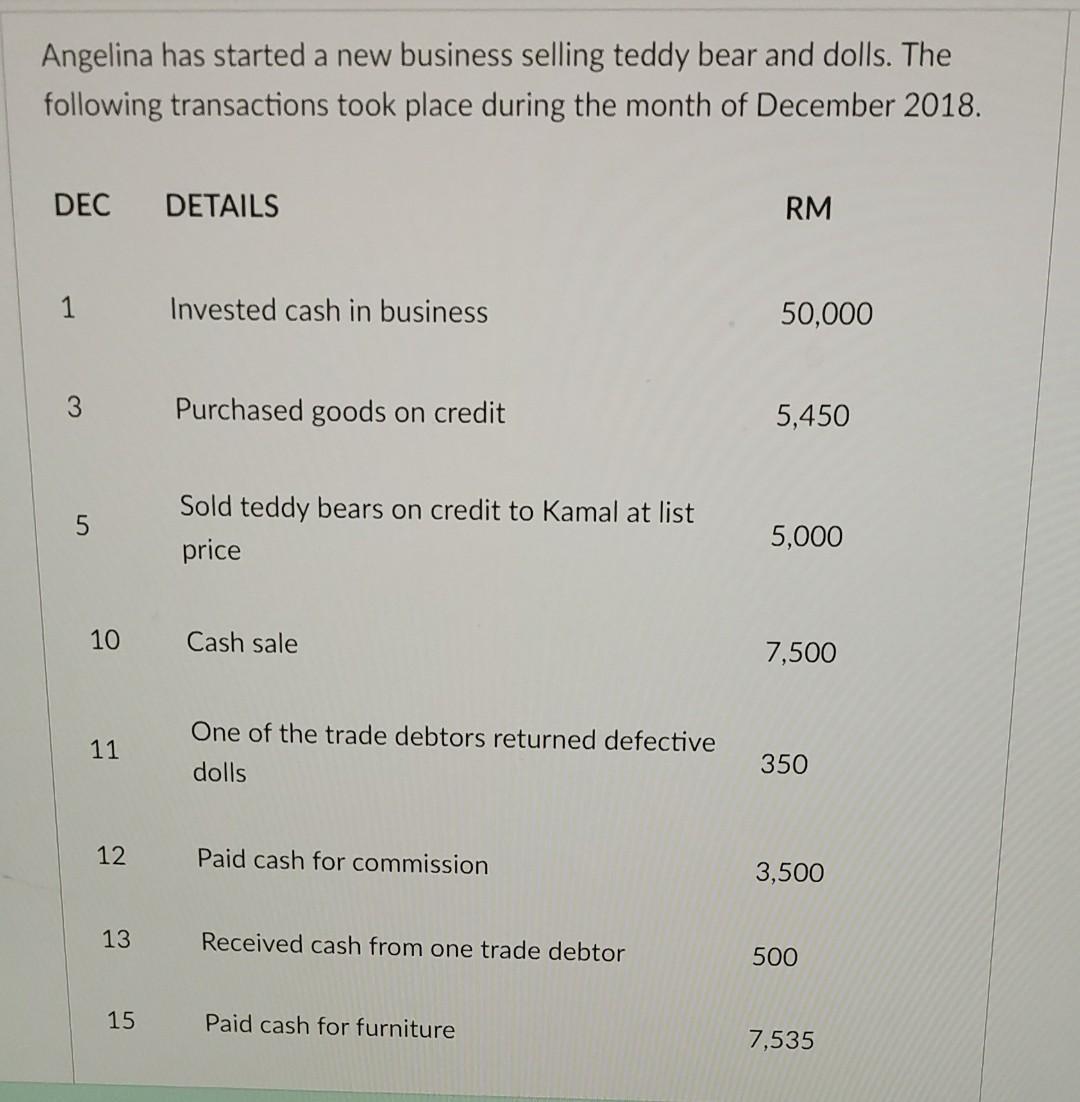

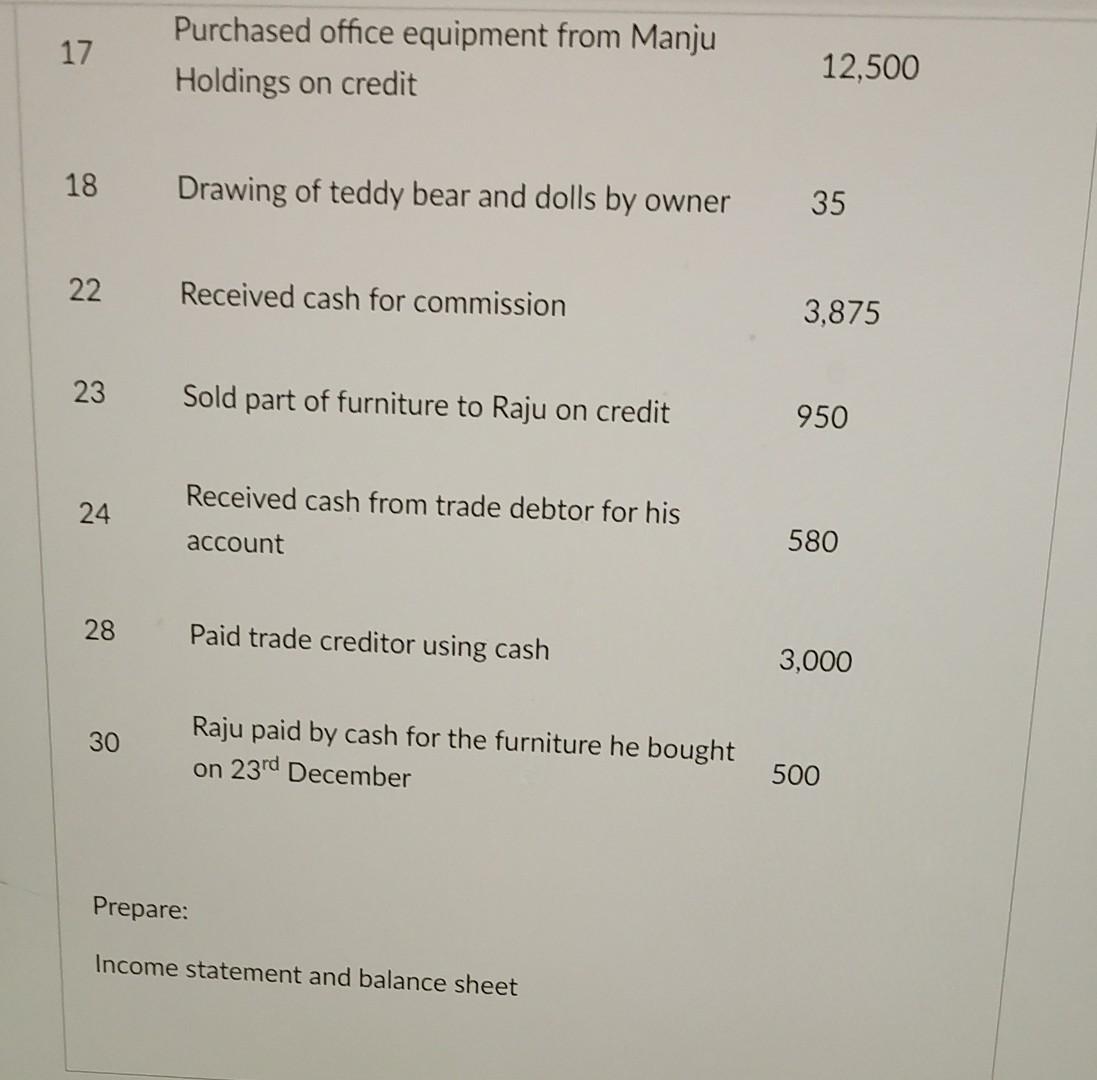

Angelina has started a new business selling teddy bear and dolls. The following transactions took place during the month of December 2018. DEC DETAILS

Angelina has started a new business selling teddy bear and dolls. The following transactions took place during the month of December 2018. DEC DETAILS RM 1 Invested cash in business 50,000 3 Purchased goods on credit 5,450 Sold teddy bears on credit to Kamal at list 5,000 price 10 Cash sale 7,500 One of the trade debtors returned defective 11 dolls 350 12 Paid cash for commission 3,500 13 Received cash from one trade debtor 500 15 Paid cash for furniture 7,535 Purchased office equipment from Manju 17 12,500 Holdings on credit 18 Drawing of teddy bear and dolls by owner 35 22 Received cash for commission 3,875 23 Sold part of furniture to Raju on credit 950 Received cash from trade debtor for his 24 580 account 28 Paid trade creditor using cash 3,000 Raju paid by cash for the furniture he bought on 23rd December 30 500 Prepare: Income statement and balance sheet

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Trial Balance Income Statement Accounts Debit Credit Revenue Cash 48...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started