The following transactions took place during the month of February Feb 2 Performed services for $1,000 for a customer on account. Feb 3

The following transactions took place during the month of February

•Feb 2 – Performed services for $1,000 for a customer on account.

•Feb 3 – Paid $800 in rent for the month of February. •Feb 12 – Received payment in full for the services performed on Feb 2•Feb 14 – Paid wages of $1,000.

•Feb 16 – Performed services for $3,000 and received payment in cash immediately.

•Feb 18 – Paid utility bill of $375.

•Feb 20 – Performed services for $2,000 and received $500 in cash immediately, the rest was on account.

•Feb 21 – Purchased supplies from a vendor on account for $550 (Hint – these supplies won’t be used right away).

•Feb 22 – Purchased miscellaneous expenses in the amount of $400.

•Feb 25 – Received payment in the amount of $1,000 for the services performed on Feb 20.

•Feb 28 – The owner withdrew $500 from the business for personal use.

Adjustment Information for the end of February is provided below:

At the end of the month, a physical count revealed that there were $900 of supplies on hand as of February 28, 2021.

The Prepaid Insurance account is for a 12-month policy that began on February 1, 2021. Please record the insurance used for the month ending February 28, 2021.

The Equipment was purchased January 1, 2021, has a 5-year useful life, no salvage value, and has been depreciated under the Straight-Line Method. The bookkeeper forgot to record the depreciation expense for the month of January, so you’re responsible for recording depreciation for both January and February. Please record as one entry.

Salaries accrued, but not paid, totaled $1,650 for the month of February. Please record the accrued salaries for the month of February.

Assignment:

1.Record the beginning balances on the T-Account tab of the Excel template provided.

2.Record the transactions in the journalUsing the Excel templates provided, navigate to the General Journal tab and record the dailytransactions provided. Please skip a line between each journal entry. Don’t forget about the Post Ref column. Although we won’t be posting to the General Ledger, it’s still important to develop good habits when recording transactions.

3.Post journal entries to the T-Accounts Post the journal entries made in Step 2 above to the T-Accounts provided in the Excel template. You should have already entered the beginning account balances into your T-Accounts from Step 1 above. Please don’t skip lines in the T-Accounts. The account balance will automatically update after each entry is posted. In the column to the left of the T-Account you’re posting to, enter the date of the transaction, excluding the year. For example, for the Feb 2 transaction, enter 2/2.

4.Prepare the Trial BalanceA Trial Balance template is already provided in the Excel file. Please navigate to the Trial Balance tab in the file and input the ending balances from your T-Accounts tab.Check figure: Total Debits & Credits should be $35,050. If you have a different total, please go back and double check your work.

5.Record the Adjusting Journal Entries Record the adjusting journal entries in the General Journal from the “Adjustment Information” above. Begin recording your adjusting entries below the bolded “Adjusting Journal Entries” in the General Journal. Please skip a line between entries. You will also 3 need to post these entries to the T-Account tab used in Step 3 above. When posting to the T-Accounts, use the date, 2/28 in the column to the left (like how you did in Step 3 above).

6.Prepare the Adjusted Trial BalanceUse the Adjusted Trial Balance Tab and enter in the accounts and their balances from the T-Accounts tab. Check figure: Total Debits & Credits should be $36,900. If you have a different total, please go back and double check your work.

7.Prepare the Financial Statements (Income Statement, Balance Sheet, and Statement of Owner’s Equity)Use the Adjusted Trial Balance Tab to complete the financial statements in the Excel file. Please only use the cells that are outlined. You are responsible for correctly filling out the financial statement headers. The templates should be very similar to what is shown in the book, so if you’re having difficulty please use the examples provided throughout the text as a guide. Check figure: Net Income should be $2,925. Total Assets should be $20,925. If you have different totals, please go back and double check your work.

8.Prepare the Closing EntriesRecord the closing entries in the General Journal based on the account balances in your T-Accounts after the adjusting journal entries. Begin recording your closing entries below the bolded “Closing Entries” in the General Journal. Please skip a line between entries. The account number for the Income Summary account is 350. You will also need to post these entries to the T-Account tab used in Step 3 above. When posting to the T-Accounts, type “Close” in the column to the left of the account you’re posting to.

9.Prepare the Post-Closing Trial BalanceUse the Post Closing TB tab in the Excel file to record the ending balances from your T-Accounts. Check figure: Total Debits & Credits should be $22,325. If you have a different total, please go back and double check your work.

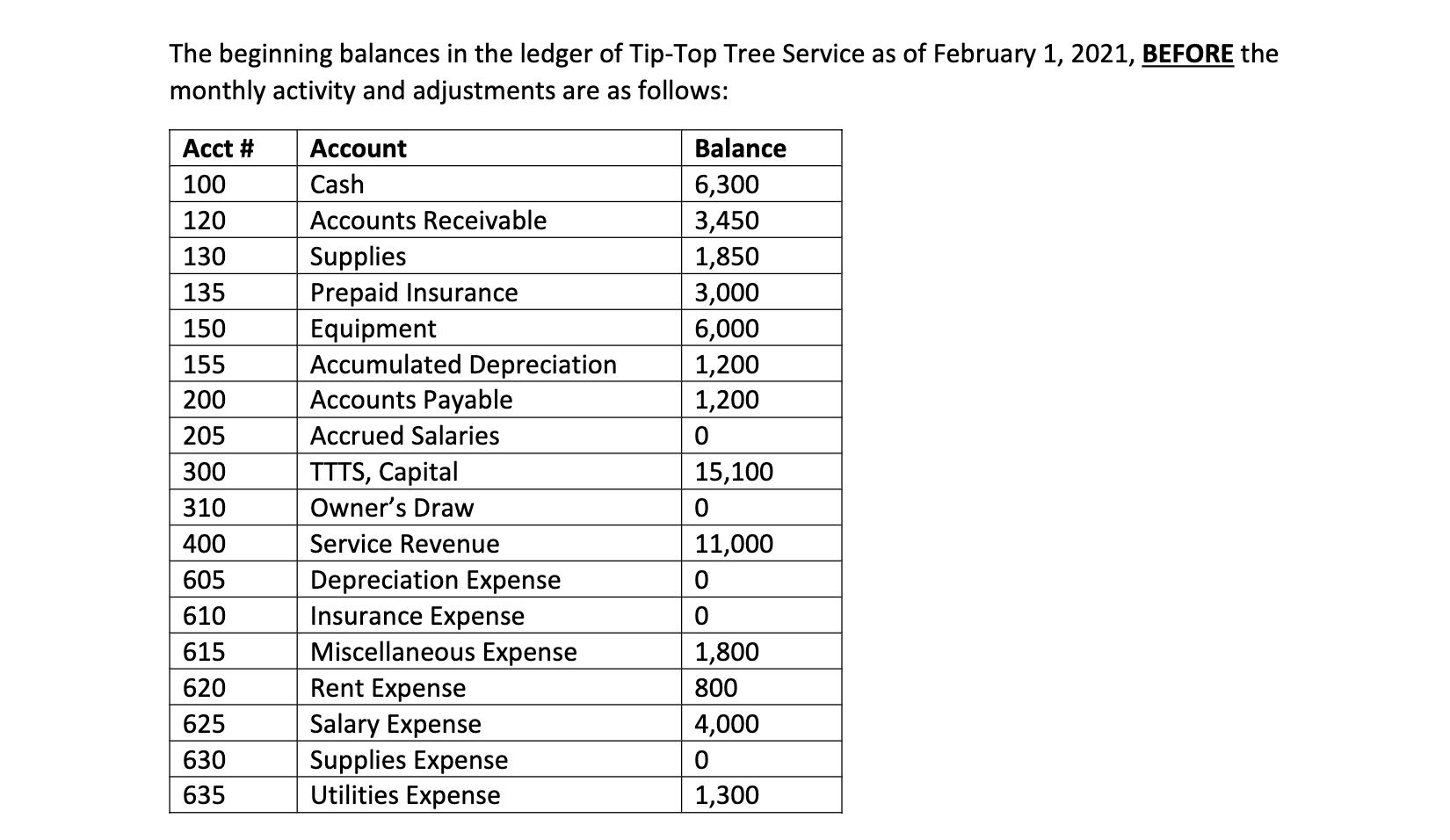

The beginning balances in the ledger of Tip-Top Tree Service as of February 1, 2021, BEFORE the monthly activity and adjustments are as follows: Acct # Account Balance 100 Cash 6,300 120 Accounts Receivable 3,450 130 Supplies 1,850 135 Prepaid Insurance 3,000 150 Equipment 6,000 155 Accumulated Depreciation 1,200 200 Accounts Payable 1,200 205 Accrued Salaries 300 TTTS, Capital 15,100 310 Owner's Draw 0 400 Service Revenue 11,000 605 Depreciation Expense 0 610 Insurance Expense 0 615 Miscellaneous Expense 1,800 620 Rent Expense 800 625 Salary Expense 4,000 630 Supplies Expense 0 635 Utilities Expense 1,300

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Journal Enterles Date Feb 2 Feb 3 Feb 12 Feb 14 Feb 16 Feb 18 Feb 20 Feb 21 Feb 22 Feb 25 Feb 28 Adj...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started