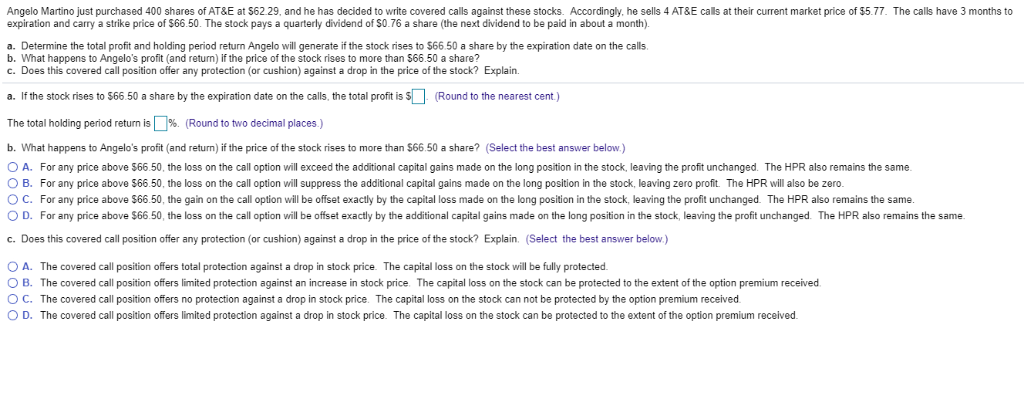

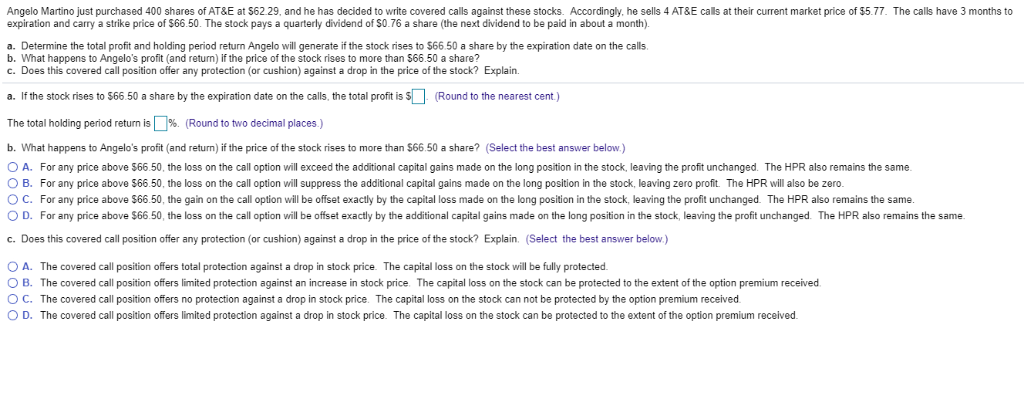

Angelo Martino just purchased 400 shares of AT&E at 562.29, and he has decided to write covered calls against these stocks. Accordingly he sells 4 AT&E cals at their current market price of $5.77. The calls have 3 months to expiration and carry a strike price of $66.50. The stock pays a quarterly dividend of $0.76 a share (the next dividend to be paid in about a month). a. Determine the total profit and holding period return Angelo will generate if the stock rises to $66.50 a share by the expiration date on the calls b. What happens to Angelo's profit (and return) if the price of the stock rises to more than $66.50 a share? c. Does this covered call position offer any protection (or cushion) against a drop in the price of the stock? Explain. a. If the stock rises to $66 50 a share by the expiration date on the calls, the total profit is (Round to the nearest cent) The total holding period return is D% (Round to two decimal places) b. What happens to Angelo's profit (and return) if the price of the stock rises to more than $66.50 a share? (Select the best answer below.) Round to the nearest cent.) O A. For any price above S66.50, the loss on the call option will exceed the additional capital gains made on the long position in the stock, leaving the proft unchanged. The HPR also remains the same O B For any price above S66.50. the loss on the call option will suppress the additional capital gains made on the long position in the stock, leaving zero profit. The HPR will also be zero. O C. For any price above $66.50, the gain on the call option will be offset exactly by the capital loss made on the long position in the stock, leaving the profit unchanged. The HPR also remains the same O D For any price above $66 50, the loss on the call option will be offset exactly by the additional capital gains made on the long position in the stock, leaving the profit unchanged The HPR also remains the same c. Does this covered call position offer any protection (or cushion) against a drop in the price of the stock? Explain. (Select the best answer below.) O A. The covered call position offers total protection against a drop in stock price The capital loss on the stock will be fully protected O B. The covered call position offers limited protection against an increase in stock price. The capital loss on the stock can be protected to the extent of the option premium received C. The covered call position offers no protection against a drop in stock price. The capital loss on the stock can not be protected by the option premium received D. The covered call position offers limited protection against a drop in stock price. The capital loss on the stock can be protected to the extent ofthe option premium received Angelo Martino just purchased 400 shares of AT&E at 562.29, and he has decided to write covered calls against these stocks. Accordingly he sells 4 AT&E cals at their current market price of $5.77. The calls have 3 months to expiration and carry a strike price of $66.50. The stock pays a quarterly dividend of $0.76 a share (the next dividend to be paid in about a month). a. Determine the total profit and holding period return Angelo will generate if the stock rises to $66.50 a share by the expiration date on the calls b. What happens to Angelo's profit (and return) if the price of the stock rises to more than $66.50 a share? c. Does this covered call position offer any protection (or cushion) against a drop in the price of the stock? Explain. a. If the stock rises to $66 50 a share by the expiration date on the calls, the total profit is (Round to the nearest cent) The total holding period return is D% (Round to two decimal places) b. What happens to Angelo's profit (and return) if the price of the stock rises to more than $66.50 a share? (Select the best answer below.) Round to the nearest cent.) O A. For any price above S66.50, the loss on the call option will exceed the additional capital gains made on the long position in the stock, leaving the proft unchanged. The HPR also remains the same O B For any price above S66.50. the loss on the call option will suppress the additional capital gains made on the long position in the stock, leaving zero profit. The HPR will also be zero. O C. For any price above $66.50, the gain on the call option will be offset exactly by the capital loss made on the long position in the stock, leaving the profit unchanged. The HPR also remains the same O D For any price above $66 50, the loss on the call option will be offset exactly by the additional capital gains made on the long position in the stock, leaving the profit unchanged The HPR also remains the same c. Does this covered call position offer any protection (or cushion) against a drop in the price of the stock? Explain. (Select the best answer below.) O A. The covered call position offers total protection against a drop in stock price The capital loss on the stock will be fully protected O B. The covered call position offers limited protection against an increase in stock price. The capital loss on the stock can be protected to the extent of the option premium received C. The covered call position offers no protection against a drop in stock price. The capital loss on the stock can not be protected by the option premium received D. The covered call position offers limited protection against a drop in stock price. The capital loss on the stock can be protected to the extent ofthe option premium received