Answered step by step

Verified Expert Solution

Question

1 Approved Answer

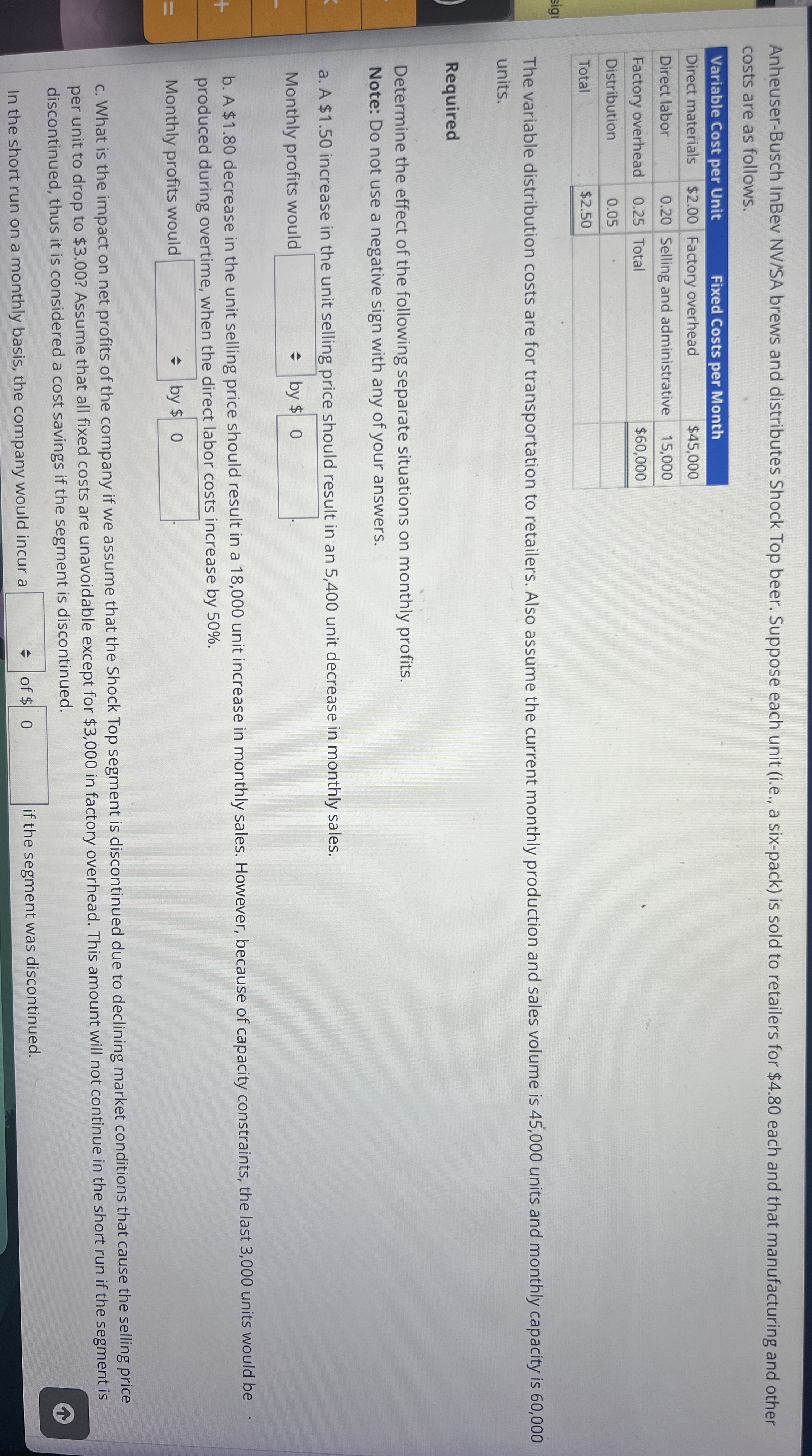

Anheuser - Busch InBev NV / SA brews and distributes Shock Top beer. Suppose each unit ( i . e . , a six -

AnheuserBusch InBev NVSA brews and distributes Shock Top beer. Suppose each unit ie a sixpack is sold to retailers for $ each and that manufacturing and other

costs are as follows.

The variable distribution costs are for transportation to retailers. Also assume the current monthly production and sales volume is units and monthly capacity is

units.

Required

Determine the effect of the following separate situations on monthly profits.

Note: Do not use a negative sign with any of your answers.

a A $ increase in the unit selling price should result in an unit decrease in monthly sales.

Monthly profits would

by $

b A $ decrease in the unit selling price should result in a unit increase in monthly sales. However, because of capacity constraints, the last units would be

produced during overtime, when the direct labor costs increase by

Monthly profits would

by $

per unit to drop to $ Assume that all fixed costs are unavoidable except for $ in factory overhead. This amount will not continue in the short run if the segment is

discontinued, thus it is considered a cost savings if the segment is discontinued.

In the short run on a monthly basis, the company would incur a

of $

if the segment was discontinued.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started