Question

Anita Mann, Marsha Mellow, and Tequila Mockingbird each own one-third of the common stock of Three M Inc. (TMI). TMI was incorporated on February 1,

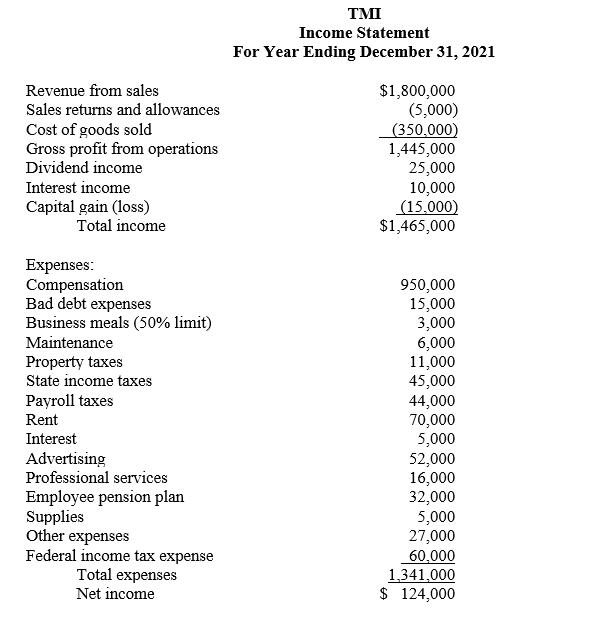

Anita Mann, Marsha Mellow, and Tequila Mockingbird each own one-third of the common stock of Three M Inc. (TMI). TMI was incorporated on February 1, 2012. It has only one class of stock outstanding and operates as a C corporation since its inception. TMI caters all types of social events throughout east Texas and Louisiana. The following is TMIs book income statement for 2021:

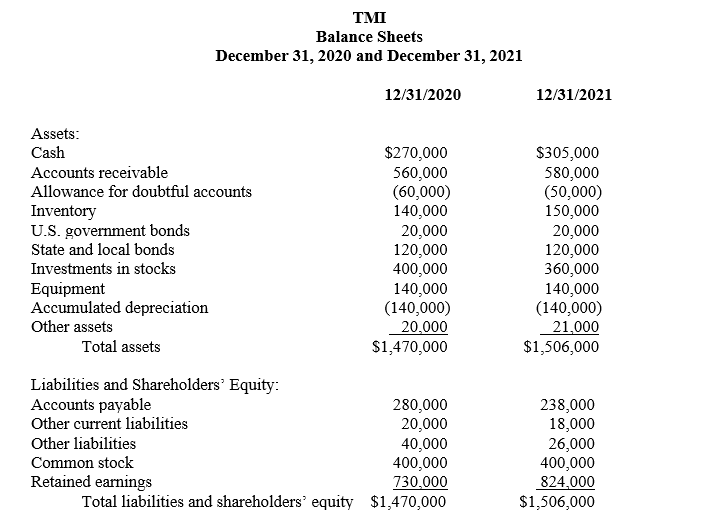

The following are TMIs book balance sheets as of December 31, 2020 and December 31, 2021:

Other Information:

TMI is located at 3400 Montrose Blvd, Suite 1900, Houston, TX 77006.

TMIs employer identification number is 76-1234567.

TMIs business activity is catering food and services. Its business activity code is 722300.

The three shareholders also work as officers for the corporation. Anita Mann is the chief executive officer and president (social security number (SSN) 462-10-2222). Marsha Mellow is the executive vice president and chief operating officer (SSN 464-14-3333). Tequila Mockingbird is the vice president of finance (SSN 469-18-4444); she is the corporate officer who will be signing the return.

All officers devote 100% of their time to the business and they are all U.S. citizens.

TMI uses the accrual method of accounting and has a calendar year-end.

TMI made four equal estimated tax payments of $15,000 each on 4/15/21, 6/15/21, 9/15/21, and 12/15/21. Its tax liability last year was $70,000. If it has overpaid its federal tax liability, TMI would like to receive a refund check but they are not interested in applying for a quick refund. TMI also does not want to e-file the return.

TMI paid a dividend of $10,000 to each of its three shareholders on November 1. TMI had ample earnings and profits (E&P) to absorb the distribution.

TMIs inventory-related purchases during 2021 were $360,000. It values its inventory based on cost using the FIFO inventory cost flow method. Assume the rules of Section 263A do not apply to TMI.

Of the $10,000 interest income, $3,000 was from a Vidor, TX bond that was used to fund public activities (issued in 2015), $1,000 was from a U.S. Treasury bond, and the remaining $6,000 was from IBC Bank money market account.

TMIs dividend income came from Muffin Man Inc. (MMI). TMI owned 10,000 shares of the stock in MMI at the start of the year, which was 10% of MMIs outstanding stock.

On October 1, TMI sold 1,000 shares of its MMI stock for $25,000. It had originally purchased these shares on April 18, 2018, for $40,000. After the sale, TMI owned 9% of MMI. TMI received a Form 1099-B showing proceeds and stock basis.

TMIs compensation is as follows: Anita $150,000; Marsha $140,000; Tequila $130,000; Others $530,000.

TMI wrote-off $25,000 in accounts receivable as uncollectible during the year.

At January 1, 2021, TMIs equipment was fully depreciated for both book and tax purposes.

The $5,000 interest expense was from a business loan.

Other expenses include $6,000 for premiums on term life insurance policies for which TMI is the beneficiary. The policies cover the lives of Anita, Marsha, and Tequila.

TMI is not a qualified personal service corporation or a personal holding company.

TMI has filed all required Forms 1099 for the year.

Required:

Prepare and print a paper return Form 1120 for Three M Inc. for tax year 2021, including Schedules C, D, G, J, K, L, M-1, M-2, and all accompanying statements and worksheets (Form 1125-A, 1125-E, and Supporting Details/Schedules/Worksheets).

TMI Income Statement For Year Ending December 31, 2021 Expenses: Compensation Bad debt expen Business meals Maintenance Property taxes State income tax Payroll taxes Rent Interest Advertising Professional ser Employee pens Supplies Other expenses 950,000 15,000 3,000 6,000 11,000 45,000 44,000 Federal income tax expense Total expenses $120124,000341,00060,000 TMI Balance Sheets December 31, 2020 and December 31, 2021 TMI Income Statement For Year Ending December 31, 2021 Expenses: Compensation Bad debt expen Business meals Maintenance Property taxes State income tax Payroll taxes Rent Interest Advertising Professional ser Employee pens Supplies Other expenses 950,000 15,000 3,000 6,000 11,000 45,000 44,000 Federal income tax expense Total expenses $120124,000341,00060,000 TMI Balance Sheets December 31, 2020 and December 31, 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started