Answered step by step

Verified Expert Solution

Question

1 Approved Answer

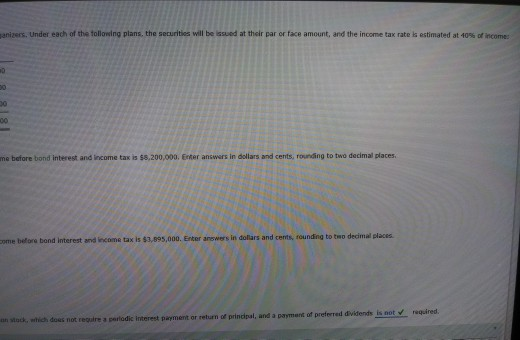

anizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate ls estimated

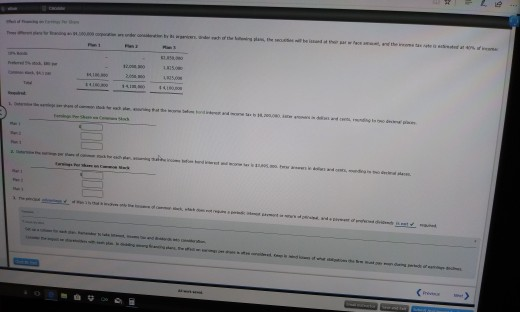

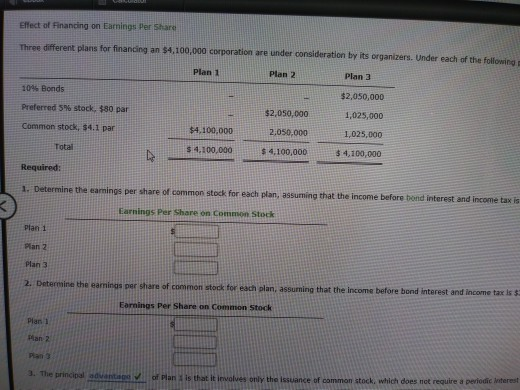

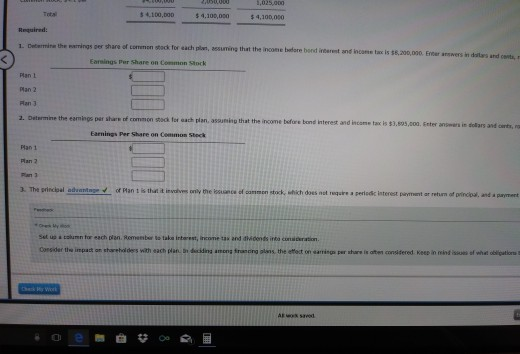

anizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate ls estimated at 40% of income: 0 ne before bond interest and income tax is $8,200,000. Enter answers in dollars and cents, rounding to two decimal places. ome belore bond interest and iecome tax is $3,895,000. Enter anowers in dolars and cents, rounding to tmo decimal places ant of preferred dividends is not required. an stock, which doss not requlre a pertodic Interest payment or return of principal, and a payma i Total 4.100,000$4,100,00o 4,00,00 Required: 1. Determine the earrings ser share of commen stock for each plan, aesuming that the income before berd inerent and income taxc is $8,20,.00. Eneer answers in dsitas ard cents, Earnings Per Share on Common Stock Plan t Ran 3 Detarmine the eamings par shars of common stock for each plan, assuming that the income before bond interest and income tax is $3,8,coa. Ester answers in dollars and cnts, ra Earnings Per Share on Cemmmon Stock . The srincoal ant Ran t is thuat it iev only te sece of commen stock uhich doss nst raqure a perledi isterest peyment ar etum of rincos, nd a pament Set us a column for each Dlan. Remensber to taka inberest, income tas and dvidends indo conaiceration Consider tl~ impact on rtarrholdes yth each planDr diing among tranong gons the etet on urine, per tat ir teraniaeed keepin reid aum madetint

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started