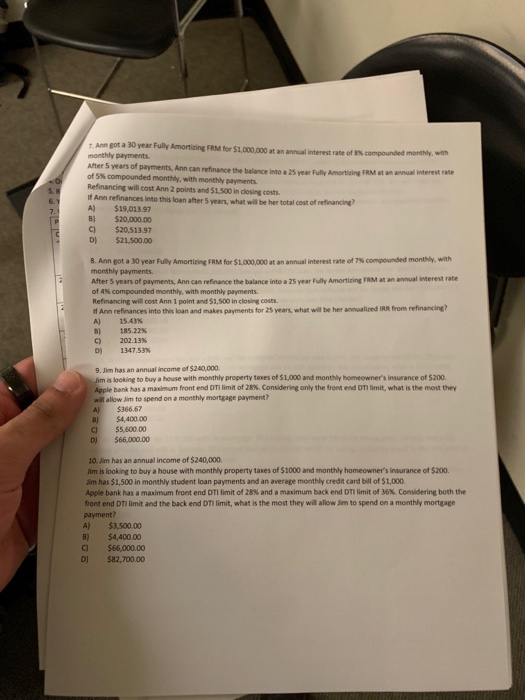

Ann got a 30 year Fully Amortizing FRM for $1,000,000 at an annual interest rate of S% compounded monthy. monthly payments After 5 years of payments, Ann can refinance the balance inte a 25 year Fully Amorticing FRM at n of 5% compounded moithly, with monthly payments. Refinancing will cost Ann 2 points and $1,500 in closing costs f Ann refinances into this loan after 5 years, what will be her total cost of refinancine A) $19,013.97 B) $20,000.00 C) $20,513.97 D) $21,500.00 monthly, with 8 Ann got a 30 year Fuly Armortiing FRM for Scoooo at an annual interest rate of 7% corponded monthly, with monthly payments After 5 years of payments, Ann can refinance the balance into a 25 year Fully Amortizing FRM at an annual interest rate of 4% compounded monthly, with monthly payments. Refinancing will cost Ann 1 point and $1,500 in closing costs if Ann refinances into this loan and makes payments for 25 years, what will be her anqualized IRR from refinancing? A)15.43% B) 185.22% C) 202.13% D) 1347.53% 9. Jim has an annual income of $240,000 is looking to buy a house with monthly property taxes of $1,000 and monthly homeowner's insurance of $200 Apple bank has a mainum front end DTI limit of 28%. Considering or by the front end DTI limit, what is the mos t they will allow lim to spend on a monthly mortgage payment? A) $366.67 B $4,400.00 C$5,600.00 D $66,000.00 10. Jim has an annual income of $240,000. im is looking to buy a house with monthly property taxes of $1000 and monthly homeowner's insurance of $200 im has $1,500 in monthly student loan payments and an average monthly credit card bill of $1,000 Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of 36% Considering both the front end DTI limit and the back end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? A) $3,500.00 B) $4,400.00 C) $66,000.00 D) $82,700.00 Ann got a 30 year Fully Amortizing FRM for $1,000,000 at an annual interest rate of S% compounded monthy. monthly payments After 5 years of payments, Ann can refinance the balance inte a 25 year Fully Amorticing FRM at n of 5% compounded moithly, with monthly payments. Refinancing will cost Ann 2 points and $1,500 in closing costs f Ann refinances into this loan after 5 years, what will be her total cost of refinancine A) $19,013.97 B) $20,000.00 C) $20,513.97 D) $21,500.00 monthly, with 8 Ann got a 30 year Fuly Armortiing FRM for Scoooo at an annual interest rate of 7% corponded monthly, with monthly payments After 5 years of payments, Ann can refinance the balance into a 25 year Fully Amortizing FRM at an annual interest rate of 4% compounded monthly, with monthly payments. Refinancing will cost Ann 1 point and $1,500 in closing costs if Ann refinances into this loan and makes payments for 25 years, what will be her anqualized IRR from refinancing? A)15.43% B) 185.22% C) 202.13% D) 1347.53% 9. Jim has an annual income of $240,000 is looking to buy a house with monthly property taxes of $1,000 and monthly homeowner's insurance of $200 Apple bank has a mainum front end DTI limit of 28%. Considering or by the front end DTI limit, what is the mos t they will allow lim to spend on a monthly mortgage payment? A) $366.67 B $4,400.00 C$5,600.00 D $66,000.00 10. Jim has an annual income of $240,000. im is looking to buy a house with monthly property taxes of $1000 and monthly homeowner's insurance of $200 im has $1,500 in monthly student loan payments and an average monthly credit card bill of $1,000 Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of 36% Considering both the front end DTI limit and the back end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? A) $3,500.00 B) $4,400.00 C) $66,000.00 D) $82,700.00