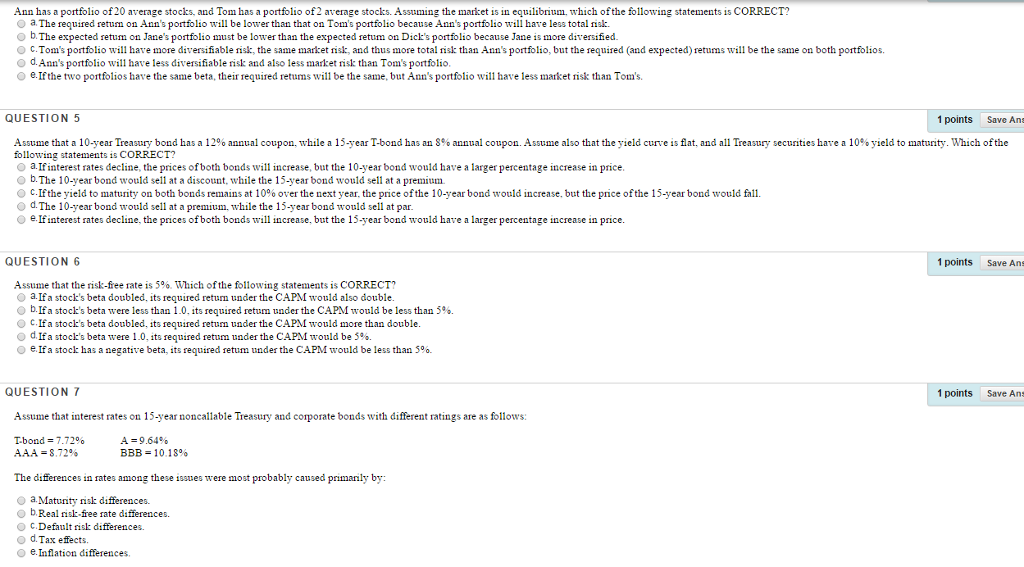

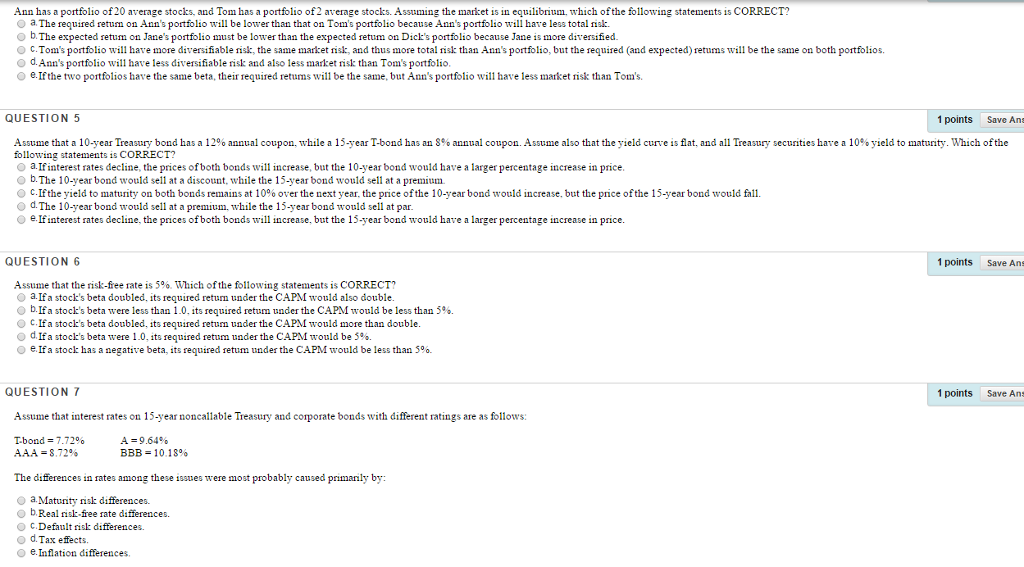

Ann has a portfolio of 20 average stocks, and Tom has a portfolio of 2 average stocks. Assuming the market is in equilibrium, which of the following statements is CORRECT? a. The required return on Ann's portfolio will be lower than that on Tom's portfolio because Ann's portfolio will have less total risk. b. The expected return on Jane's portfolio must be lower than the expected return on Dick's portfolio because Jane is more diversified. c. Tom's portfolio will have more diversifiable risk, the same market risk, and thus more total risk than Ann's portfolio, but the required (and expected) returns will be the same on both portfolios. d. Ann's portfolio will have less diversifiable risk and also less market risk than Tom's portfolio. e. If the two portfolios have the same beta, their required returns will be the same, but Ann's portfolio will have less market risk than Tom's. Assume that a 10-year Treasury bond has a 12% annual coupon, while a 15-year T-bond has an 8% annual coupon. Assume also that the yield curve is flat, and all Treasury securities have a 10% yield to maturity. Which of the following statements is CORRECT? a. If interest rates decline the prices of both bonds will increase, but the 10-year bond would have a larger percentage increase in puce b. The 10-year bond would sell at a discount, while the 15-year bond would sell at a premium c. If the yield to maturity on both bonds remains at 10% over the next year, the price of the 10-year bond would increase, but the price of the 15-year bond would fall. d. The 10-year bond would sell at a premium, while the 15-year bond would sell at par. e. If interest rates decline, the prices of both bonds will increase, but the 15-year bond would have a larger percentage increase in price. Assume that the risk-free rate is 5%. Which of the following statements is CORRECT? a. If a stock's beta doubled, its required return under the CAPM would also double. b. If a stock's beta were less than 1.0, its required return under the CAPM would be less than 5%. c. If a stock's beta doubled, its required return under the CAPM would more than double. d. If a stock's beta were 1.0, its required return under the CAPM would be 5%. e. If a stock has a negative beta, its required return under the CAPM would be less than 5%. Assume that interest rates on 15-year noncallable Treasury and corporate bonds with different ratings are as follows: T-bond = 7.72% A = 9.64% AAA = 8.72% BBB = 10.18 % The differences in rates among these issues were most probably caused primarily by: a. Maturity risk differences. b. Real risk-free rate differences. c. Default risk differences. d. Tax effects. e. Inflation differences