Question

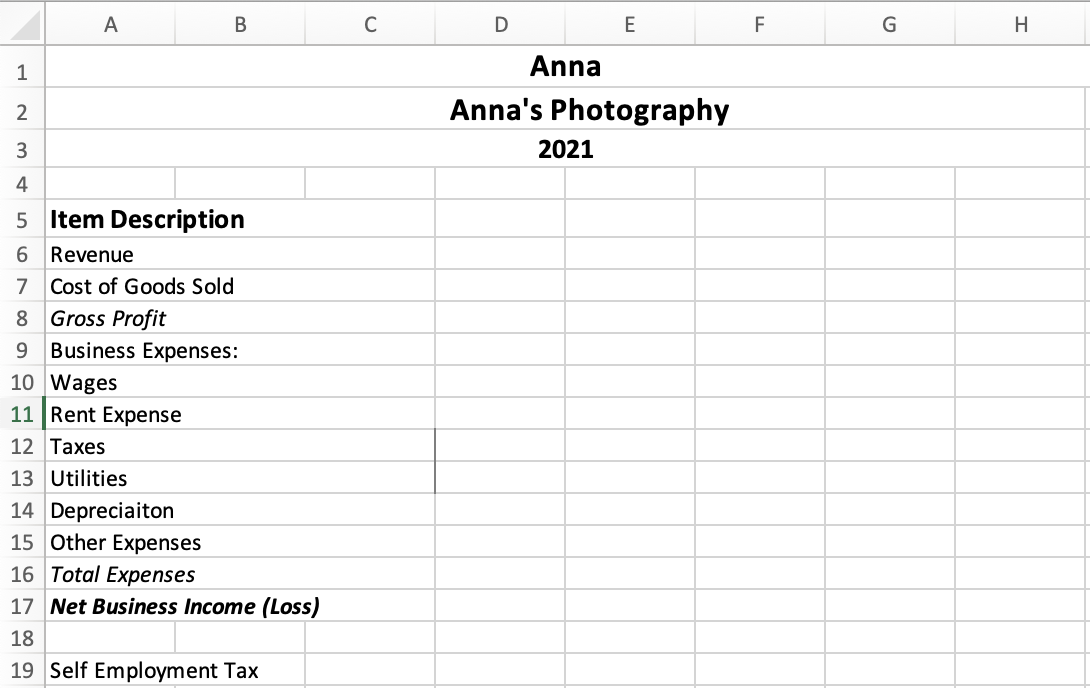

Anna has a great eye for shooting photography and so dedicates her work to that field. She works part-time teaching photography at a private school.

Anna has a great eye for shooting photography and so dedicates her work to that field. She works part-time teaching photography at a private school. She earned $10,000 in salary from the School of the Arts. the following items were withheld from her gross wages, $1,000 federal income taxes, $100 state income tax, $620 social security and $145 Medicare. She is not covered under their insurance plan as she only works 15 hours a week.

Anna is known for producing beautiful framed compositions. On June and August of this past year she had an exhibition and sold matted, framed photographs at each event. She estimates that the cost of each composition in canvas and supplies is about $260.

The sales are as follows:

A) June - 39 photographic compositions for a total of $ 19,000

B) August 20 photographic compositions for a total of $ 11,000

She works in a studio that adjoins their home residence exclusively used for business and is part of the property of their home. The expenses related to the studio allocated on the basis of square footage are as follows:

A) Depreciation $3,000

B) Taxes $1,400

C) Utilities $2,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started