Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anna has been in the business of breeding stock horses on her 250-acre property for the past 20 years. Now retiring from the business,

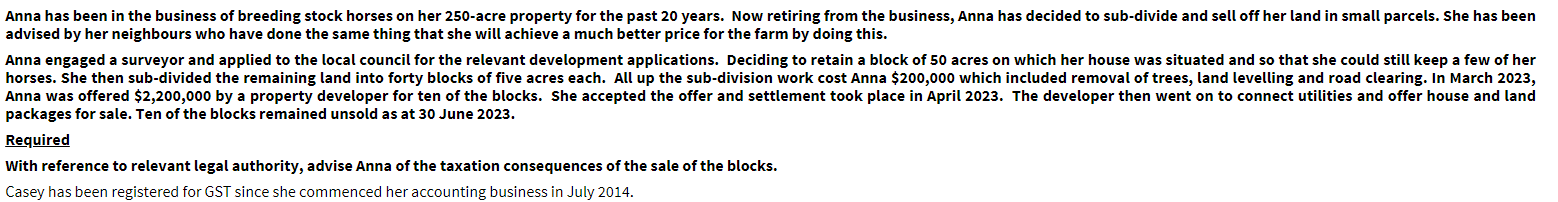

Anna has been in the business of breeding stock horses on her 250-acre property for the past 20 years. Now retiring from the business, Anna has decided to sub-divide and sell off her land in small parcels. She has been advised by her neighbours who have done the same thing that she will achieve a much better price for the farm by doing this. Anna engaged a surveyor and applied to the local council for the relevant development applications. Deciding to retain a block of 50 acres on which her house was situated and so that she could still keep a few of her horses. She then sub-divided the remaining land into forty blocks of five acres each. All up the sub-division work cost Anna $200,000 which included removal of trees, land levelling and road clearing. In March 2023, Anna was offered $2,200,000 by a property developer for ten of the blocks. She accepted the offer and settlement took place in April 2023. The developer then went on to connect utilities and offer house and land packages for sale. Ten of the blocks remained unsold as at 30 June 2023. Required With reference to relevant legal authority, advise Anna of the taxation consequences of the sale of the blocks. Casey has been registered for GST since she commenced her accounting business in July 2014.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The sale of the land parcels would likely trigger capital gains tax CGT for Anna The CGT woul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started