Answered step by step

Verified Expert Solution

Question

1 Approved Answer

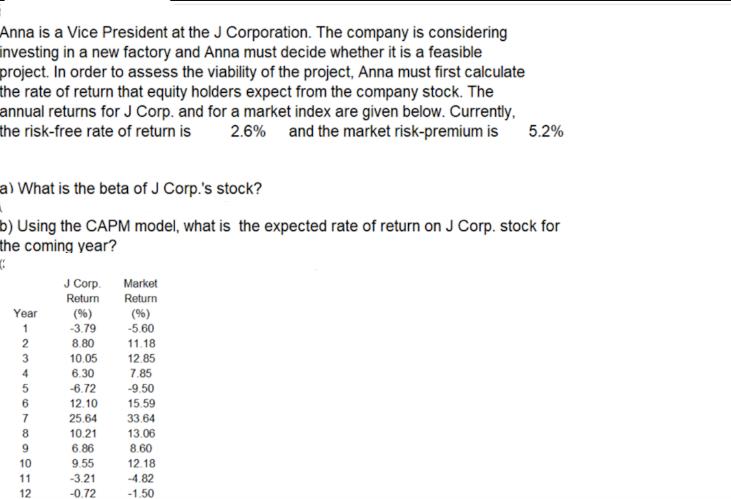

Anna is a Vice President at the J Corporation. The company is considering investing in a new factory and Anna must decide whether it

Anna is a Vice President at the J Corporation. The company is considering investing in a new factory and Anna must decide whether it is a feasible project. In order to assess the viability of the project, Anna must first calculate the rate of return that equity holders expect from the company stock. The annual returns for J Corp. and for a market index are given below. Currently, the risk-free rate of return is 2.6% and the market risk-premium is a) What is the beta of J Corp.'s stock? b) Using the CAPM model, what is the expected rate of return on J Corp. stock for the coming year? 4 Year 1 2 3 4 5 6 7 8 9 10 11 12 J Corp. Return (96) -3.79 8.80 10.05 6.30 -6.72 12.10 25.64 10.21 6.86 9.55 -3.21 -0.72 Market Return (%) -5.60 11.18 12.85 7.85 -9.50 15.59 5.2% 33.64 13.06 8.60 12.18 -4.82 -1.50

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep a To calculate beta we use the C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started