Answered step by step

Verified Expert Solution

Question

1 Approved Answer

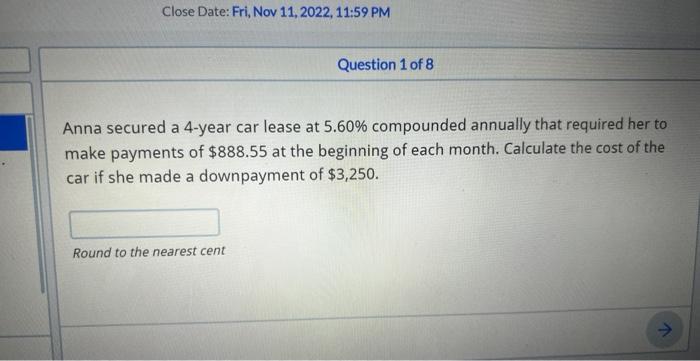

Anna secured a 4-year car lease at 5.60% compounded annually that required her to make payments of $888.55 at the beginning of each month. Calculate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started