Answered step by step

Verified Expert Solution

Question

1 Approved Answer

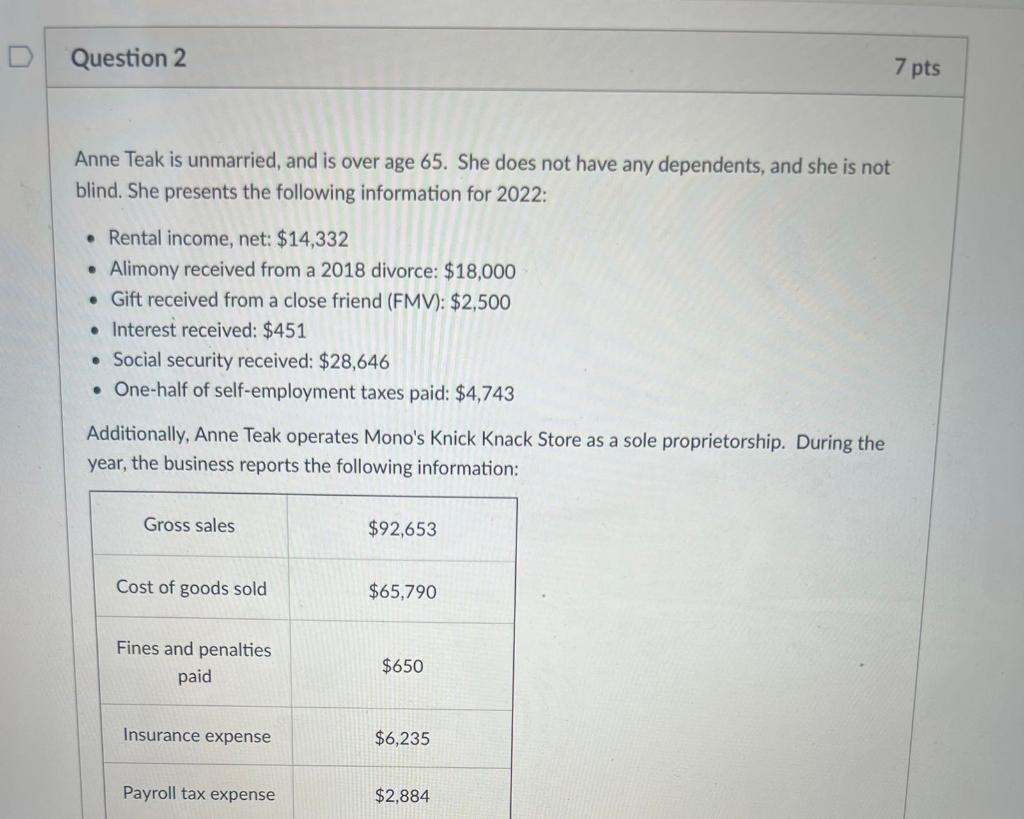

Anne Teak is unmarried, and is over age 65. She does not have any dependents, and she is not blind. She presents the following information

Anne Teak is unmarried, and is over age 65. She does not have any dependents, and she is not blind. She presents the following information for 2022: Rental income, net: $14,332 Alimony received from a 2018 divorce: $18,000 Gift received from a close friend (FMV): $2,500 Interest received: $451 Social security received: $28,646 One-half of self-employment taxes paid: $4,743 Additionally, Anne Teak operates Mono's Knick Knack Store as a sole proprietorship. During the year, the business reports the following information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started