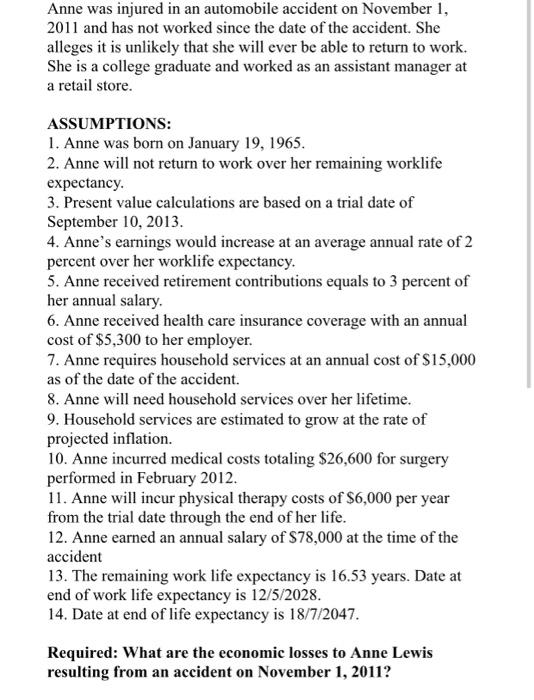

Anne was injured in an automobile accident on November 1, 2011 and has not worked since the date of the accident. She alleges it is unlikely that she will ever be able to return to work. She is a college graduate and worked as an assistant manager at a retail store. ASSUMPTIONS: 1. Anne was born on January 19, 1965. 2. Anne will not return to work over her remaining worklife expectancy 3. Present value calculations are based on a trial date of September 10, 2013. 4. Anne's earnings would increase at an average annual rate of 2 percent over her worklife expectancy. 5. Anne received retirement contributions equals to 3 percent of her annual salary 6. Anne received health care insurance coverage with an annual cost of $5,300 to her employer. 7. Anne requires household services at an annual cost of $15,000 as of the date of the accident. 8. Anne will need household services over her lifetime. 9. Household services are estimated to grow at the rate of projected inflation. 10. Anne incurred medical costs totaling $26,600 for surgery performed in February 2012 11. Anne will incur physical therapy costs of $6,000 per year from the trial date through the end of her life. 12. Anne earned an annual salary of S78,000 at the time of the accident 13. The remaining work life expectancy is 16.53 years. Date at end of work life expectancy is 12/5/2028. 14. Date at end of life expectancy is 18/7/2047. Required: What are the economic losses to Anne Lewis resulting from an accident on November 1, 2011? Anne was injured in an automobile accident on November 1, 2011 and has not worked since the date of the accident. She alleges it is unlikely that she will ever be able to return to work. She is a college graduate and worked as an assistant manager at a retail store. ASSUMPTIONS: 1. Anne was born on January 19, 1965. 2. Anne will not return to work over her remaining worklife expectancy 3. Present value calculations are based on a trial date of September 10, 2013. 4. Anne's earnings would increase at an average annual rate of 2 percent over her worklife expectancy. 5. Anne received retirement contributions equals to 3 percent of her annual salary 6. Anne received health care insurance coverage with an annual cost of $5,300 to her employer. 7. Anne requires household services at an annual cost of $15,000 as of the date of the accident. 8. Anne will need household services over her lifetime. 9. Household services are estimated to grow at the rate of projected inflation. 10. Anne incurred medical costs totaling $26,600 for surgery performed in February 2012 11. Anne will incur physical therapy costs of $6,000 per year from the trial date through the end of her life. 12. Anne earned an annual salary of S78,000 at the time of the accident 13. The remaining work life expectancy is 16.53 years. Date at end of work life expectancy is 12/5/2028. 14. Date at end of life expectancy is 18/7/2047. Required: What are the economic losses to Anne Lewis resulting from an accident on November 1, 2011