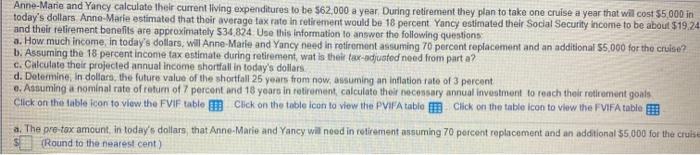

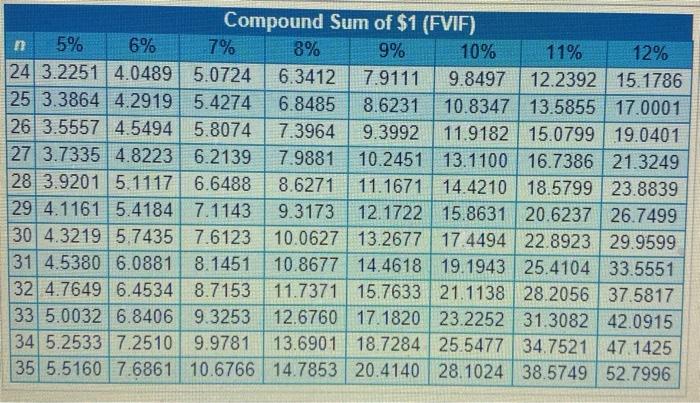

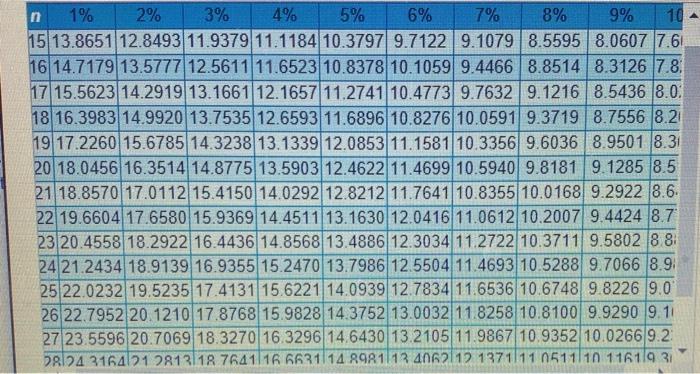

Anne-Marie and Yancy calculate their current living expenditures to be $62,000 a year During retirement they plan to take one cruise a year that will cost 55.000 in today's dollars Anne-Marie estimated that thoir average tax rate in retirement would be 18 percent Yancy estimated their Social Security Income to be about $19.24 and their retirement benefits are approximately 534 824 Use this information to answer the following questions a. How much income in today's dollars, will Anne-Marie and Yancy need in rotirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Assuming the 18 percent income tax estimate during retirement, wat is their far-adjusted need from parta? c. Calculate their projected annual income shortfall in today's dollars d. Determine, in dollars, the future value of the shortfall 25 years from now, assuming an inflation rate of 3 percent o. Assuming a nominal rate of totum of 7 percent and 18 years in retirement calculato their necessary annual investment to reach their retirement goals Click on the table icon to view the FVIF table Click on the table icon to view the PVIFA table Click on the table icon to view the FIFA table ! a. The pro-tax amount, in today's dollars that Anne-Marie and Yaney will need in retirement assuming 70 percent replacement and an additional 55,000 for the cruise (Round to the nearest cent) Compound Sum of $1 (FVIF) n 5% 6% 7% 8% 9% 10% 11% 12% 24 3.2251 4.0489 5.0724 6.3412 7.9111 9.8497 12.2392 15.1786 25 3.3864 4.2919 5.4274 6.8485 8.6231 10.8347 13.5855 17.0001 26 3.5557 4.5494 5.8074 7.3964 9.3992 11.9182 15.0799 19.0401 27 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 21.3249 28 3.92015.1117 6.6488 8.6271 11.1671 14.4210 18.5799 23.8839 29 4.11615.4184 7.1143 9.3173 12.1722 15.8631 20.6237 26.7499 30 4.3219 5.7435 7.6123 10.0627 13.2677 17.4494 22.8923 29.9599 31 4.5380 6.0881 8.1451 10.8677 14.4618 19.1943 25.4104 33.5551 32 4.7649 6.4534 8.7153 11.7371 15.7633 21.1138 28.2056 37.5817 33 5.0032 6.8406 9.3253 12.6760 17.1820 23.2252 31.3082 42.0915 34 5.25337.2510 9.9781 13.6901 18.7284 25.5477 34.7521 47.1425 35 5.5160 7.6861 10.6766 14.7853 20.4140 28.1024 38.5749 52.7996 n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10 15 13.865112.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.61 16 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.85148.3126 7.8; 17 15.5623 14.291913.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0: 18 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.21 19 17.2260 15.6785 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036 8.9501 8.31 20 18.0456 16.3514 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5 21 18.8570 17.0112 15.4150 14.0292 12.8212 11.7641 10.8355 10.0168 9.2922 8.6. 22 19.6604 17.6580 15.9369 14.4511 13.1630 12.0416 11.0612 10.2007 9.4424 8.7 23 20.4558 18.2922 16.4436 14.8568 13.4886 12.3034 11.2722 10.3711 9.5802 8 8 24 21.2434 18.9139 16.9355 15.2470 13.7986 12.5504 11.4693 10.5288 9.7066 8.9 25 22.0232 19.5235 17 4131 15.6221 14.0939 12.7834 11.6536 10.6748 9.8226 9.0 26 22.7952 20.1210 17.8768 15.9828 14.3752 13.0032 11.8258 10.8100 9.9290 9.11 27 23.5596 20.7069 18.3270 16.3296 14.6430 13.2105 11.9867 10.9352 10.0266 9.2 124 3164121 2813 18 7641116 663114 8981113 4062112 1371111 0511110 116119 31 Future Value of an Annuity (FVIFA) n 6% 7% 8% 9% 10% 11% 12% 13% 24 50.8156 58.1767 66.7648 76.7898 88.4973 102.1742 118.1552 136.8315 25 54.8645 63.2490 73.1059 84.7009 98.3471 114.4133 133.3339 155.6196 26 59.1564 68.6765 79.9544 93.3240 109.1818 127.9988 150.3339 176.8501 27 63.7058 74.4838 87.3508 102.7231 121.0999 143.0786 169.3740 200.8406 28 68.5281 80.6977 95.3388 112.9682 134.2099 159.8173 190.6989 227.9499 29 73.6398 87.3465 103.9659 124.1354 148.6309 178.3972 214.5828258.5834 30 79.0582 94.4608 113.2832 136.3075 164.4940 199.0209241.3327 293.1992 31 84.8017 102.0730 123.3459 149.5752 181.9434 221.9132 271.2926 332.3151 32 90.8898 110.2182134.2135 164.0370 201.1378 247.3236 304.8477376.5161 33 97 3432 118.9334 145.9506 179.8003222.2515 275.5292 342.4294 426.4632 34 104.1838 128.2588 158.6267 196.9823 245.4767 306.8374 384.5210 482.9034 35 111.4348 138.2369 172.3168 215.7108 271.0244 341.5896 431.6635 546.6808