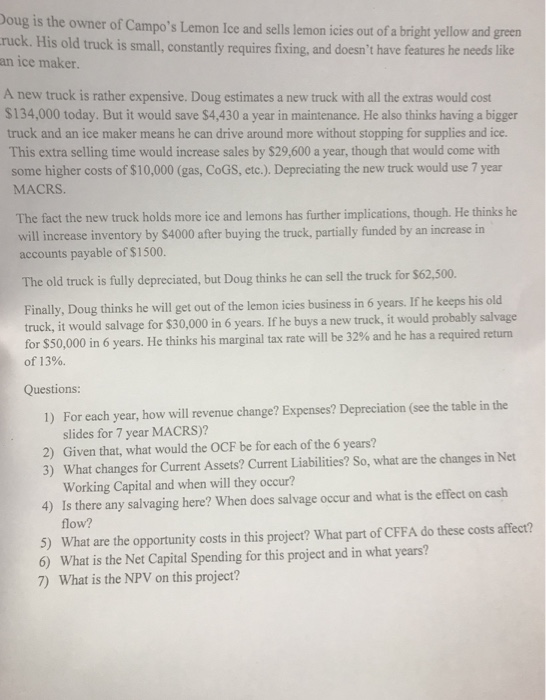

oug is the owner of Campo's Lemon Ice and sells lemon icies out of a bright yellow and green ruck. His old truck is small, constantly requires fixing, and doesn't have features he needs like an ice maker. A new truck is rather expensive. Doug estimates a new truck with all the extras would cost $134,000 today. But it would save $4,430 a year in maintenance. He also thinks having a bigger truck and an ice maker means he can drive around more without stopping for supplies and ice. This extra selling time would increase sales by $29,600 a year, though that would come with some higher costs of $10,000 (gas, CoGS, etc.). Depreciating the new truck would use 7 year MACRS The fact the new truck holds more ice and lemons has further implications, though. He thinks he will increase inventory by $4000 after buying the truck, partially funded by an increase in accounts payable of $1500. The old truck is fully depreciated, but Doug thinks he can sell the truck for $62,500. Finally, Doug thinks he will get out of the lemon icies business in 6 years. If he keeps his old truck, it would salvage for $30,000 in 6 years. If he buys a new truck, it would probably salvage for $50,000 in 6 years. He thinks his marginal tax rate will be 32% and he has a required return of 1 3%. Questions: 1) For each year, how will revenue change? Expenses? Depreciation (see the table in the slides for 7 year MACRS)? 2) Given that, what would the OCF be for each of the 6 years? 3) What changes for Current Assets? Current Liabilities? So, what are the changes in Net Working Capital and when will they occur? 4) Is there any salvaging here? When does salvage occur and what is the effect on cash flow? 5) What are the opportunity costs in this project? What part of CFFA do these costs affect? 6) What is the Net Capital Spending for this project and in what years? 7) What is the NPV on this project? oug is the owner of Campo's Lemon Ice and sells lemon icies out of a bright yellow and green ruck. His old truck is small, constantly requires fixing, and doesn't have features he needs like an ice maker. A new truck is rather expensive. Doug estimates a new truck with all the extras would cost $134,000 today. But it would save $4,430 a year in maintenance. He also thinks having a bigger truck and an ice maker means he can drive around more without stopping for supplies and ice. This extra selling time would increase sales by $29,600 a year, though that would come with some higher costs of $10,000 (gas, CoGS, etc.). Depreciating the new truck would use 7 year MACRS The fact the new truck holds more ice and lemons has further implications, though. He thinks he will increase inventory by $4000 after buying the truck, partially funded by an increase in accounts payable of $1500. The old truck is fully depreciated, but Doug thinks he can sell the truck for $62,500. Finally, Doug thinks he will get out of the lemon icies business in 6 years. If he keeps his old truck, it would salvage for $30,000 in 6 years. If he buys a new truck, it would probably salvage for $50,000 in 6 years. He thinks his marginal tax rate will be 32% and he has a required return of 1 3%. Questions: 1) For each year, how will revenue change? Expenses? Depreciation (see the table in the slides for 7 year MACRS)? 2) Given that, what would the OCF be for each of the 6 years? 3) What changes for Current Assets? Current Liabilities? So, what are the changes in Net Working Capital and when will they occur? 4) Is there any salvaging here? When does salvage occur and what is the effect on cash flow? 5) What are the opportunity costs in this project? What part of CFFA do these costs affect? 6) What is the Net Capital Spending for this project and in what years? 7) What is the NPV on this project