Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anne-Marie and Yancy calculate their current living expenditures to be $82,000 a year. During retirement they plan to take one cruise a year that

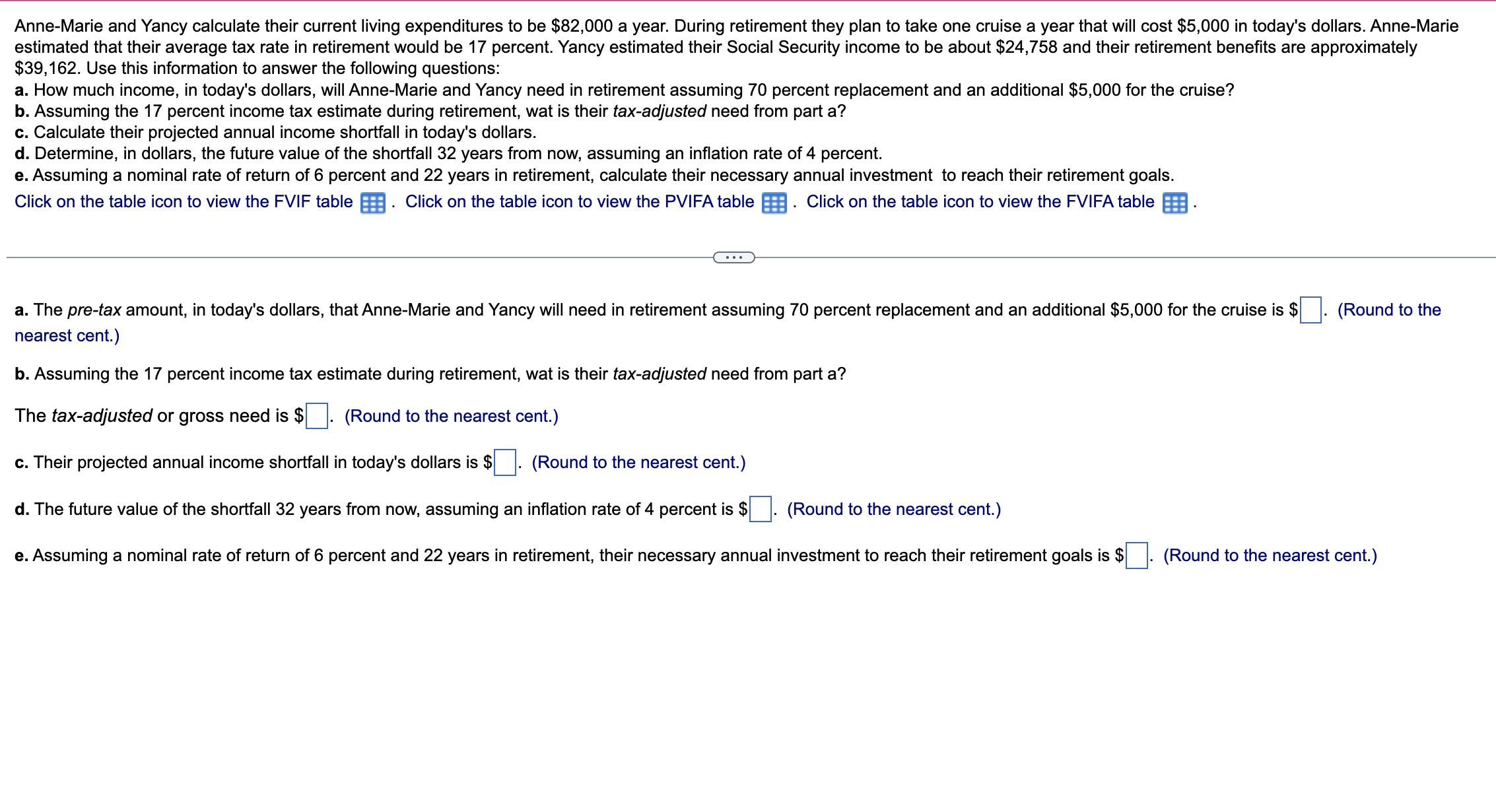

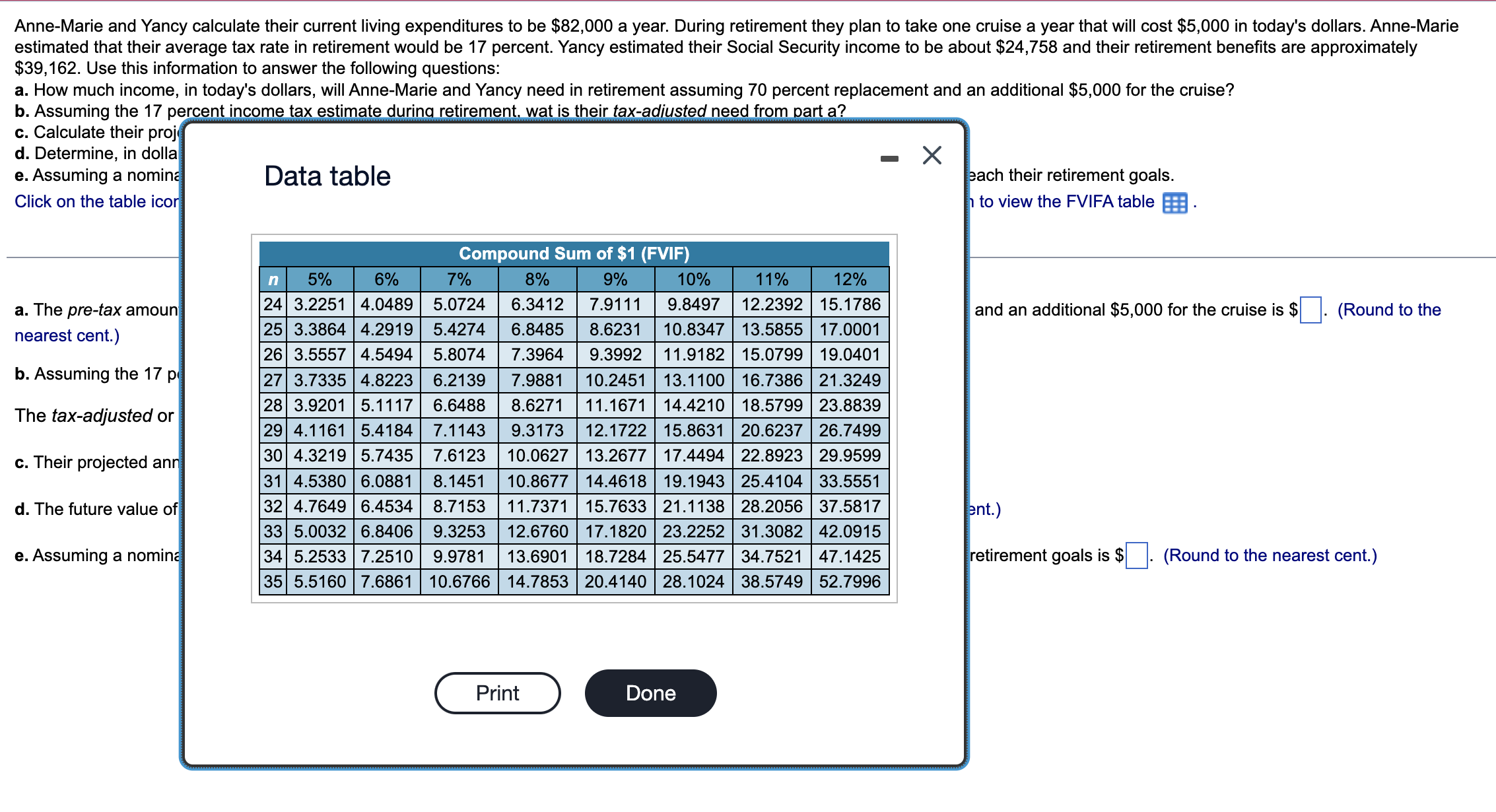

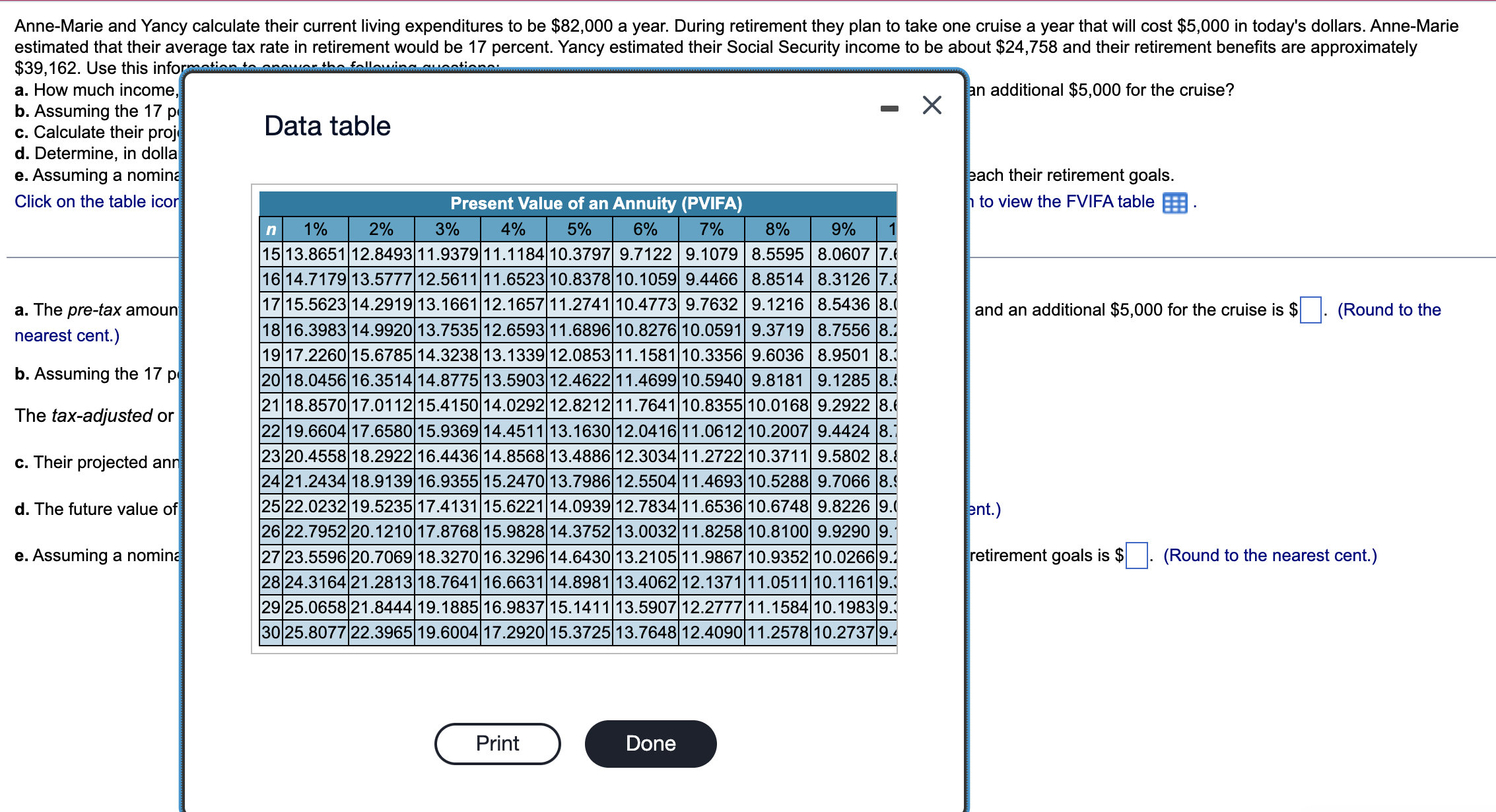

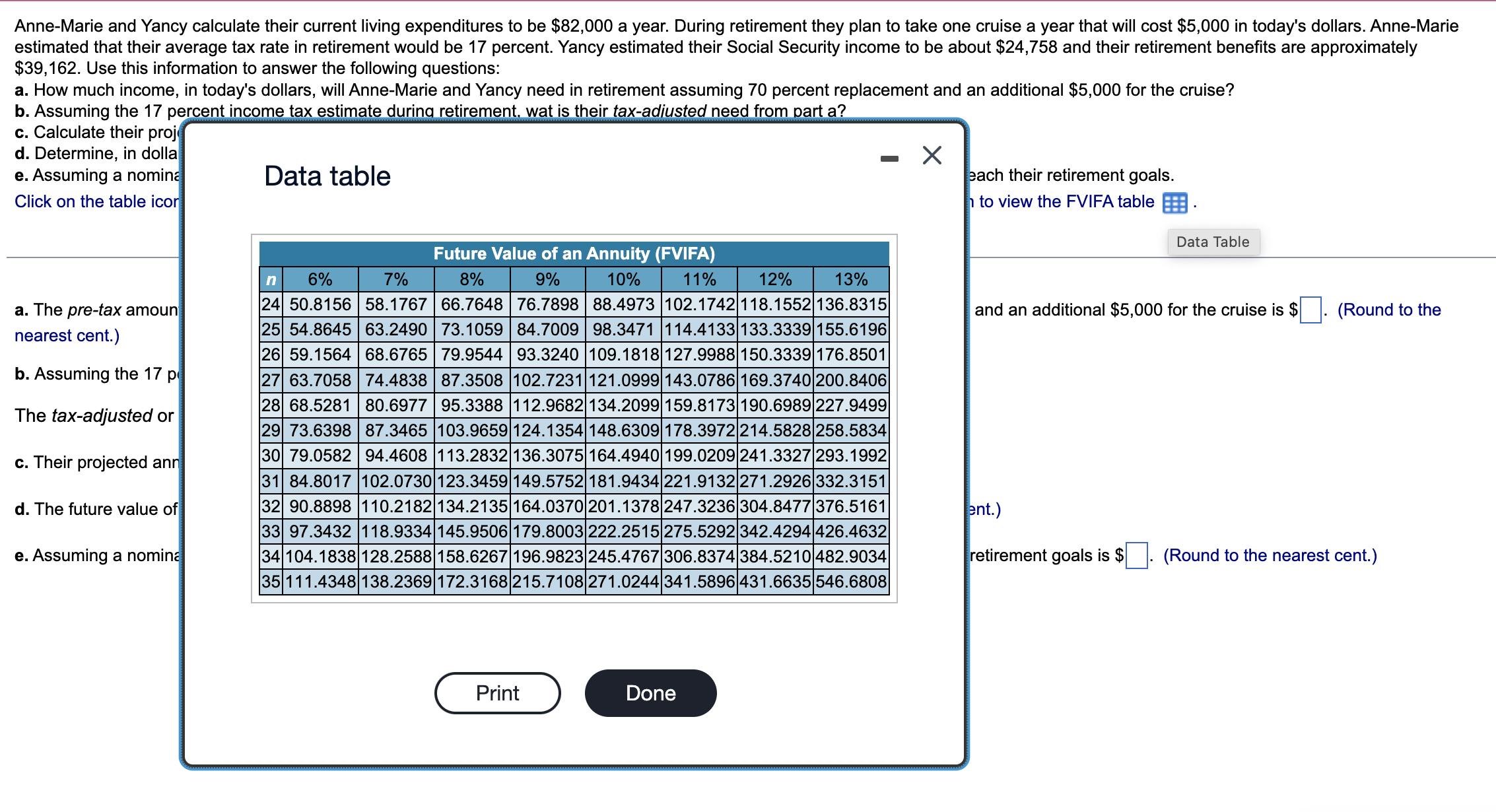

Anne-Marie and Yancy calculate their current living expenditures to be $82,000 a year. During retirement they plan to take one cruise a year that will cost $5,000 in today's dollars. Anne-Marie estimated that their average tax rate in retirement would be 17 percent. Yancy estimated their Social Security income to be about $24,758 and their retirement benefits are approximately $39,162. Use this information to answer the following questions: a. How much income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Assuming the 17 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? c. Calculate their projected annual income shortfall in today's dollars. d. Determine, in dollars, the future value of the shortfall 32 years from now, assuming an inflation rate of 4 percent. e. Assuming a nominal rate of return of 6 percent and 22 years in retirement, calculate their necessary annual investment to reach their retirement goals. Click on the table icon to view the FVIF table. Click on the table icon to view the PVIFA table Click on the table icon to view the FVIFA table. a. The pre-tax amount, in today's dollars, that Anne-Marie and Yancy will need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise is $ nearest cent.) b. Assuming the 17 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? (Round to the The tax-adjusted or gross need is $ (Round to the nearest cent.) c. Their projected annual income shortfall in today's dollars is $ (Round to the nearest cent.) d. The future value of the shortfall 32 years from now, assuming an inflation rate of 4 percent is $ (Round to the nearest cent.) e. Assuming a nominal rate of return of 6 percent and 22 years in retirement, their necessary annual investment to reach their retirement goals is $ (Round to the nearest cent.) Anne-Marie and Yancy calculate their current living expenditures to be $82,000 a year. During retirement they plan to take one cruise a year that will cost $5,000 in today's dollars. Anne-Marie estimated that their average tax rate in retirement would be 17 percent. Yancy estimated their Social Security income to be about $24,758 and their retirement benefits are approximately $39,162. Use this information to answer the following questions: a. How much income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Assuming the 17 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? c. Calculate their proj d. Determine, in dolla e. Assuming a nomina Click on the table icor Data table - each their retirement goals. to view the FVIFA table Compound Sum of $1 (FVIF) a. The pre-tax amoun nearest cent.) b. Assuming the 17 p The tax-adjusted or c. Their projected ann d. The future value of e. Assuming a nomina n 5% 6% 7% 8% 9% 24 3.2251 4.0489 5.0724 6.3412 7.9111 25 3.3864 4.2919 5.4274 6.8485 8.6231 26 3.5557 4.5494 5.8074 7.3964 9.3992 27 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 21.3249 28 3.9201 5.1117 6.6488 8.6271 11.1671 14.4210 | 18.5799 23.8839 29 4.1161 5.4184 7.1143 9.3173 12.1722 15.8631 20.6237 26.7499 30 4.3219 5.7435 7.6123 10.0627 13.2677 | 17.4494 22.8923 29.9599 31 4.5380 6.0881 8.1451 10.8677 14.4618 19.1943 25.4104 33.5551 32 4.7649 6.4534 8.7153 11.7371 15.7633 21.1138 28.2056 37.5817 33 5.0032 6.8406 9.3253 12.6760 17.1820 23.2252 31.3082 42.0915 34 5.2533 7.2510 9.9781 13.6901 18.7284 25.5477 34.7521 47.1425 35 5.5160 7.6861 10.6766 14.7853 20.4140 28.1024 38.5749 52.7996 10% 11% 12% 9.8497 12.2392 15.1786 10.8347 13.5855 17.0001 11.9182 15.0799 19.0401 and an additional $5,000 for the cruise is $ (Round to the ent.) retirement goals is $ (Round to the nearest cent.) Print Done Anne-Marie and Yancy calculate their current living expenditures to be $82,000 a year. During retirement they plan to take one cruise a year that will cost $5,000 in today's dollars. Anne-Marie estimated that their average tax rate in retirement would be 17 percent. Yancy estimated their Social Security income to be about $24,758 and their retirement benefits are approximately $39,162. Use this information to answer the following questions: an additional $5,000 for the cruise? a. How much income, b. Assuming the 17 p c. Calculate their proj d. Determine, in dolla Data table e. Assuming a nomina Click on the table icor a. The pre-tax amoun nearest cent.) b. Assuming the 17 p The tax-adjusted or c. Their projected ann d. The future value of e. Assuming a nomina 2% 4% 5% each their retirement goals. to view the FVIFA table 8% 9% 1 Present Value of an Annuity (PVIFA) n 1% 3% 6% 7% 15 13.8651 12.8493|11.9379|11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.0 |16|14.7179 13.5777 12.5611 11.6523 10.8378|10.1059 9.4466 8.8514 8.3126 7. 17 15.5623 14.2919 13.1661|12.1657|11.2741 10.4773 9.7632 9.1216 8.5436 8.0 18 16.3983 14.9920|13.7535|12.6593 11.6896 10.8276|10.0591 9.3719 8.7556 8.1 19 17.2260 15.6785|14.3238|13.1339|12.0853|11.1581 10.3356 9.6036 8.9501 8.3 2018.0456|16.3514 14.8775|13.5903|12.4622 11.4699|10.5940 9.8181 9.1285 8.5 21 18.8570 17.0112 15.4150|14.0292 12.8212 11.7641|10.8355 10.0168 9.2922 8.6 22 19.6604 17.6580 15.9369|14.4511|13.1630 12.0416|11.0612|10.2007 9.4424 8.1 23 20.4558 18.2922 16.4436|14.8568 13.4886|12.3034 11.2722 10.3711 9.5802 8. 24 21.2434 18.9139| 16.9355 15.2470 13.7986| 12.5504 11.4693| 10.5288 9.7066 8.9 25 22.0232 19.5235 17.4131|15.6221|14.0939|12.7834 11.6536|10.6748 9.8226 9.0 26 22.7952 20.1210 17.8768|15.9828 14.3752 13.0032 11.8258 10.8100 9.9290 9.1 27 23.5596 20.7069|18.3270|16.3296|14.6430|13.2105 11.9867|10.9352 10.0266 9.1 28 24.3164 21.2813 18.7641 16.6631 14.8981 13.4062 12.1371|11.0511|10.1161 9.3 29 25.0658 21.8444 19.1885 16.9837 15.1411 13.5907 12.2777 11.1584 10.1983 9.3 30 25.8077 22.3965 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 10.2737 9.4 and an additional $5,000 for the cruise is $ (Round to the ent.) retirement goals is $ (Round to the nearest cent.) Print Done Anne-Marie and Yancy calculate their current living expenditures to be $82,000 a year. During retirement they plan to take one cruise a year that will cost $5,000 in today's dollars. Anne-Marie estimated that their average tax rate in retirement would be 17 percent. Yancy estimated their Social Security income to be about $24,758 and their retirement benefits are approximately $39,162. Use this information to answer the following questions: a. How much income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Assuming the 17 percent income tax estimate during retirement, wat is their tax-adjusted need from part a? c. Calculate their proj d. Determine, in dolla e. Assuming a nomina Data table Click on the table icor - each their retirement goals. to view the FVIFA table Data Table and an additional $5,000 for the cruise is $ (Round to the a. The pre-tax amoun nearest cent.) b. Assuming the 17 p The tax-adjusted or c. Their projected ann d. The future value of e. Assuming a nomina 13% Future Value of an Annuity (FVIFA) n 6% 7% 8% 9% 10% 11% 12% 24 50.8156 58.1767 66.7648 76.7898 88.4973 102.1742 118.1552 136.8315| 25 54.8645 63.2490 73.1059 84.7009 98.3471 114.4133|133.3339|155.6196 26 59.1564 68.6765 79.9544 93.3240 109.1818 127.9988|150.3339|176.8501 27 63.7058 74.4838 87.3508 102.7231|121.0999|143.0786|169.3740|200.8406| 28 68.5281 80.6977 95.3388 112.9682 134.2099 159.8173|190.6989|227.9499 29 73.6398 87.3465 103.9659|124.1354|148.6309|178.3972 214.5828 258.5834 30 79.0582 94.4608 113.2832 136.3075|164.4940 199.0209|241.3327 293.1992 31 84.8017 102.0730 123.3459|149.5752 181.9434 221.9132 271.2926 332.3151 32 90.8898 110.2182 134.2135 164.0370 201.1378|247.3236 304.8477 376.5161 33 97.3432 118.9334|145.9506|179.8003 222.2515 275.5292 342.4294 426.4632 34 104.1838|128.2588|158.6267 196.9823|245.4767 306.8374 384.5210 482.9034 |35|111.4348 138.2369|172.3168|215.7108|271.0244 341.5896 431.6635 546.6808 ent.) Print Done retirement goals is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started