Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Annette are sales managers for Acme USA. Both work full - time in the Acme offices under the same manager and share the same type

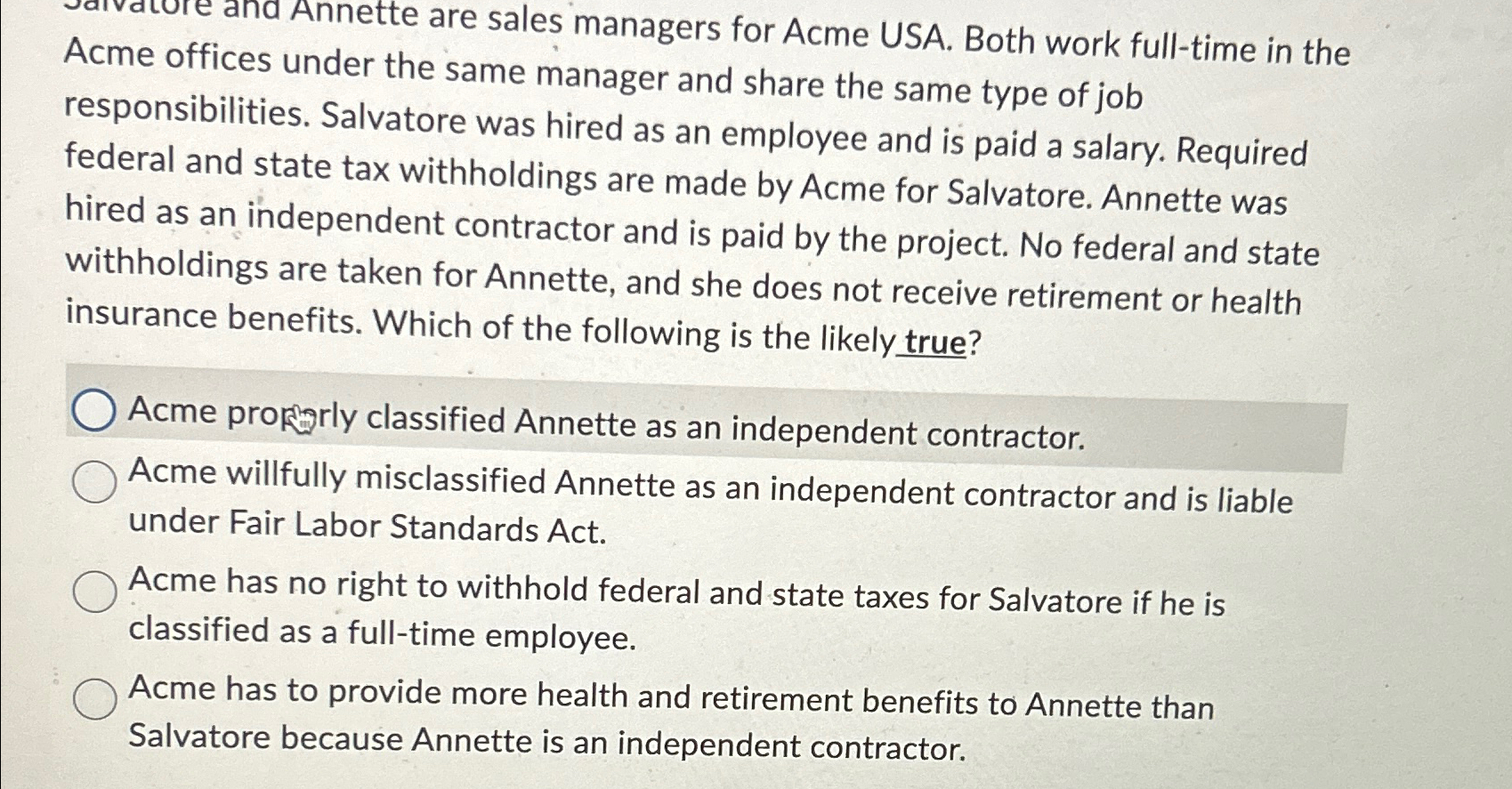

Annette are sales managers for Acme USA. Both work fulltime in the Acme offices under the same manager and share the same type of job responsibilities. Salvatore was hired as an employee and is paid a salary. Required federal and state tax withholdings are made by Acme for Salvatore. Annette was hired as an independent contractor and is paid by the project. No federal and state withholdings are taken for Annette, and she does not receive retirement or health insurance benefits. Which of the following is the likely true?

Acme proprly classified Annette as an independent contractor.

Acme willfully misclassified Annette as an independent contractor and is liable under Fair Labor Standards Act.

Acme has no right to withhold federal and state taxes for Salvatore if he is classified as a fulltime employee.

Acme has to provide more health and retirement benefits to Annette than Salvatore because Annette is an independent contractor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started