Answered step by step

Verified Expert Solution

Question

1 Approved Answer

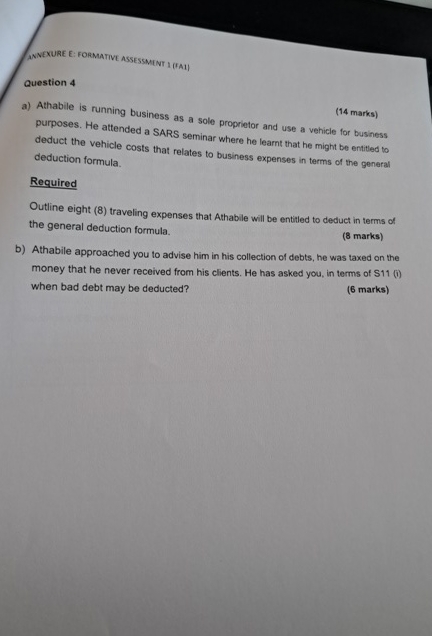

ANNEXURE E: FORMATIVE ASSESSMINT 1 ( FA 1 ) Question 4 ( 1 4 marks ) a ) Athabile is running business as a sole

ANNEXURE E: FORMATIVE ASSESSMINT FA

Question

marks

a Athabile is running business as a sole proprietor and use a vehicle for business purposes. He attended a SARS seminar where he learnt that he might be entitled to deduct the vehicle costs that relates to business expenses in terms of the general deduction formula.

Required

Outline eight traveling expenses that Athabile will be entitled to deduct in terms of the general deduction formula.

marks

b Athabile approached you to advise him in his collection of debts, he was taxed on the money that he never received from his clients. He has asked you, in terms of Si when bad debt may be deducted?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started