Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Annie's mortgage statement shows a total payment of $693.13 with $599.82 paid toward principal and interest and $93.31 paid for taxes and insurance. Taxes and

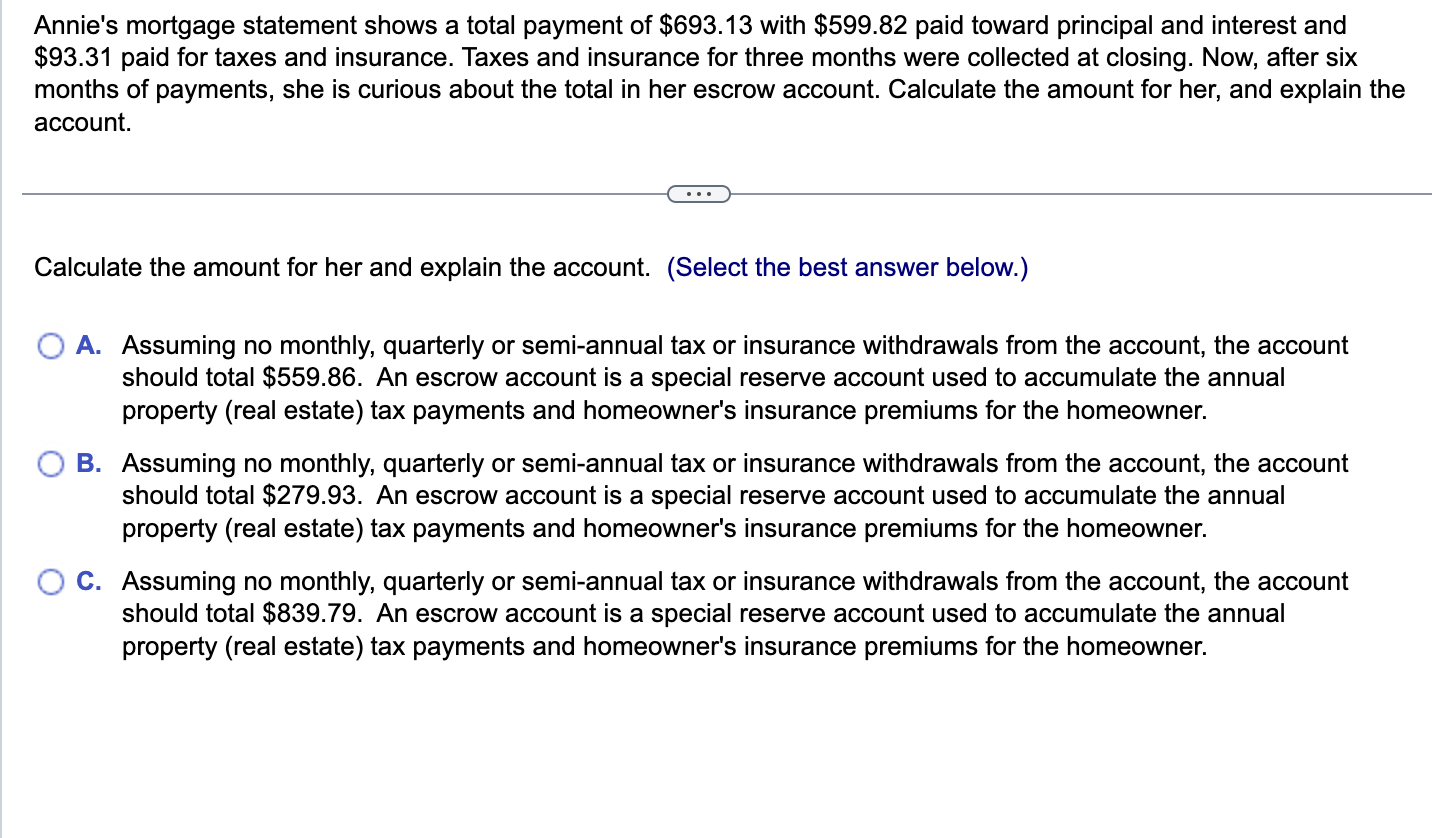

Annie's mortgage statement shows a total payment of $693.13 with $599.82 paid toward principal and interest and $93.31 paid for taxes and insurance. Taxes and insurance for three months were collected at closing. Now, after six months of payments, she is curious about the total in her escrow account. Calculate the amount for her, and explain the account. Calculate the amount for her and explain the account. (Select the best answer below.) A. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total $559.86. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner. B. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total \$279.93. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner. C. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total $839.79. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner

Annie's mortgage statement shows a total payment of $693.13 with $599.82 paid toward principal and interest and $93.31 paid for taxes and insurance. Taxes and insurance for three months were collected at closing. Now, after six months of payments, she is curious about the total in her escrow account. Calculate the amount for her, and explain the account. Calculate the amount for her and explain the account. (Select the best answer below.) A. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total $559.86. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner. B. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total \$279.93. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner. C. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total $839.79. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started