Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2017 Year 2011, 2013, 2014 are the ones I need help in. I am

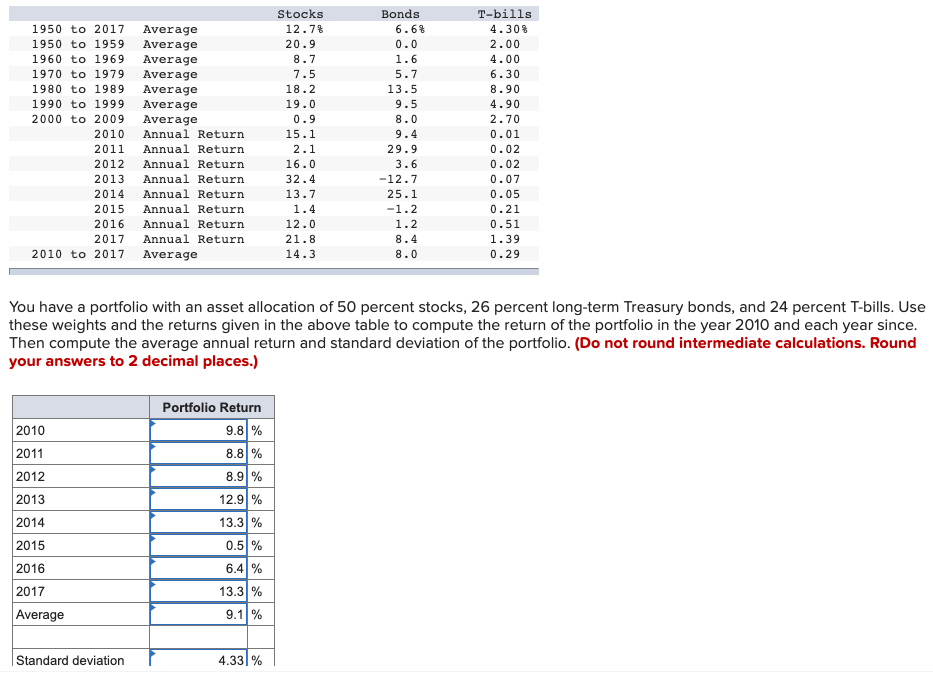

Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2017

Year 2011, 2013, 2014 are the ones I need help in. I am sure that 8.2 (2011), 13.2 (2013), 12.9 (2014) are incorrect percentages. This new set on the table I am not sure about being right.

You have a portfolio with an asset allocation of 50 percent stocks, 26 percent long-term Treasury bonds, and 24 percent T-bills. Use these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since. Then compute the average annual return and standard deviation of the portfolio. (Do not round intermediate calculations. Round your answers to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started