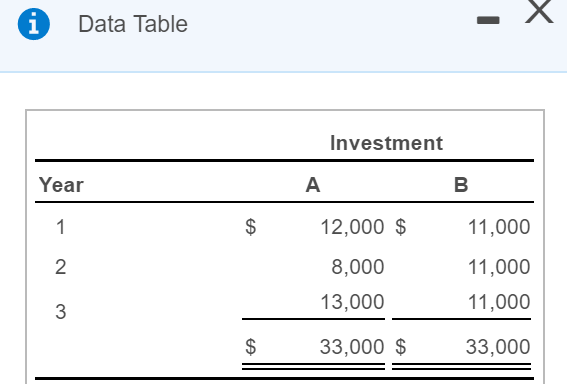

Annual cash flows from two competing investment opportunities are given. Each investment opportunity will require the same initial investment.

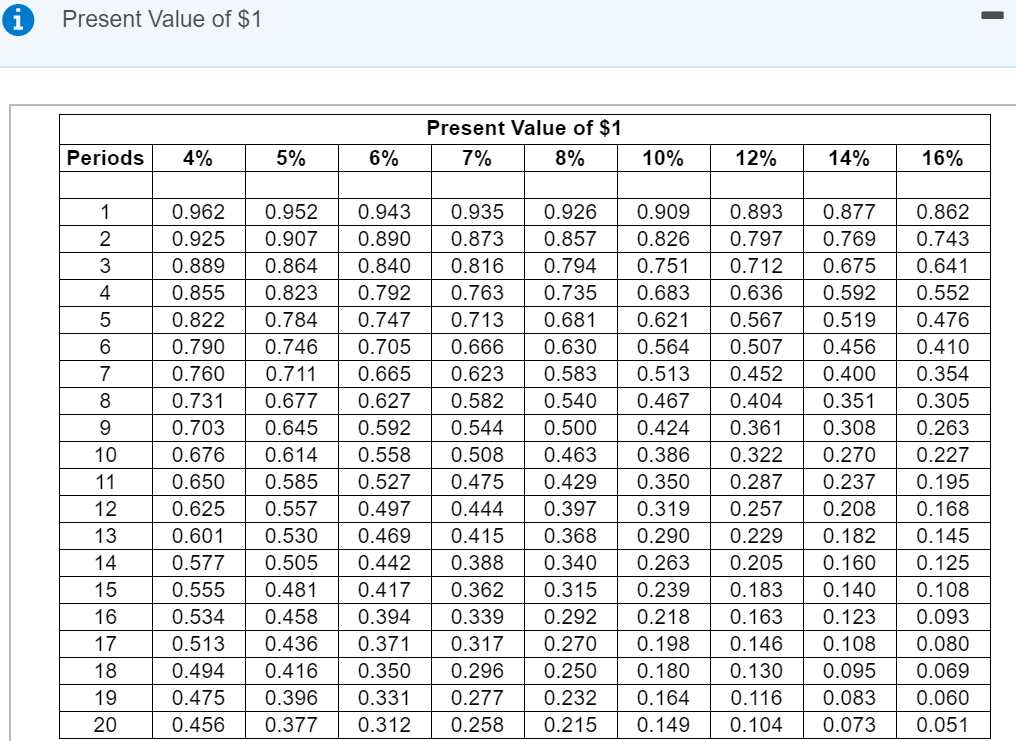

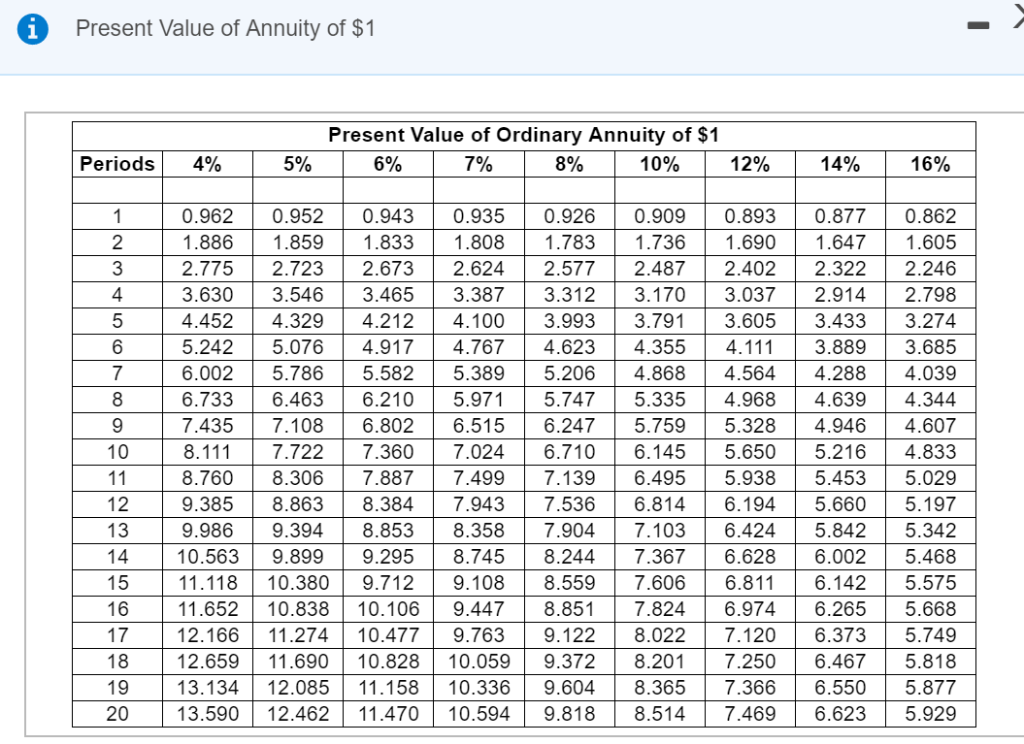

Begin by computing the present value of each investment opportunity. (Assume that the annual cash flows occur at the end of each year. If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round intermediary computations and your final answer to the nearest whole dollar.)

Begin by computing the present value of each investment opportunity. (Assume that the annual cash flows occur at the end of each year. If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round intermediary computations and your final answer to the nearest whole dollar.)

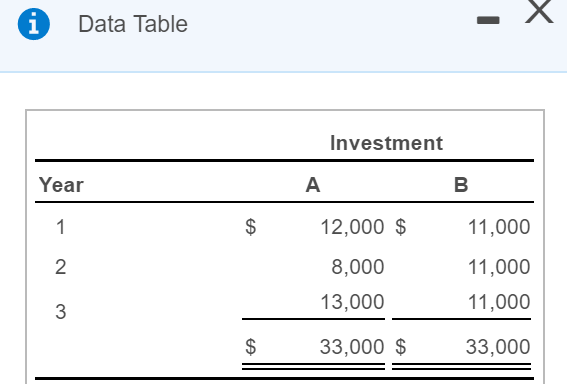

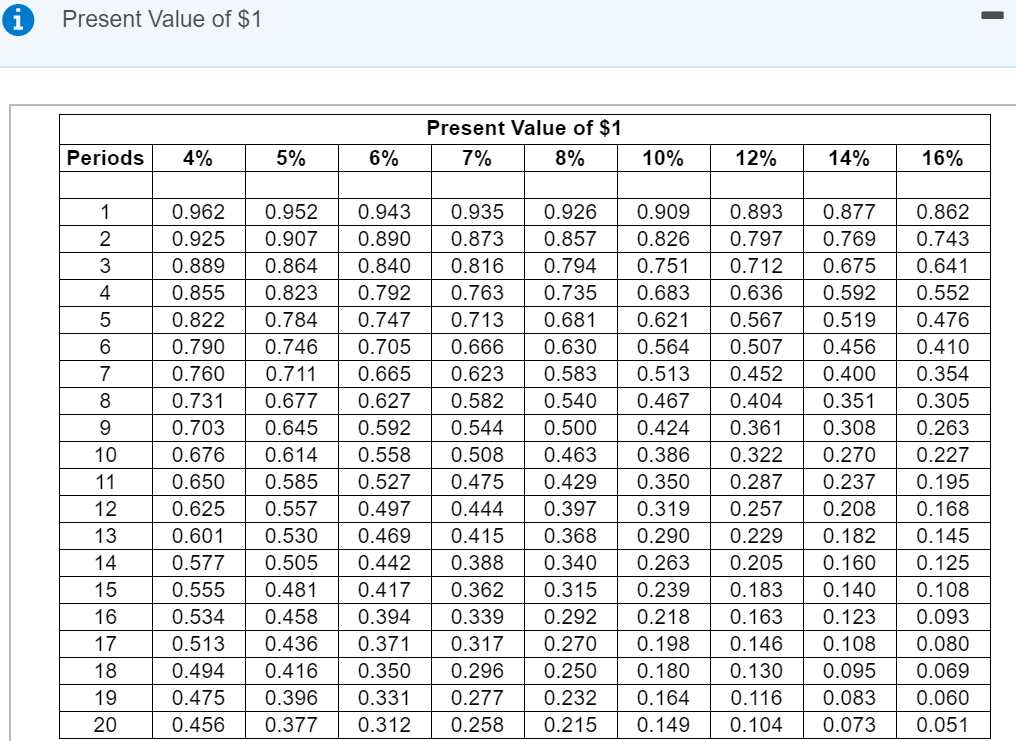

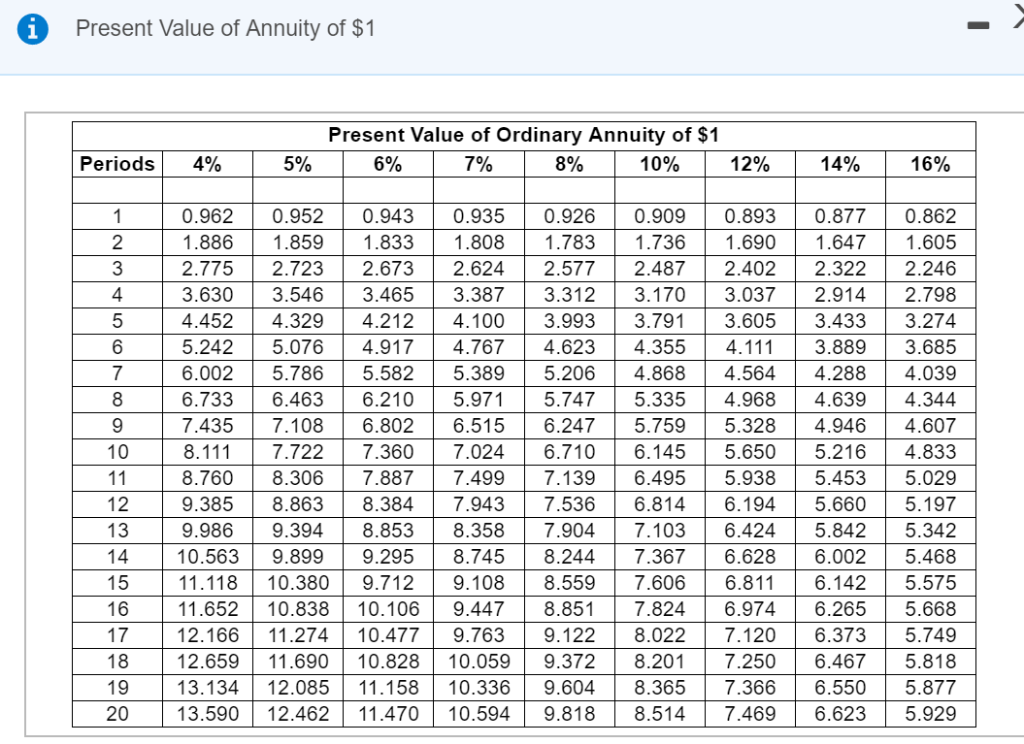

Data Table -X Investment Year 11,000 11,000 11,000 33,000 12,000 $ 8,000 13,000 33,000 $ 2 3 Present Value of $1 Present Value of $1 Periods | 4% 5% 5% 10% 12% 14% 16% 0.9620.952 0.943 0.9350.926 0.9090.893 0.877 0.862 0.9250.907 0.890 0.8730.857 0.8260.797 0.769 0.743 0.8890.864 0.840 0.8160.794 0.7510.712 0.675 0.641 0.855 0.823 0.792 0.7630.7350.683 0.636 0.5920.552 0.8220.784 0.7470.713 0.681 0.621 0.567 0.519 0.476 0.7900.746 0.705 0.666 0.630 0.564 0.507 0.456 0.410 0.7600.7110.665 0.6230.583 0.513 0.452 0.400 0.354 0.731 0.6770.627 0.582 0.5400.467 0.404 0.35 0.305 0.7030.645 0.5920.544 0.500 0.424 0.361 0.308 0.263 0.6760.614 0.558 0.5080.463 0.386 0.322 0.270 0.227 0.6500.585 0.527 0.4750.429 0.350 0.287 0.237 0.195 0.625 0.557 0.4970.444 0.3970.319 0.257 0.2080.168 0.601 0.530 0.469 0.415 0.368 0.2900.229 0.182 0.145 0.5770.505 0.442 0.388 0.340 0.263 0.205 0.160 0.125 0.5550.481 0.417 0.3620.315 0.2390.183 0.140 0.108 0.534 0.458 0.394 0.3390.2920.218 0.163 0.1230.093 0.5130.436 0.37 0.3170.270 0.198 0.146 0.108 0.080 0.4940.416 0.350 0.296 0.250 0.180 0.130 0.095 0.069 0.4750.396 0.331 0.277 0.232 0.164 0.116 0.083 0.060 0.456 0.377 0.312 0.258 0.2150.149 0.104 0.0730.051 2 4 5 6 8 10 12 13 15 16 18 19 20 Present Value of Annuity of $1 Present Value of Ordinary Annuity of $1 Periods | 4% 5% 6% 5% 10% 12% 14% 16% 0.962 0.952 0.943 0.9350.926 0.9090.8930.877 0.862 1.8861.8591.833 1.8081.783 1.736 1.690 1.6471.605 2.775 2.723 2.673 2.6242.577 2.487 2.402 2.322 2.246 3.630 3.546 3.465 3.387 3.312 3.170 3.0372.914 2.798 4.4524.329 4.212 4.1003.993 3.7913.6053.433 3.274 5.2425.076 4.917 4.7674.623 4.355 4.1113.889 3.685 6.0025.786 5.5825.389 5.2064.868 4.564 4.2884039 6.733 6.463 6.210 5.9715.747 5.335 4.968 4.6394.344 7.4357.108 6.802 6.515 6.247 5.7595.328 4.946 4.607 8.117.722 7.360 7.024 6.710 6.145 5.6505.216 4.833 8.7608.306 7.887 7.499 7.1396.495 5.938 5.453 5.029 9.385 8.863 8.384 7.943 7.5366.814 6.1945.6605.197 9.9869.394 8.853 8.358 7.904 7.103 6.4245.842 5.342 10.563 9.899 9.2958.745 8.244 7.3676.628 6.0025.468 11.11810.380 9.7129.108 8.559 7.606 6.8116.142 5.575 11.65210.838 10.106 9.447 8.85 7.824 6.974 6.265 5.668 12.16611.274 10.477 9.7639.1228.022 7.120 6.3735.749 12.65911.690 10.828 10.0599.372 8.201 7.2506.467 5.818 13.13412.085 11.158 10.3369.604 8.365 7.366 6.550 5.877 13.59012.462 11.470 10.594 9.818 8.514 7.469 6.623 5.929 2 4 7 8 10 16 17 20 The present value of investment opportunity A is $ and the present value of investment opportunity Bis$ Investment opportunity | | should be chosen because the present value of cash flows is than the present value of investment opportunity higher lower

Begin by computing the present value of each investment opportunity. (Assume that the annual cash flows occur at the end of each year. If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round intermediary computations and your final answer to the nearest whole dollar.)

Begin by computing the present value of each investment opportunity. (Assume that the annual cash flows occur at the end of each year. If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round intermediary computations and your final answer to the nearest whole dollar.)