Answered step by step

Verified Expert Solution

Question

1 Approved Answer

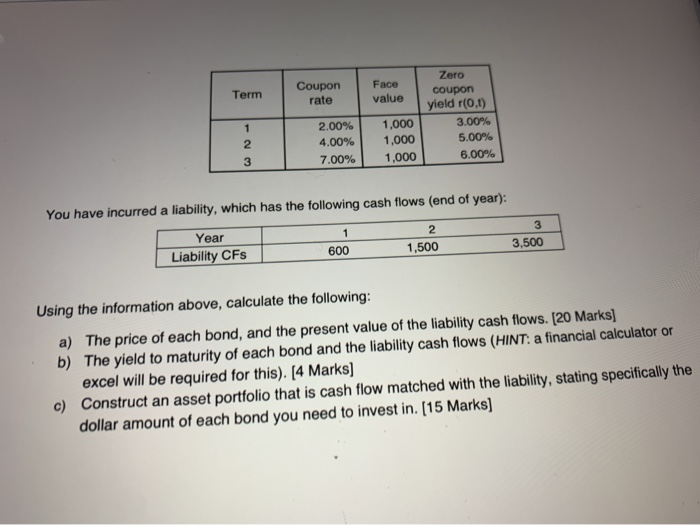

annual coupon paying bonds Term Coupon rate Face value 2.00% 4.00% 7.00% Zero coupon yield r(0,1) 3.00 5.00% 6.00% 1,000 1.000 1,000 You have incurred

annual coupon paying bonds

Term Coupon rate Face value 2.00% 4.00% 7.00% Zero coupon yield r(0,1) 3.00 5.00% 6.00% 1,000 1.000 1,000 You have incurred a liability, which has the following cash flows (end of year): Year Liability CFs 600 1,500 3,500 Using the information above, calculate the following: a) The price of each bond, and the present value of the liability cash flows. [20 Marks) b) The yield to maturity of each bond and the liability cash flows (HINT: a financial calculator or excel will be required for this). [4 Marks] c) Construct an asset portfolio that is cash flow matched with the liability, stating specifically the dollar amount of each bond you need to invest in. (15 Marks) Term Coupon rate Face value 2.00% 4.00% 7.00% Zero coupon yield r(0,1) 3.00 5.00% 6.00% 1,000 1.000 1,000 You have incurred a liability, which has the following cash flows (end of year): Year Liability CFs 600 1,500 3,500 Using the information above, calculate the following: a) The price of each bond, and the present value of the liability cash flows. [20 Marks) b) The yield to maturity of each bond and the liability cash flows (HINT: a financial calculator or excel will be required for this). [4 Marks] c) Construct an asset portfolio that is cash flow matched with the liability, stating specifically the dollar amount of each bond you need to invest in. (15 Marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started