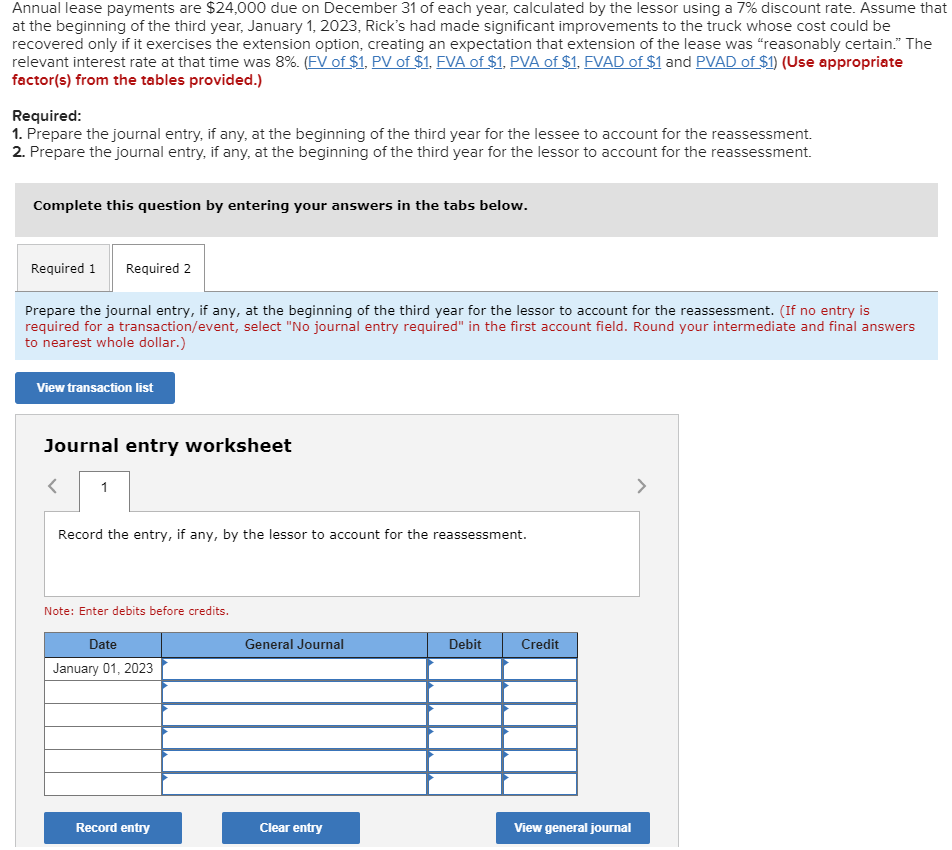

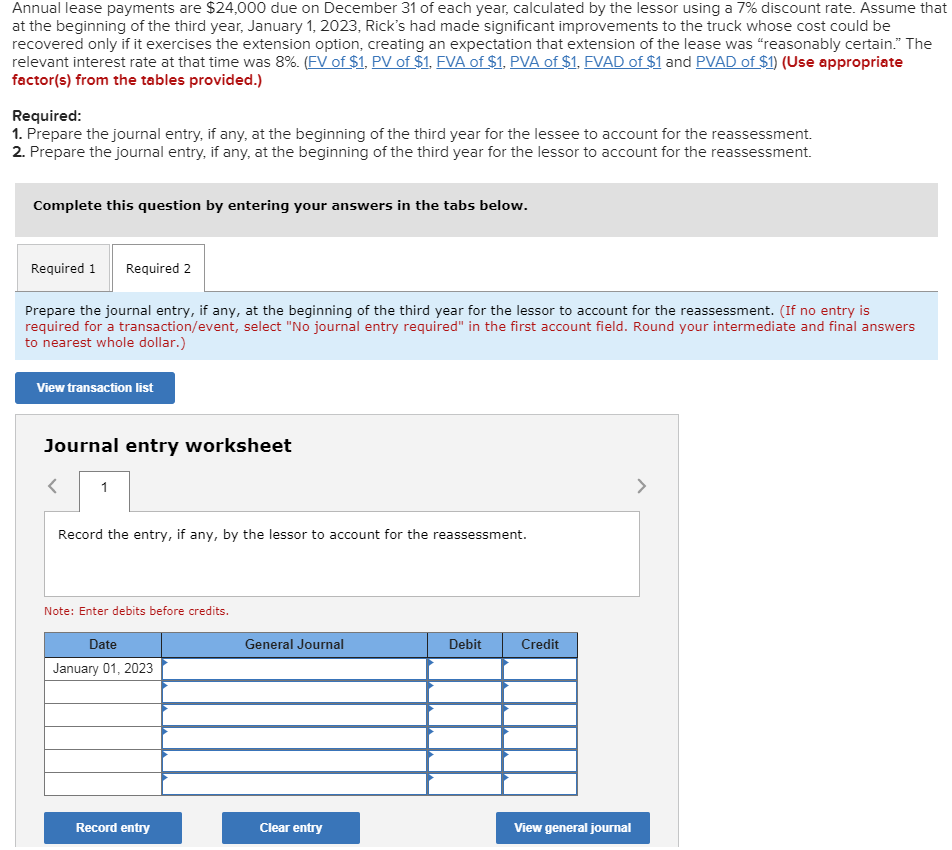

Annual lease payments are $24,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. Assume that at the beginning of the third year, January 1, 2023, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." The relevant interest rate at that time was 8%. (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry, if any, at the beginning of the third year for the lessee to account for the reassessment. 2. Prepare the journal entry, if any, at the beginning of the third year for the lessor to account for the reassessment. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry, if any, at the beginning of the third year for the lessor to account for the reassessment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar.) View transaction list Journal entry worksheet Record the entry, if any, by the lessor to account for the reassessment. Note: Enter debits before credits. General Journal Debit Credit Date January 01, 2023 Record entry Clear entry View general journal Annual lease payments are $24,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. Assume that at the beginning of the third year, January 1, 2023, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." The relevant interest rate at that time was 8%. (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry, if any, at the beginning of the third year for the lessee to account for the reassessment. 2. Prepare the journal entry, if any, at the beginning of the third year for the lessor to account for the reassessment. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry, if any, at the beginning of the third year for the lessor to account for the reassessment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar.) View transaction list Journal entry worksheet Record the entry, if any, by the lessor to account for the reassessment. Note: Enter debits before credits. General Journal Debit Credit Date January 01, 2023 Record entry Clear entry View general journal