Question

Another foreign subsidiary currency problem On January 1, 2014, Parent Company purchased a foreign subsidiary for 200,000 units of the foreign currency, which at that

Another foreign subsidiary currency problem

On January 1, 2014, Parent Company purchased a foreign subsidiary for 200,000 units of the foreign currency, which at that time was equivalent to $220,000. The subsidiary had property, plant and equipment with a total carrying value of 500,000 FC units and liabilities with a carrying value of 300,000 FC units (and no monetary assets). (Also on January 1, 2014 the subsidiarys common stock and its retained earnings were each worth 100,000 FC units.)

Each year the subsidiary declared and paid dividends to the parent company on July 31. On March 31, 2015, the subsidiary sold land that had a carrying value of 10,000 FC for 7,000 FC. This land, as well as all of the other property, plant and equipment owned by the subsidiary had been obtained prior to when it was purchased by Parent Company on Jan. 1, 2014.

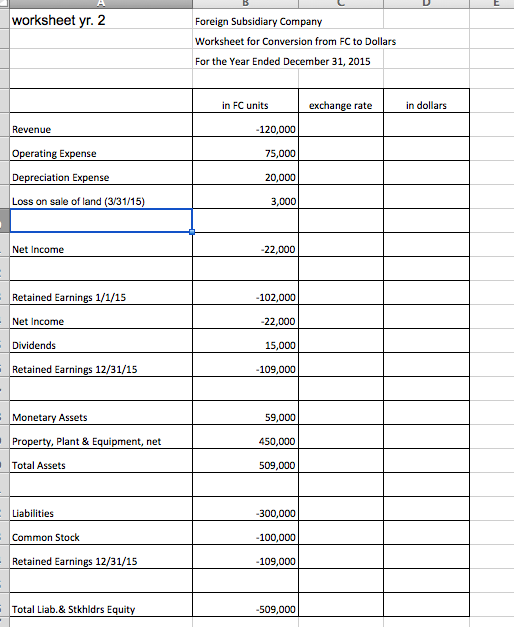

1) Please print two copies of the foreign currency conversion worksheets for 2015, which was the second year that Parent Company owned its foreign subsidiary. The worksheets do not have either the Cumulative Translation Adjustment or the Re-measurement Gain/Loss written in. There are blank lines for you to write in whichever is appropriate. For this assignment assume that the subsidiary earned its regular revenue and incurred its expenses evenly throughout the years. Remember that the sale of land would take place on a specific date.

2) Label one worksheet Temporal Method. Complete it, re-measuring the FC balances to US dollars based on the assumption that the US dollar is the subsidiarys functional currency. For this worksheet, the subsidiarys January 1, 2015 retained earnings in dollars was $134,440.

3) Label the second worksheet Current Rate Method. Complete it, translating the FC balances to US dollars based on the assumption that the subsidiarys functional currency is its local currency. For this worksheet, the subsidiarys January 1, 2015 retained earnings in dollars was $112,180.

4) Finally, prepare the reconciliation for the Cumulative Translation Adjustment for the current rate method. To do this you need to know that the translation adjustment for 2014 was a negative (debit) $16,140 amount.

Exchange rates for 2014 and 2015:

1/1/14 1 FC = $1.10

7/31/14 1 FC = $1.04

Avg. 2014 1 FC = $1.05

12/31/14 1 FC = $1.02

1 / 1 /15 1 FC = $1.02

3 /31/15 1 FC = $1.06

7 /31/15 1 FC = $1.11

Avg. 2015 1 FC = $1.07

12/31/15 1 FC = $1.08

worksheet yr. 2 Foreign Subsidiary Company Worksheet for Conversion from FC to Dollars For the Year Ended December 31, 2015 in FC units exchange rate in dollars Revenue Operating Expense Depreciation Expense Loss on sale of land (3/31/15) 120,000 75,000 20,000 3,000 Net Income 22,000 Retained Earnings 1/1/15 Net Income Dividends Retained Earnings 12/31/15 102,000 22,000 15,000 109,000 Monetary Assets Property, Plant & Equipment, net Total Assets 59,000 450,000 509,000 Liabilities Common Stock Retained Earnings 12/31/15 300,000 100,000 109,000 Total Liab.& Stkhldrs Equity 509,000 worksheet yr. 2 Foreign Subsidiary Company Worksheet for Conversion from FC to Dollars For the Year Ended December 31, 2015 in FC units exchange rate in dollars Revenue Operating Expense Depreciation Expense Loss on sale of land (3/31/15) 120,000 75,000 20,000 3,000 Net Income 22,000 Retained Earnings 1/1/15 Net Income Dividends Retained Earnings 12/31/15 102,000 22,000 15,000 109,000 Monetary Assets Property, Plant & Equipment, net Total Assets 59,000 450,000 509,000 Liabilities Common Stock Retained Earnings 12/31/15 300,000 100,000 109,000 Total Liab.& Stkhldrs Equity 509,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started