Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ans ABC Pvt Ltd acquired a property on 1 January 2018 at a cost of Rs. 28m and commenced depreciation over a 50 year useful

ans

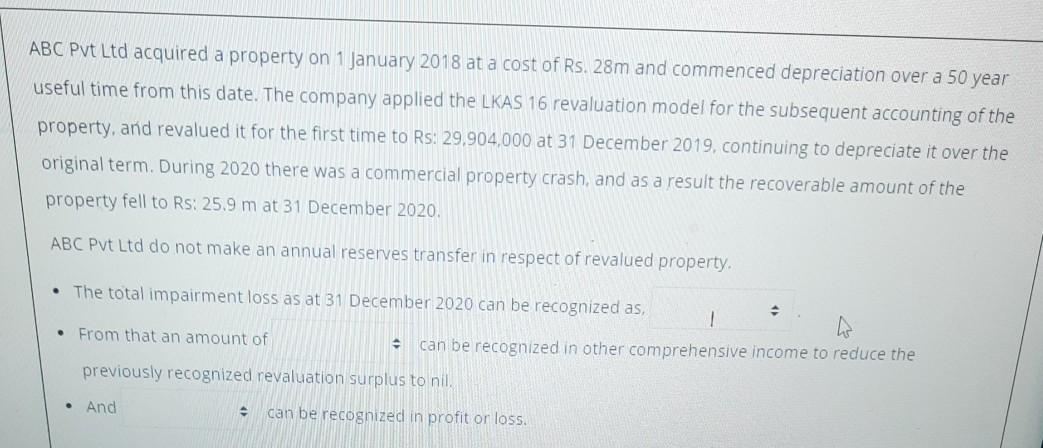

ABC Pvt Ltd acquired a property on 1 January 2018 at a cost of Rs. 28m and commenced depreciation over a 50 year useful time from this date. The company applied the LKAS 16 revaluation model for the subsequent accounting of the property, and revalued it for the first time to Rs: 29,904,000 at 31 December 2019, continuing to depreciate it over the original term. During 2020 there was a commercial property crash, and as a result the recoverable amount of the property fell to Rs: 25.9 m at 31 December 2020. ABC Pvt Ltd do not make an annual reserves transfer in respect of revalued property The total impairmentloss as at 31 December 2020 can be recognized as, 1 From that an amount of can be recognized in other comprehensive income to reduce the previously recognized revaluation surplus to nil. And can be recognized in profit or lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started