1. Calculate the common-size inventories for both years and comment on any differences that you note. Given that the company is in the furniture

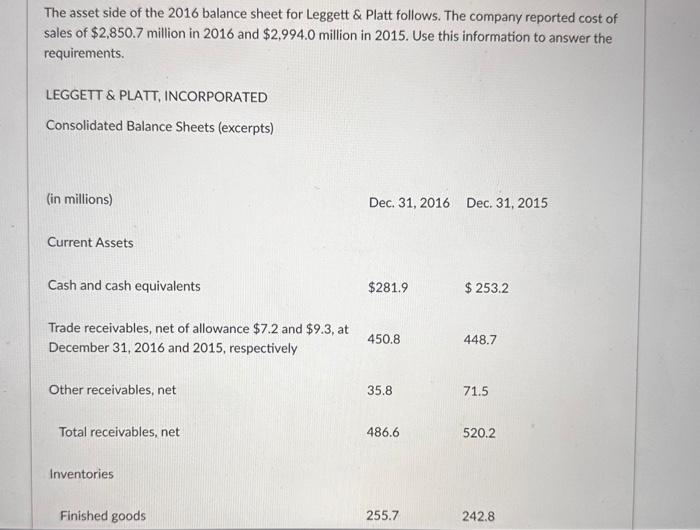

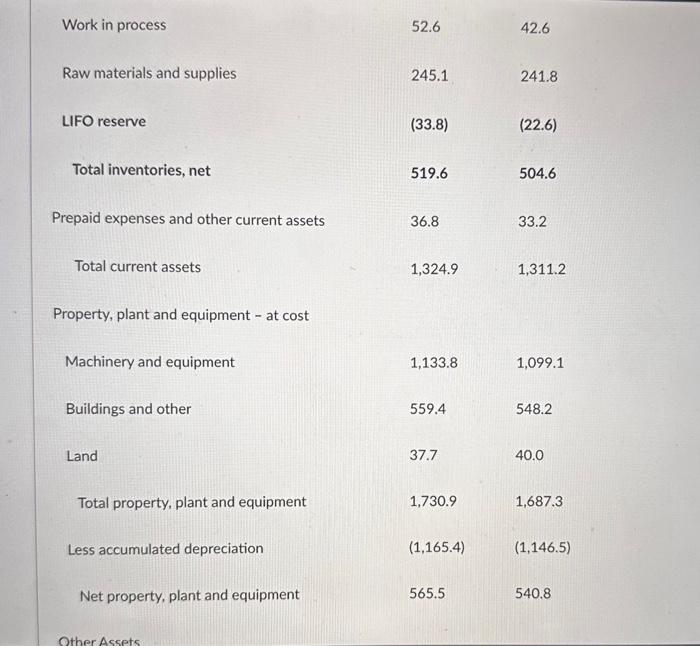

1. Calculate the common-size inventories for both years and comment on any differences that you note. Given that the company is in the furniture manufacturing industry, does this ratio seem appropriate? What additional information you need to make an informed judgement? 2. Compute inventory turnover for both years and interpret any change. At December 31, 2014, Total inventories, net were $481.4 million. 3. Leggett & Platt uses LIFO for at least some of its inventory method. What would the company have reported as inventory in 2016 and 2015 if the company had used the FIFO method? (LIFO reserve balances: $33.8 million in 2016; $22.6 million in 2015; and $73.0 million in 2014.) 4. Recalculate cost of goods sold (COGS) under the FIFO method. 5. Recompute the inventory turnover ratios for 2016 and 2015 under the FIFO method. What difference do you notice between the FIFO-based ratios and the LIFO-based ratios? 6. What is LIFO reserve? Why is the adjustment of LIFO reserve to produce FIFO-based numbers necessary? 7. What is the cumulative effect of LIFO inventory accounting on Leggett & Platt's pre-tax income as of 2016 year-end compared to FIFO accounting? 8. What is the cumulative dollar amount of the company's tax expense been affected by the use of LIFO inventory costing as of the year-end 2016, assuming the tax rate is 35%? 9. What effect has the use of LIFO inventory costing had on the company's pre-tax income and tax expense for 2016 only (assume tax rate of 35%)? The asset side of the 2016 balance sheet for Leggett & Platt follows. The company reported cost of sales of $2,850.7 million in 2016 and $2,994.0 million in 2015. Use this information to answer the requirements. LEGGETT & PLATT, INCORPORATED Consolidated Balance Sheets (excerpts) (in millions) Dec. 31, 2016 Dec. 31, 2015 Current Assets Cash and cash equivalents $281.9 $253.2 Trade receivables, net of allowance $7.2 and $9.3, at 450.8 448.7 December 31, 2016 and 2015, respectively Other receivables, net 35.8 71.5 Total receivables, net Inventories Finished goods 486.6 520.2 255.7 242.8 Other Assets Goodwill 791.3 806.1 Other intangibles, less accumulated amortization of $137.0 and $139.8 at December 31, 2016 and 2015, 164.9 respectively 188.4 Sundry 137.5 117.2 Total other assets 1,093.7 1,111.7 Total assets $2,984.1 $2,963.7 1. Calculate the common-size inventories for both years and comment on any differences that you note. Given that the company is in the furniture manufacturing industry, does this ratio seem appropriate? What additional information you need to make an informed judgement? 2. Compute inventory turnover for both years and interpret any change. At December 31, 2014, Total inventories, net were $481.4 million. 3. Leggett & Platt uses LIFO for at least some of its inventory method. What would the company have reported as inventory in 2016 and 2015 if the company had used the FIFO method? (LIFO reserve balances: $33.8 million in 2016; $22.6 million in 2015; and $73.0 million in 2014.) 4. Recalculate cost of goods sold (COGS) under the FIFO method. 5. Recompute the inventory turnover ratios for 2016 and 2015 under the FIFO method. What difference do you notice between the FIFO-based ratios and the LIFO-based ratios? 6. What is LIFO reserve? Why is the adjustment of LIFO reserve to produce FIFO-based numbers Work in process 52.6 42.6 Raw materials and supplies 245.1 241.8 LIFO reserve (33.8) (22.6) Total inventories, net 519.6 504.6 Prepaid expenses and other current assets 36.8 33.2 Total current assets 1,324.9 1,311.2 Property, plant and equipment - at cost Machinery and equipment 1,133.8 1,099.1 Buildings and other 559.4 548.2 Land 37.7 40.0 Total property, plant and equipment 1,730.9 1,687.3 Less accumulated depreciation (1,165.4) (1,146.5) Net property, plant and equipment 565.5 540.8 Other Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the questions step by step starting with number 1 1 Calculate the commonsize inventories for both years Commonsize Inventories Formula Commonsize Inventory Inventory Total Assets 100 Commonsi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started