Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ans asap 2. The purchase price of equipment is Rs. 10 lakh. The predicted salvage value of the equipment, maintenance cost and the operating hrs

ans asap

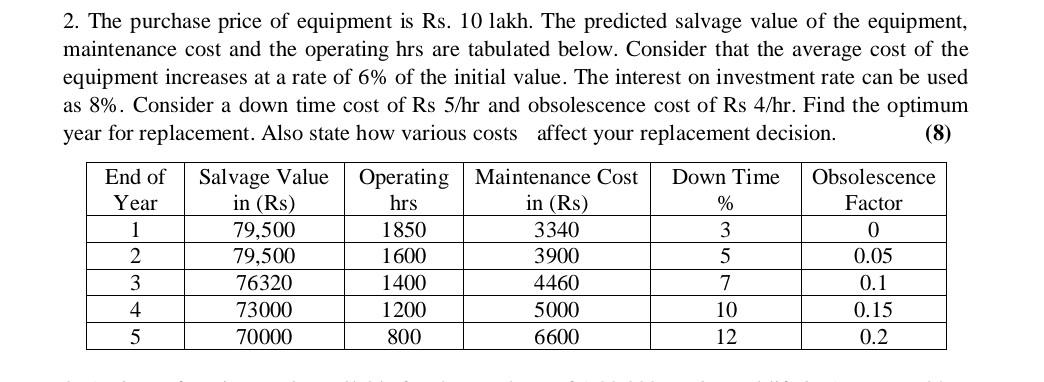

2. The purchase price of equipment is Rs. 10 lakh. The predicted salvage value of the equipment, maintenance cost and the operating hrs are tabulated below. Consider that the average cost of the equipment increases at a rate of 6% of the initial value. The interest on investment rate can be used as 8%. Consider a down time cost of Rs 5/hr and obsolescence cost of Rs 4/hr. Find the optimum year for replacement. Also state how various costs affect your replacement decision. (8) End of Year 1 2 3 4 5 Salvage Value in (Rs) 79,500 79,500 76320 73000 70000 Operating Maintenance Cost hrs in (Rs) 1850 3340 1600 3900 1400 4460 1200 5000 800 6600 Down Time % 3 5 7 10 12 Obsolescence Factor 0 0.05 0.1 0.15 0.2 2. The purchase price of equipment is Rs. 10 lakh. The predicted salvage value of the equipment, maintenance cost and the operating hrs are tabulated below. Consider that the average cost of the equipment increases at a rate of 6% of the initial value. The interest on investment rate can be used as 8%. Consider a down time cost of Rs 5/hr and obsolescence cost of Rs 4/hr. Find the optimum year for replacement. Also state how various costs affect your replacement decision. (8) End of Year 1 2 3 4 5 Salvage Value in (Rs) 79,500 79,500 76320 73000 70000 Operating Maintenance Cost hrs in (Rs) 1850 3340 1600 3900 1400 4460 1200 5000 800 6600 Down Time % 3 5 7 10 12 Obsolescence Factor 0 0.05 0.1 0.15 0.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started