Answered step by step

Verified Expert Solution

Question

1 Approved Answer

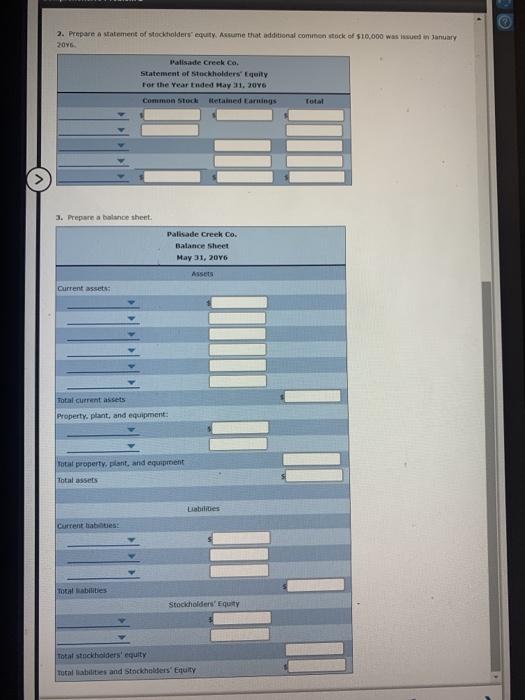

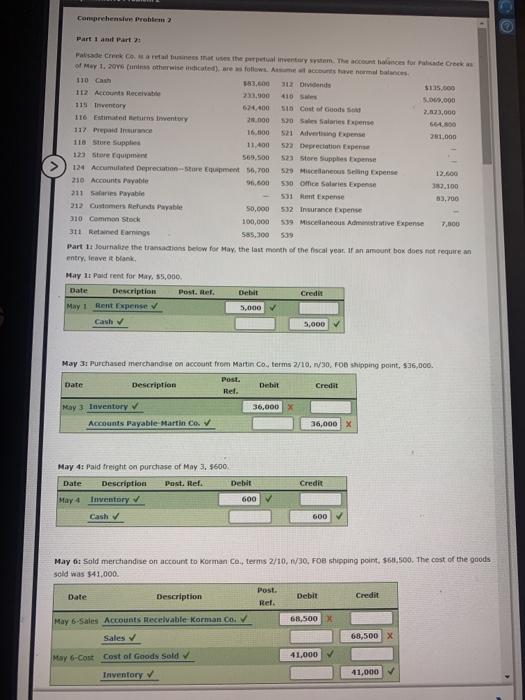

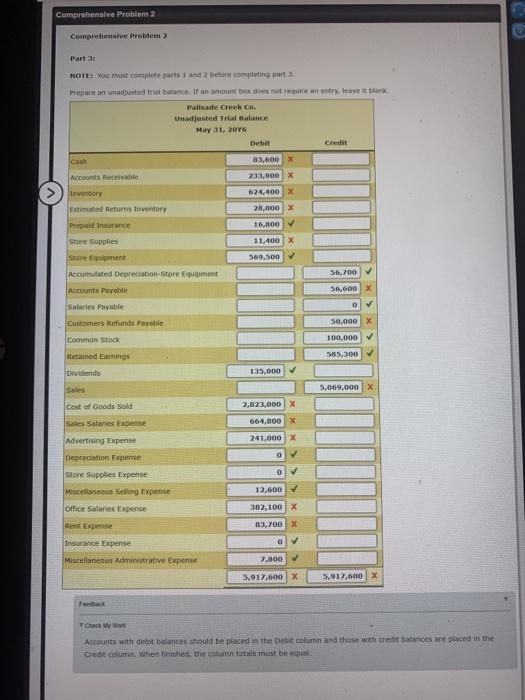

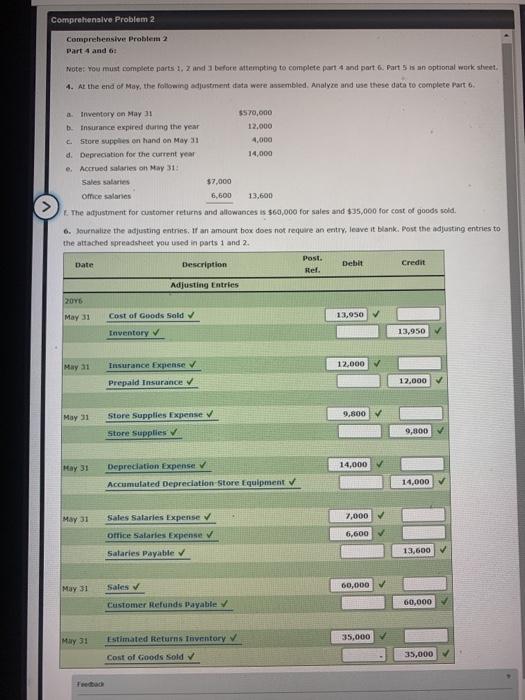

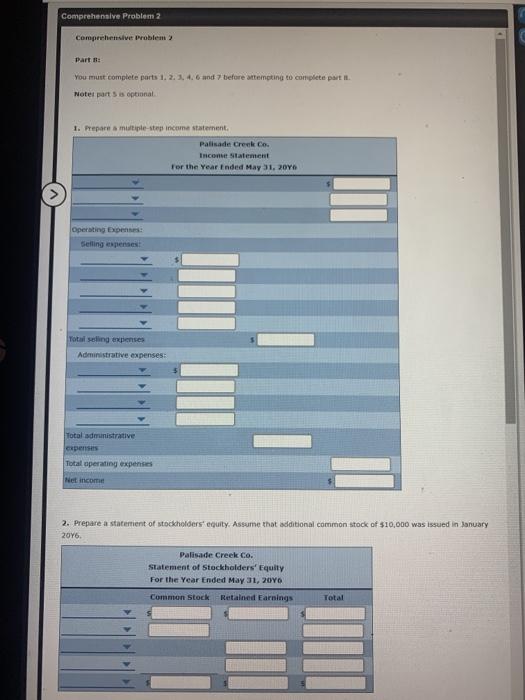

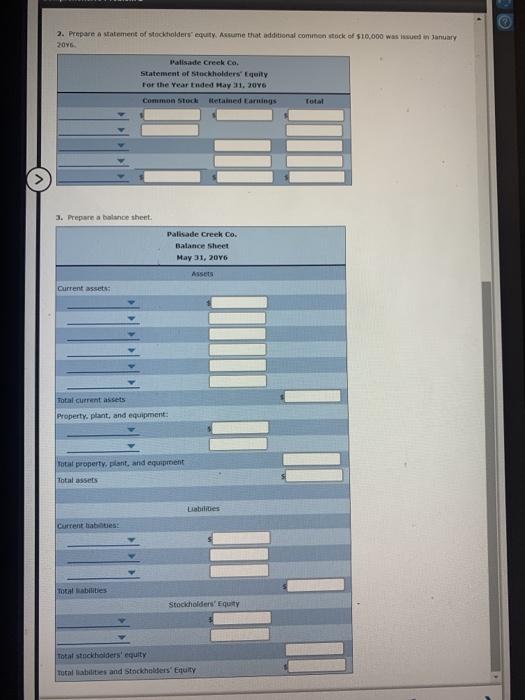

ansser part 8 Comprehensive Problem Part 1 and Part 1 Palisadece Canapeal inventory. The accounts for Park of May 1, 206 (less otherwise indicated) are

ansser part 8

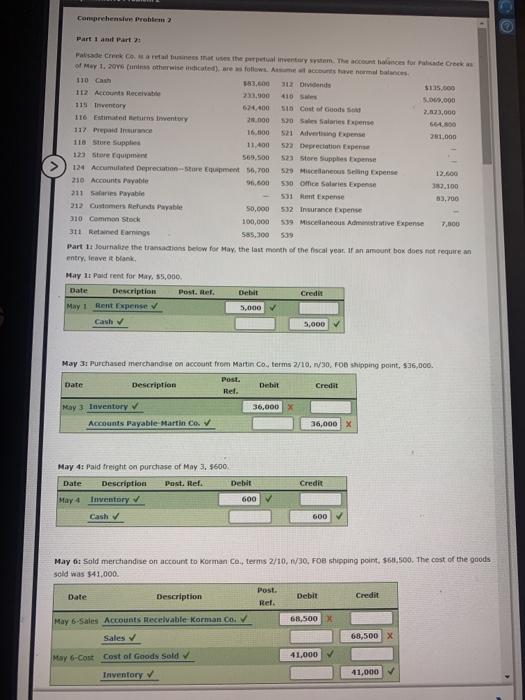

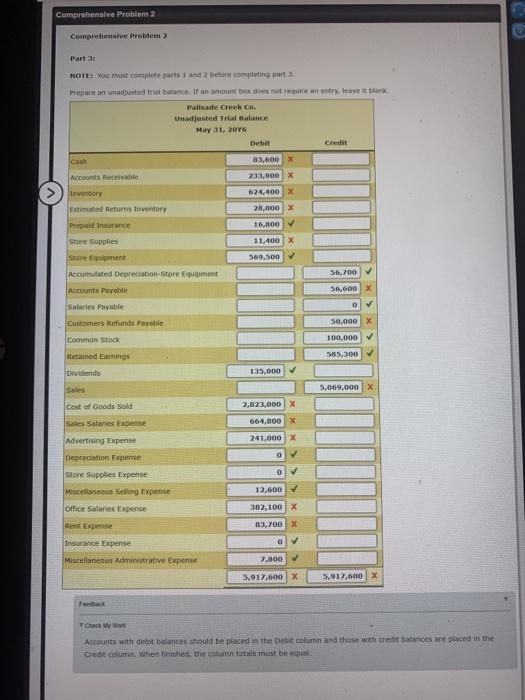

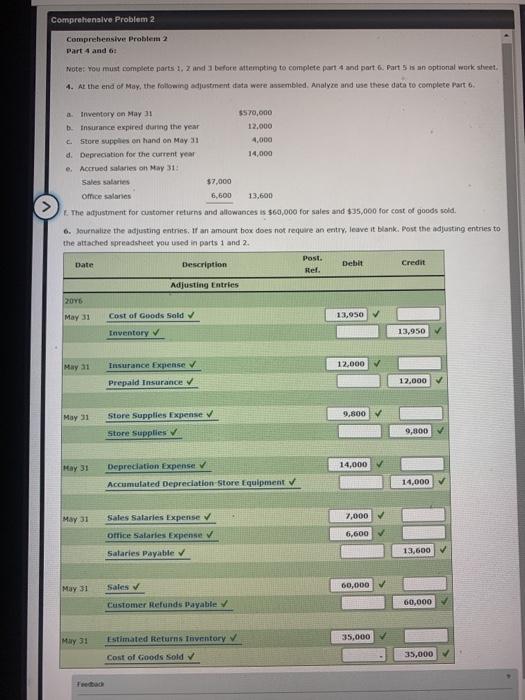

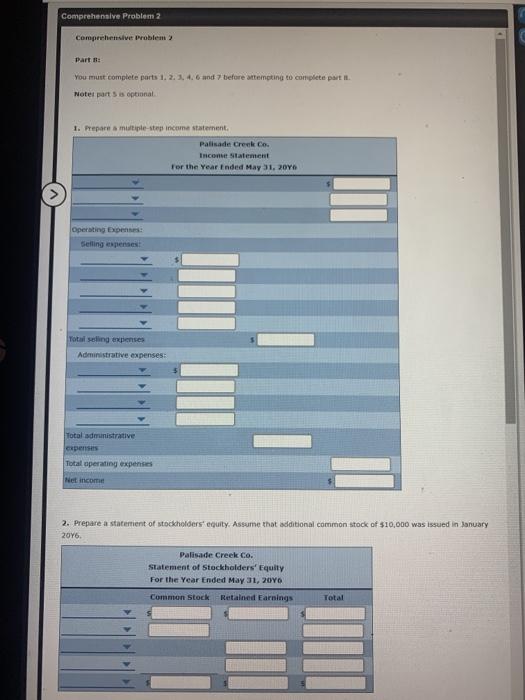

Comprehensive Problem Part 1 and Part 1 Palisadece Canapeal inventory. The accounts for Park of May 1, 206 (less otherwise indicated) are follow. Am sccounts we nemal bancs 10 ch 183.600 312 Dividende 112 Accounts Receive 23.500 410 S SOL.000 115 Trentory 624.400 SID Cast of Good 7.673,000 116 Estimate turns twentory 210.000 50 S Sales Expense S40800 117 Preparice 16.000 52 Advertising Expense 281,000 118 Store Supplies 11.400 52 greciation Expen 123 store romane 565.500 523 Store Supplies Expense 124 Accumulated Depreciation Store pupment 1.700 529 Miscellaneous Selling Expense 12.600 250 Accounts Payable 91,600 530 Of Salaries Expense 32.100 211 Series Payable 531 Rent Expense 83,200 212 Ostomers Nefunds Payable 50.000 532 Ince Expense 310 Common Stock 100,000 S19 Miscellaneous Administrative Expense 7,000 311 Reed Earnings 585,300 539 Part 11 Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require entry, leave it black Credit May It Paid rent for May, 55,000 Date Description Post. Ret. May 1 Rent Expense Cash Debit 5,000 5.000 May 31 Purchased merchandise on account from Martin Co. terms 2/10, 130, FOB shipping point, 536,000. Post Date Description Debit Credit Rel. May 3 Inventory 36,000 Accounts Payable Martin Co. 36,000 X Credit May 4: Paid freight on purchase of May 3. 5600 Date Description Post. Ref. Debit May 4 Inventory 600 Cash 600 May 6: Sold merchandise on account to Korman Co, terms 2/10, 130, FOB shipping point, 168,500. The cost of the goods sold was 541,000. Post. Date Description Debit Credit Ref. May 6-Sales Accounts Receivable Korman Co 68,500 X Sales 68,500 x 41,000 May 6-Cost Cost of Goods Sold Inventory 41,000 Comprehensive Problem 2 Comprehensive Problem? Part 3 NOTE: You must complete part and before completing part 3 Prepare an unadjusted trial once a mont box does not require an entry, leave lank Palisade Creek co, Unadjusted trial Balance Hay 31, 2016 Dent Credit 3,600 x Accounts Receivable 233,900X inventory Estimated Return very Prodinn 624,400 X 21,000 X 16,000 11,400 X 569,500 56,700 Store Supplies store Equipment Accumulated Depreciation Store Equipment Accounts Payable Salaries Payable Customers Refunds Payable Common Stock 56,600 x O 50,000 X 100,000 Burtained Earnings 585,300 Dividends 135,000 5,069,000 X Sales Cost of Goods Sold 2,823,000 X 664,800 X Sales salaries Expense Advertising Expense Depreciation Expense 241,000 X 0 0 12,600 382,100X Store Supplies Expense Miscellaneous Seting Expense Office Stories Expense Rent Expense Insurance Expense Miscellaneous Administrative Expense 3:3,700 X O 7,800 5,917.600 X 5,917,600 X Che WWE Accounts with debit balances should be placed in the Debit column and those with credit balances are placed in the Credit column When finished, the column totals must be equal. Comprehensive Problem 2 Comprehensive Problem 2 Part 4 and 6 Noter You must complete parts and before attempting to complete part 4 and part 6 Part 5 an optional work sheet 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6 Inventory on May 11 $570,000 insurance expired during the year 12,000 Store supplies on hand on May 31 4.000 d. Depreciation for the current year 14,000 e Accrued salaries on May 31: Sales salaries $7.000 Omice salaries 6,600 13.600 The adjustment for customer returns and allowance is $60,000 for sales and $35,000 for cost of goods sold 6. Journalize the adjusting entries. If an amount hox does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2 Post. Date Description Debit Credit Ref. Adjusting Entries 2016 May 31 Cost of Goods Sold 11,950 13,950 Inventory May 31 12.000 Insurance Expense Prepaid Insurance 12,000 May 31 9,800 Store Supplies Expense Store Supplies 9,800 Hay 31 14,000 Depreciation Expense Accumulated Depreciation Store Equipment 14,000 May 31 7,000 Safes Salaries Expense Office Salaries Expense Salaries Payable 6,600 13,600 May 31 Sales 60,000 Customer Refunds Payable 60,000 May 31 Estimated Returns Inventory 35,000 Cost of Goods Sold 35,000 Freibad Comprehensive Problem Part 1 and Part 1 Palisadece Canapeal inventory. The accounts for Park of May 1, 206 (less otherwise indicated) are follow. Am sccounts we nemal bancs 10 ch 183.600 312 Dividende 112 Accounts Receive 23.500 410 S SOL.000 115 Trentory 624.400 SID Cast of Good 7.673,000 116 Estimate turns twentory 210.000 50 S Sales Expense S40800 117 Preparice 16.000 52 Advertising Expense 281,000 118 Store Supplies 11.400 52 greciation Expen 123 store romane 565.500 523 Store Supplies Expense 124 Accumulated Depreciation Store pupment 1.700 529 Miscellaneous Selling Expense 12.600 250 Accounts Payable 91,600 530 Of Salaries Expense 32.100 211 Series Payable 531 Rent Expense 83,200 212 Ostomers Nefunds Payable 50.000 532 Ince Expense 310 Common Stock 100,000 S19 Miscellaneous Administrative Expense 7,000 311 Reed Earnings 585,300 539 Part 11 Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require entry, leave it black Credit May It Paid rent for May, 55,000 Date Description Post. Ret. May 1 Rent Expense Cash Debit 5,000 5.000 May 31 Purchased merchandise on account from Martin Co. terms 2/10, 130, FOB shipping point, 536,000. Post Date Description Debit Credit Rel. May 3 Inventory 36,000 Accounts Payable Martin Co. 36,000 X Credit May 4: Paid freight on purchase of May 3. 5600 Date Description Post. Ref. Debit May 4 Inventory 600 Cash 600 May 6: Sold merchandise on account to Korman Co, terms 2/10, 130, FOB shipping point, 168,500. The cost of the goods sold was 541,000. Post. Date Description Debit Credit Ref. May 6-Sales Accounts Receivable Korman Co 68,500 X Sales 68,500 x 41,000 May 6-Cost Cost of Goods Sold Inventory 41,000 Comprehensive Problem 2 Comprehensive Problem? Part 3 NOTE: You must complete part and before completing part 3 Prepare an unadjusted trial once a mont box does not require an entry, leave lank Palisade Creek co, Unadjusted trial Balance Hay 31, 2016 Dent Credit 3,600 x Accounts Receivable 233,900X inventory Estimated Return very Prodinn 624,400 X 21,000 X 16,000 11,400 X 569,500 56,700 Store Supplies store Equipment Accumulated Depreciation Store Equipment Accounts Payable Salaries Payable Customers Refunds Payable Common Stock 56,600 x O 50,000 X 100,000 Burtained Earnings 585,300 Dividends 135,000 5,069,000 X Sales Cost of Goods Sold 2,823,000 X 664,800 X Sales salaries Expense Advertising Expense Depreciation Expense 241,000 X 0 0 12,600 382,100X Store Supplies Expense Miscellaneous Seting Expense Office Stories Expense Rent Expense Insurance Expense Miscellaneous Administrative Expense 3:3,700 X O 7,800 5,917.600 X 5,917,600 X Che WWE Accounts with debit balances should be placed in the Debit column and those with credit balances are placed in the Credit column When finished, the column totals must be equal. Comprehensive Problem 2 Comprehensive Problem 2 Part 4 and 6 Noter You must complete parts and before attempting to complete part 4 and part 6 Part 5 an optional work sheet 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6 Inventory on May 11 $570,000 insurance expired during the year 12,000 Store supplies on hand on May 31 4.000 d. Depreciation for the current year 14,000 e Accrued salaries on May 31: Sales salaries $7.000 Omice salaries 6,600 13.600 The adjustment for customer returns and allowance is $60,000 for sales and $35,000 for cost of goods sold 6. Journalize the adjusting entries. If an amount hox does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2 Post. Date Description Debit Credit Ref. Adjusting Entries 2016 May 31 Cost of Goods Sold 11,950 13,950 Inventory May 31 12.000 Insurance Expense Prepaid Insurance 12,000 May 31 9,800 Store Supplies Expense Store Supplies 9,800 Hay 31 14,000 Depreciation Expense Accumulated Depreciation Store Equipment 14,000 May 31 7,000 Safes Salaries Expense Office Salaries Expense Salaries Payable 6,600 13,600 May 31 Sales 60,000 Customer Refunds Payable 60,000 May 31 Estimated Returns Inventory 35,000 Cost of Goods Sold 35,000 Freibad

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started