Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answe it all - request ! Company S acquired machinery that cost $35,000, had an estimated salvage value of $5,000, and a useful life of

answe it all - request !

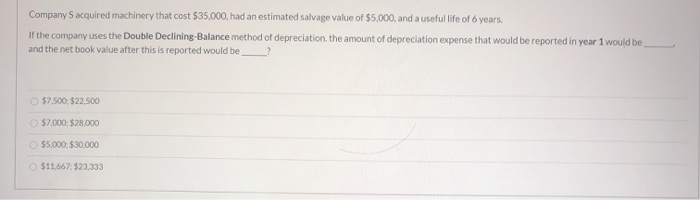

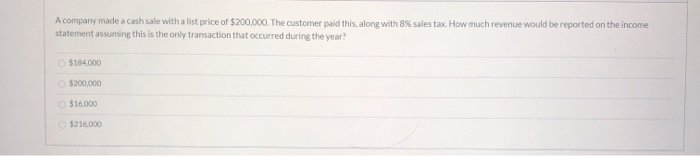

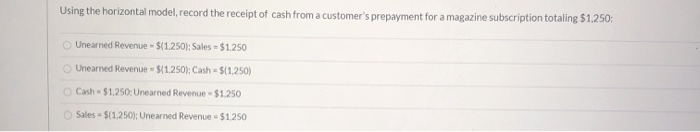

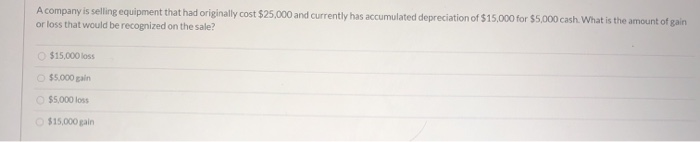

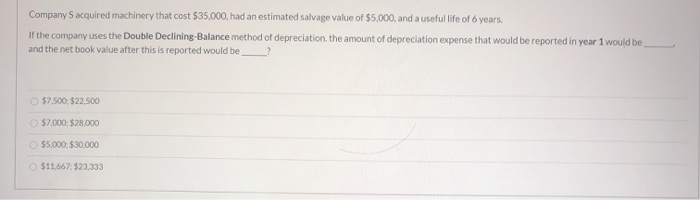

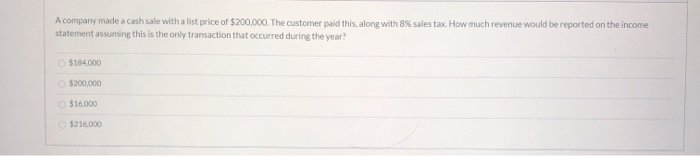

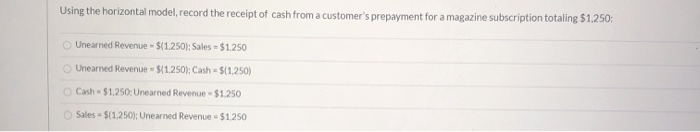

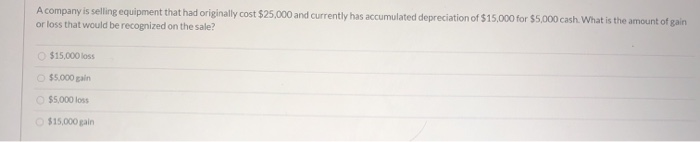

Company S acquired machinery that cost $35,000, had an estimated salvage value of $5,000, and a useful life of 6 years. If the company uses the Double Declining-Balance method of depreciation, the amount of depreciation expense that would be reported in year 1 would be and the net book value after this is reported would be $7.500, $22,500 $7,000: $28.000 $5,000: $30.000 $11,667: $23,333 A company made a cash sale with a list price of $200,000. The customer paid this along with 8% sales tax. How much revenue would be reported on the income statement assuming this is the only transaction that occurred during the year? $184.000 $200,000 516 000 $216.000 Using the horizontal model, record the receipt of cash from a customer's prepayment for a magazine subscription totaling $1.250; Unearned Revenue - $(1.250); Sales = $1.250 Unearned Revenue $(1.250): Cash - $(1.250) Cash $1.250: Unearned Revenue - $1.250 Sales - $(1.250): Unearned Revenue - $1250 A company is selling equipment that had originally cost $25,000 and currently has accumulated depreciation of $15,000 for $5,000 cash. What is the amount of gain or loss that would be recognized on the sale? $15,000 loss $5.000 gain $5,000 loss $15,000 gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started