answear all

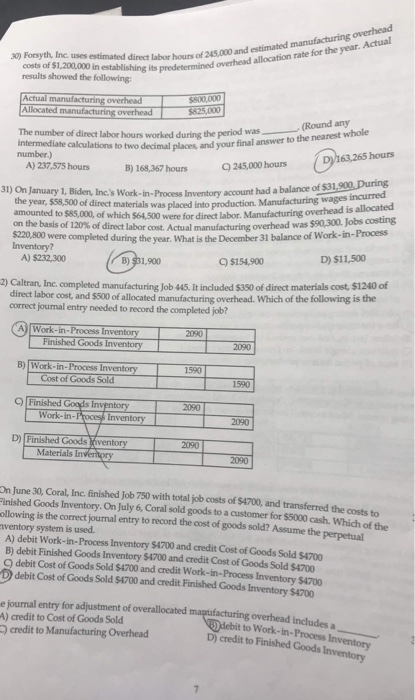

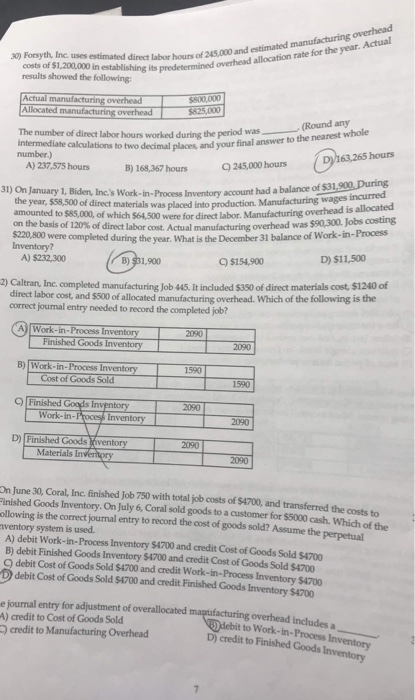

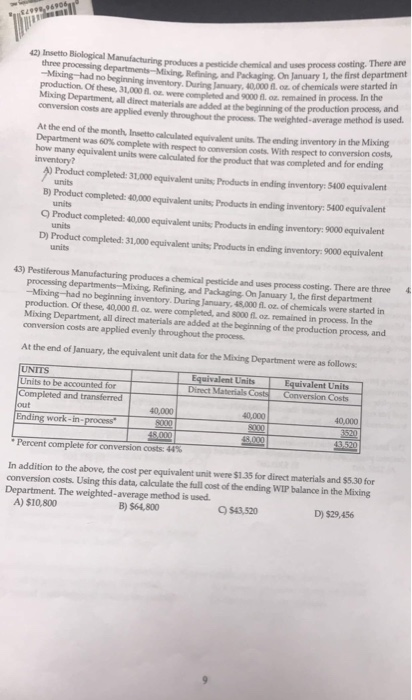

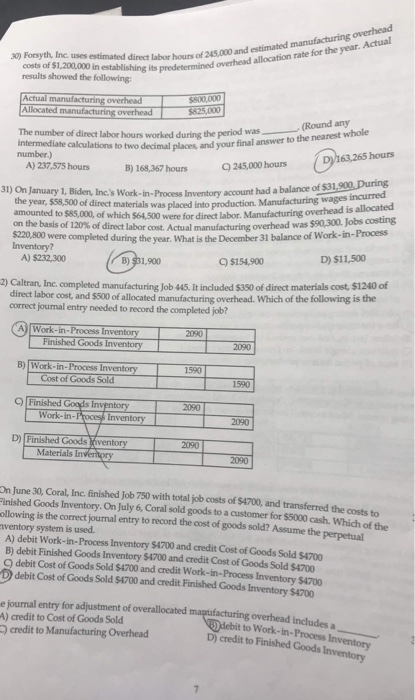

30) Forsyth, Inc. uses estimated direct labor hours of 245,000 and estimated manufacturing overhead costs of $1,200,000 in establishing its predetermined overhead allocation rate for the year. Actual results showed the following $800 000 $825,000 Actual manufacturing overhead Allocated manufacturing overhead (Round any The number of direct labor hours worked during the period was intermediate calculations to two decimal places, and your final answer to the nearest whole DV163.265 hours number.) A) 237,575 hours 9 245,000 hours B) 168,367 hours 31) On January 1, Biden, Inc's Work-in-Process Inventory accouunt had a balance of $31,900 During the year, $58,500 of direct materials was placed into production. Manufacturing wages incurred amounted to $85,000, of which $64,500 were for direct labor. Manufacturing overhead is allocated on the basis of 120 % of direct labor cost. Actual manufacturing overhead was $90,300. Jobs costing $220,800 were completed during the year. What is the December 31 balance of Work-in-Process Inventory? A) $232,300 D) $11,500 9 $154,900 B) $31,900 2) Caltran, Inc. completed manufacturing Job 445, It included $350 of direct materials cost, $1240 of direct labor cost, and $500 of allocated manufacturing overhead. Which of the following is the correct journal entry needed to record the completed job? A) Work-in-Process Inventory Finished Goods Inventory 2090 2090 B) Work-in-Process Inventory 1590 Cost of Goods Sold 1590 9 Finished Goods Inventory Work-in-Process Inventory 2090 2090 D) Finished Goods Inventory 2090 Materials Invertory 2090 Iune 30, Coral, Inc. finished Job 750 with total job costs of $4700, and transferred the cnste to inished Goods Inventory, On July 6, Coral sold goods to a customer for $5000 cash. Which of the ollowing is the correct jounal entry to record the cost of goods sold? Assume the pernetual nventory system is used. A) debit Work-in-Process Inventory $4700 and credit Cost of Goods Sold $4700 B) debit Finished Goods Inventorry $4700 and credit Cost of Goods Sold $4700 O debit Cost of Goods Sold $4700 and credit Work-in- Process Inventory $4700 debit Cost of Goods Sold $4700 and credit Finished Goods Inventory $4700 e journal entry for adjustment of overallocated mapufacturing overhead includes a A) credit to Cost of Goods Sold credit to Manufacturing Overhead debit to Work-in-Process Inventory D) credit to Finished Goods Inventory 42) Insetto Biclogical Manufacturing produces a pesticide chemical and uses process costing. There are three processing departments-Mixing, Refining, and Packaging. On January 1, the first department Mixing-had no beginning inventory. During January, 40,000 oz. of chemicals were started in production. Of these, 31,000 l. oz were completed and 9000 f oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the proces. The weighted-average method is used. At the end of the month, Insetto calculated euivalent units The ending inventory in the Mbang Department was 60% complete with respect to conversion costs. With respect to conversion costs, how many equivalent units were calculated for the product that was completed and for ending inventory? ) Product completed: 31,000 equivalent units Products in ending inventory: 5400 equivalent units B) Product completed: 40,000 equivalent units Products in ending inventory: 5400 equivalent units 9 Product completed: 40,000 equivalent units; Products in ending inventory: 9000 equivalent units D) Product completed: 31,000 equivalent units Products in ending inventory: 9000 equivalent units 43) Pestiferous Manufacturing produces a chemical pesticide and uses process costing. There are three processing departments-Mixing, Refining, and Packaging On January 1, the first department -Mixing-had no beginning inventory. During January, 48,000 fl. oz. of chemicals were started in production. Of these, 40,000 f. oz were completed, and 8000 f oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process At the end of January, the equivalent unit data for the Miding Department were as follows Equivalent Units Direct Materials Costi UNITS Units to be accounted for Completed and transferred out Ending work-in-process Equivalent Units Conversion Costs 40,000 40,000 8000 48.000 40,000 8000 3520 48.000 43,520 Percent complete for conversion costs: 44% In addition to the above, the cost per equivalent unit were $1.35 for direct materials and $5.30 for conversion costs. Using this data, calculate the full cost of the ending WIP balance in the Mixing Department. The weighted-average method is used A) $10,800 9 $43520 B) $64,800 D) $29,456 9) Goods that have been started in the manufacturing process but are not yet complete the A) Finished Goods Inventory account 9 Cost of Goods Sold account are inclu B Work-in-Process Inventory accoum D) Raw Materials Inventory account 10) Castillo Corporation, a manufacturer, reports costs for the year as follows Direct Materials Used Wages to Line Workers Office Rent Indirect Materials Used $735,000 510,000 26,000 700,000 Ho much is the total period costs for Castillo? A26,000 B) $700,000 9 $510,000 D) $735,000 11) The following information relates to Myer, Inc Advertising Costs Sales Salary Sales Revenue President's Salary Office Rent Manufacturing Equipment Depreciation Indirect Materials Used Indirect Labor $10600 500,000 230.000 60,500 1200 8000 13,000 Factory Repair and Maintenance Direct Materials Used Direct Labor Delivery Vehicle Depreciation Administrative Salaries 920 27,500 36,000 1550 22,000 How much were Myer's product costs? A) $604,650 B) $510,600 9 $86,620 D) $252,000 12) Super Tread Inc. is a large manufacturer of auto tires. Super Tread has provided the following information: Sales Revenue Beginning Finished Goods Inventory Cost of Goods Sold Cost of Goods Manufactured $55,000 15,500 Codo 37,500 44,500 Calculate the amount of ending Finished Goods Inventory reported on Super Tread's balance sheet. A) $7000 9 $10,500 B) $60,000 D) $22,500