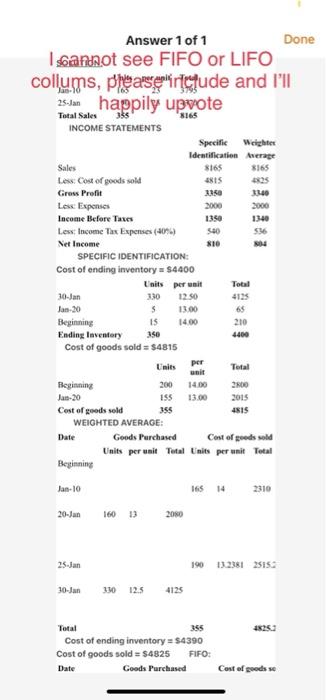

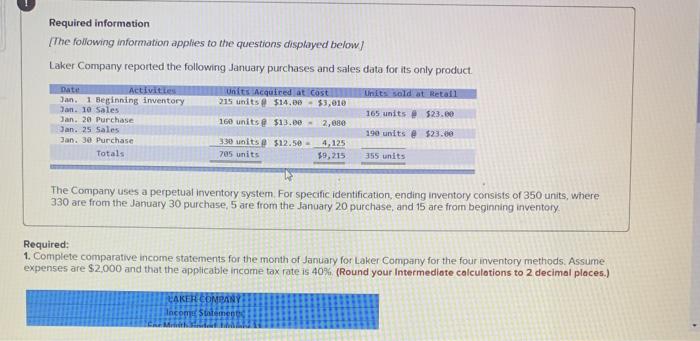

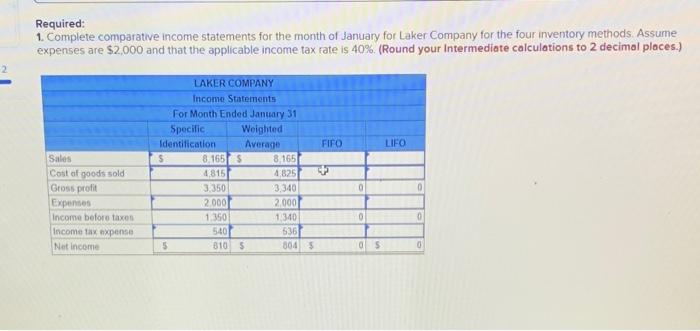

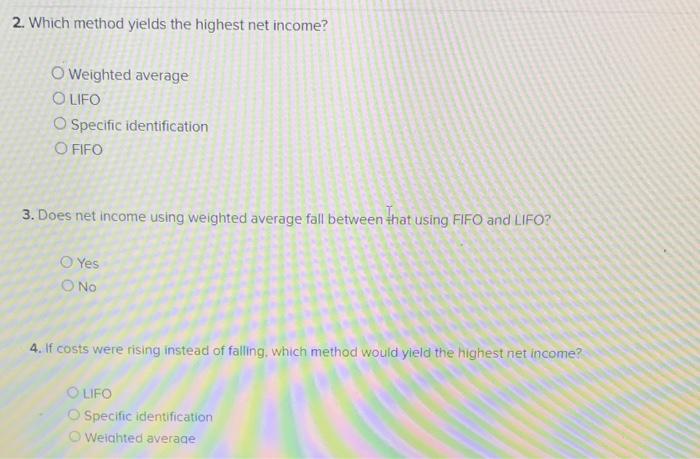

Answer 1 of 1 Done scannot see FIFO or LIFO collums, phearsenkircude and I'll 25.Jun. happily upvote INCOME STATEMENTS Total Sales 355 8165 Specific Weights Identification Average Sales 3165 8165 Less Cost of goods sold 3815 Gross Profit 2350 38.40 Less Expenses 2000 2000 Income Before Taxes 1350 1340 Les Income Tax Expenses (40%) 540 5365 Net Income 810 04 SPECIFIC IDENTIFICATION: Cost of ending inventory = $4400 Units per unit Total 30.Jan 330 12.50 4125 Jan-20 $ 13.00 65 Beginning 15 14.00 210 Ending Inventory 4400 Cost of goods sold = $4815 Units per Total uni Beginning 200 14.00 200 Jan-20 155 13.00 2015 Cost of goods sold 355 4815 WEIGHTED AVERAGE: Goods Purchased Cost of goods sold Units per unit Total Units per unit Total Beginning 350 Jan-10 165 14 2310 20-Jan 1601 2080 25.Jan 190 13.238125153 30-Jan 3:30 12.5 4125 355 1825 Total Cost of ending inventory = $4390 Cost of goods sold = $4825 FIFO: Date Goods Purchased Cost of goods se Required information [The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data for its only product Date Activities Units Acquired at Cost Units sold at Retail Jan. 1 Beginning inventory 215 units $14.00 - $3,010 Jan 10 Sales 165 units # 523.00 Jan. 20 Purchase 160 units@ $13.00 - 2,080 Jan. 25 Sales 190 units @ $23.00 Jan. 30 Purchase 330 units @ $12.50 4.125 Totals 705 units $9,215 355 units The Company uses a perpetual Inventory system. For specific identification, ending inventory consists of 350 units, where 330 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory Required: 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $2,000 and that the applicable income tax rate is 40% (Round your Intermediate calculations to 2 decimal places.) LAKER COMPANY Income Statement Required: 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods Assume expenses are $2,000 and that the applicable income tax rate is 40% (Round your Intermediate calculations to 2 decimal places.) 2 FIFO LIFO LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average $ 8.1655 8,165 4815 4,825 3.350 3,340 2.000 2.000 1.350 1.340 540 5 8105 8045 0 Sales Cost of goods sold Gross profit Expenses Income before taxon Income tax expense Net Income 0 0 0 5:36 05 0 2. Which method yields the highest net income? O Weighted average O LIFO O Specific identification O FIFO 3. Does net income using weighted average fall between that using FIFO and LIFO? Yes O NO 4. If costs were rising instead of falling, which method would yield the highest net income? OLIFO Specific identification Weighted average