Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer? 1. SREI Infrastructure Ltd. has three business organized in three different divisions. All three divisions are profitable and they are going to expand its

Answer?

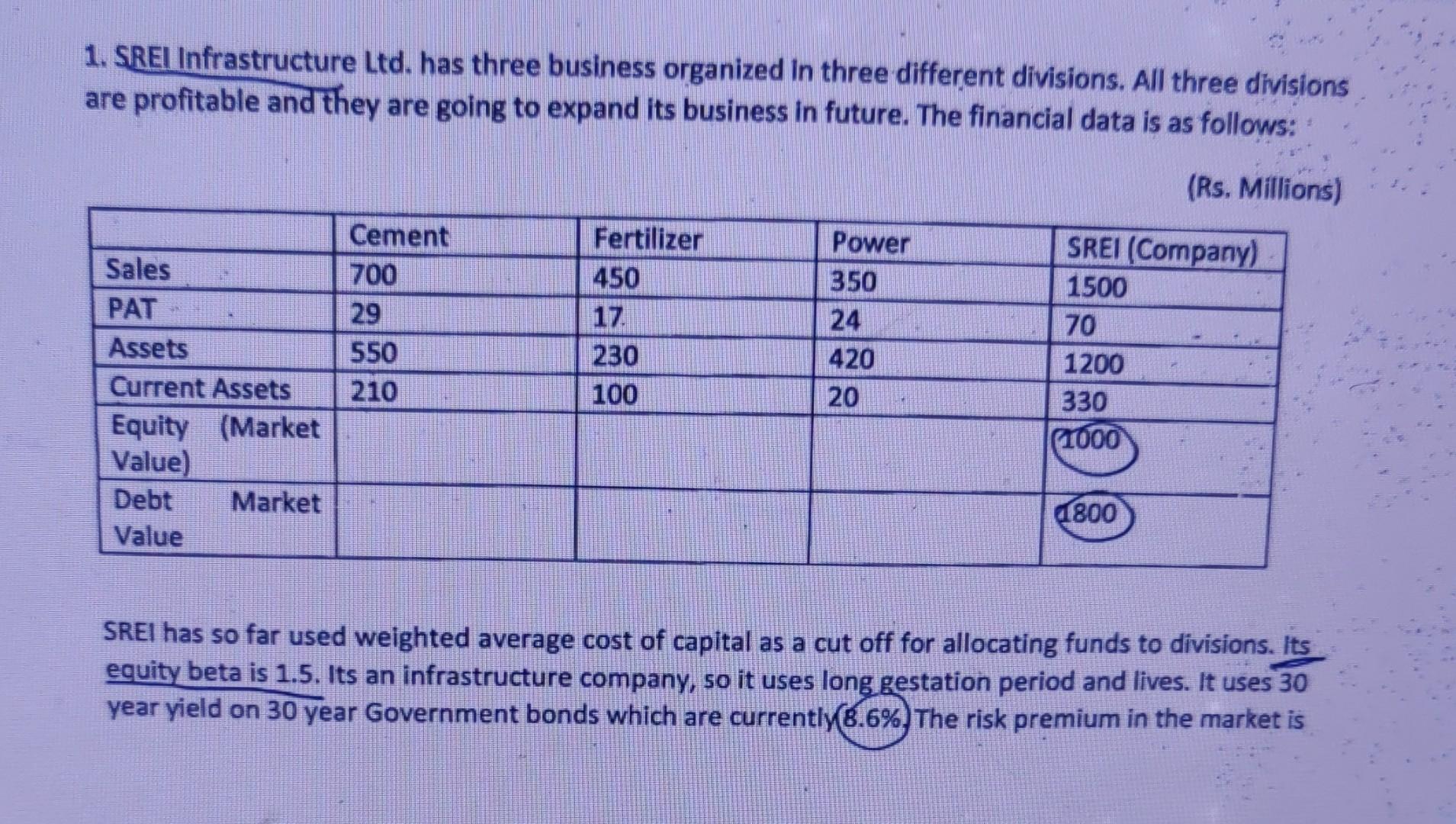

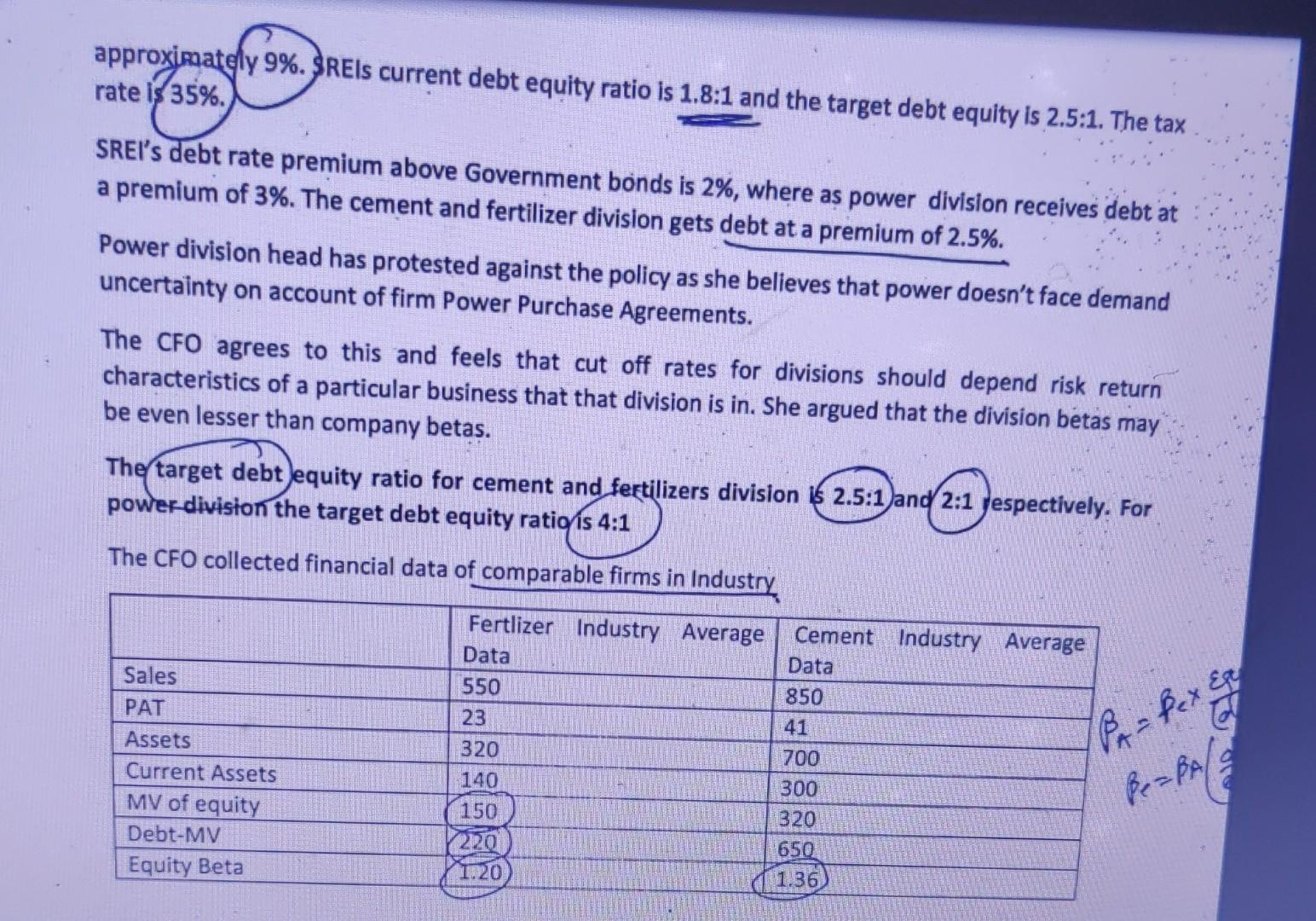

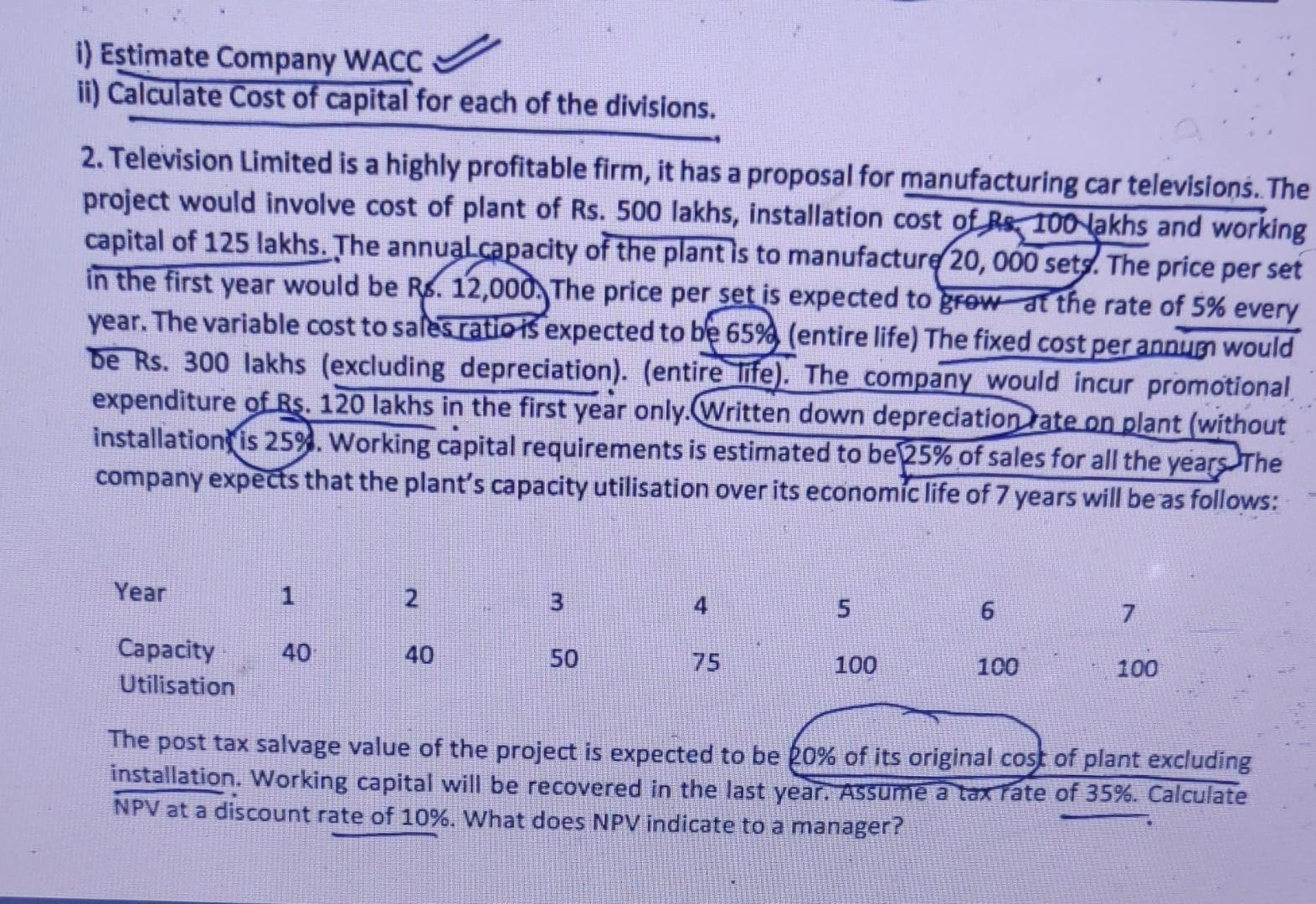

1. SREI Infrastructure Ltd. has three business organized in three different divisions. All three divisions are profitable and they are going to expand its business in future. The financial data is as follows: (Rs. Millions) Sales PAT Assets Current Assets Equity (Market Value) Debt Market Value Cement 700 29 550 210 Fertilizer 450 17 230 100 Power 350 24 420 20 SREI (Company) 1500 70 1200 330 1000 0800 SREI has so far used weighted average cost of capital as a cut off for allocating funds to divisions. Its equity beta is 1.5. Its an infrastructure company, so it uses long gestation period and lives. It uses 30 year yield on 30 year Government bonds which are currently(8.6%. The risk premium in the market is approximately 9%. SREls current debt equity ratio is 1.8:1 and the target debt equity is 2.5:1. The tax rate is 35%. SREI's debt rate premium above Government bonds is 2%, where as power division receives debt at a premium of 3%. The cement and fertilizer division gets debt at a premium of 2.5%. Power division head has protested against the policy as she believes that power doesn't face demand uncertainty on account of firm Power Purchase Agreements. The CFO agrees to this and feels that cut off rates for divisions should depend risk return characteristics of a particular business that that division is in. She argued that the division betas may be even lesser than company betas. The target debt equity ratio for cement and fertilizers division 16 2.5:1 and 2:1 respectively. For power-division the target debt equity ratio is 4:1 The CFO collected financial data of comparable firms in Industry Fertlizer Industry Average Cement Industry Average Data Data Sales 550 850 PAT 23 41 Assets 320 700 Current Assets 140 300 MV of equity 150 320 Debt-MV 220 Equity Beta 1.20 1.36 Pr-kexes Be=BA) 650 1) Estimate Company WACC ii) Calculate Cost of capital for each of the divisions. 2. Television Limited is a highly profitable firm, it has a proposal for manufacturing car televisions. The project would involve cost of plant of Rs. 500 lakhs, installation cost of Rs. 100 lakhs and working capital of 125 lakhs. The annual capacity of the plant is to manufacture 20,000 sets. The price per set in the first year would be R$ 12,000, The price per set is expected to grow at the rate of 5% every year. The variable cost to sales ratio is expected to be 65% (entire life) The fixed cost per annuen would de Rs. 300 lakhs (excluding depreciation). (entire Tife). The company would incur promotional expenditure of Rs. 120 lakhs in the first year only. Written down depreciation rate on plant (without installation is 25%. Working capital requirements is estimated to be 25% of sales for all the company expects that the plant's capacity utilisation over its economic life of 7 years will be as follows: years. The Year 1 2. 3 ma 5 6 40 40 Capacity Utilisation 50 75 100 100 100 The post tax salvage value of the project is expected to be 20% of its original cost of plant excluding installation. Working capital will be recovered in the last year. Assume a tax rate of 35%. Calculate NPV at a discount rate of 10%. What does NPV indicate to a manager? 1. SREI Infrastructure Ltd. has three business organized in three different divisions. All three divisions are profitable and they are going to expand its business in future. The financial data is as follows: (Rs. Millions) Sales PAT Assets Current Assets Equity (Market Value) Debt Market Value Cement 700 29 550 210 Fertilizer 450 17 230 100 Power 350 24 420 20 SREI (Company) 1500 70 1200 330 1000 0800 SREI has so far used weighted average cost of capital as a cut off for allocating funds to divisions. Its equity beta is 1.5. Its an infrastructure company, so it uses long gestation period and lives. It uses 30 year yield on 30 year Government bonds which are currently(8.6%. The risk premium in the market is approximately 9%. SREls current debt equity ratio is 1.8:1 and the target debt equity is 2.5:1. The tax rate is 35%. SREI's debt rate premium above Government bonds is 2%, where as power division receives debt at a premium of 3%. The cement and fertilizer division gets debt at a premium of 2.5%. Power division head has protested against the policy as she believes that power doesn't face demand uncertainty on account of firm Power Purchase Agreements. The CFO agrees to this and feels that cut off rates for divisions should depend risk return characteristics of a particular business that that division is in. She argued that the division betas may be even lesser than company betas. The target debt equity ratio for cement and fertilizers division 16 2.5:1 and 2:1 respectively. For power-division the target debt equity ratio is 4:1 The CFO collected financial data of comparable firms in Industry Fertlizer Industry Average Cement Industry Average Data Data Sales 550 850 PAT 23 41 Assets 320 700 Current Assets 140 300 MV of equity 150 320 Debt-MV 220 Equity Beta 1.20 1.36 Pr-kexes Be=BA) 650 1) Estimate Company WACC ii) Calculate Cost of capital for each of the divisions. 2. Television Limited is a highly profitable firm, it has a proposal for manufacturing car televisions. The project would involve cost of plant of Rs. 500 lakhs, installation cost of Rs. 100 lakhs and working capital of 125 lakhs. The annual capacity of the plant is to manufacture 20,000 sets. The price per set in the first year would be R$ 12,000, The price per set is expected to grow at the rate of 5% every year. The variable cost to sales ratio is expected to be 65% (entire life) The fixed cost per annuen would de Rs. 300 lakhs (excluding depreciation). (entire Tife). The company would incur promotional expenditure of Rs. 120 lakhs in the first year only. Written down depreciation rate on plant (without installation is 25%. Working capital requirements is estimated to be 25% of sales for all the company expects that the plant's capacity utilisation over its economic life of 7 years will be as follows: years. The Year 1 2. 3 ma 5 6 40 40 Capacity Utilisation 50 75 100 100 100 The post tax salvage value of the project is expected to be 20% of its original cost of plant excluding installation. Working capital will be recovered in the last year. Assume a tax rate of 35%. Calculate NPV at a discount rate of 10%. What does NPV indicate to a managerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started