Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer #1 This is a college business finance course so use the normal formular with a normal calculator. You can get it in this book

Answer #1

Answer #1

This is a college business finance course so use the normal formular with a normal calculator. You can get it in this book " Foundation of finance (8th edition) by Athur Keown ( Dr. Soc.)

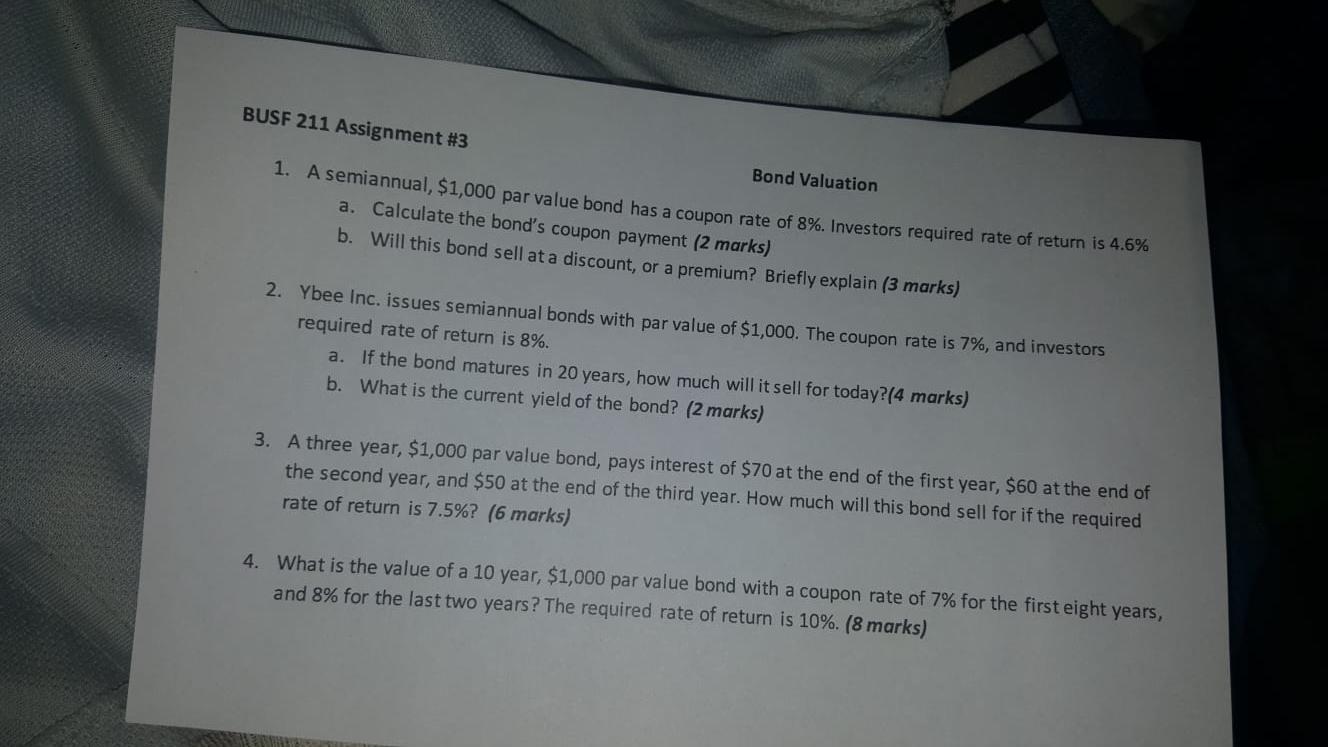

BUSF 211 Assignment #3 Bond Valuation 1. A semiannual, $1,000 par value bond has a coupon rate of 8%. Investors required rate of return is 4.6% a. Calculate the bond's coupon payment (2 marks) b. Will this bond sell at a discount, or a premium? Briefly explain (3 marks) 2. Ybee Inc. issues semiannual bonds with par value of $1,000. The coupon rate is 7%, and investors required rate of return is 8%. a. If the bond matures in 20 years, how much will it sell for today?(4 marks) b. What is the current yield of the bond? (2 marks) 3. A three year, $1,000 par value bond, pays interest of $70 at the end of the first year, $60 at the end of the second year, and $50 at the end of the third year. How much will this bond sell for if the required rate of return is 7.5%? (6 marks) 4. What is the value of a 10 year, $1,000 par value bond with a coupon rate of 7% for the first eight years, and 8% for the last two years? The required rate of return is 10%. (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started