Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 10 and 11 please Alan Barnett is 43 years old and has accumulated $78.000 in his self-directed defined contribution pension plan. Each year he

answer 10 and 11 please

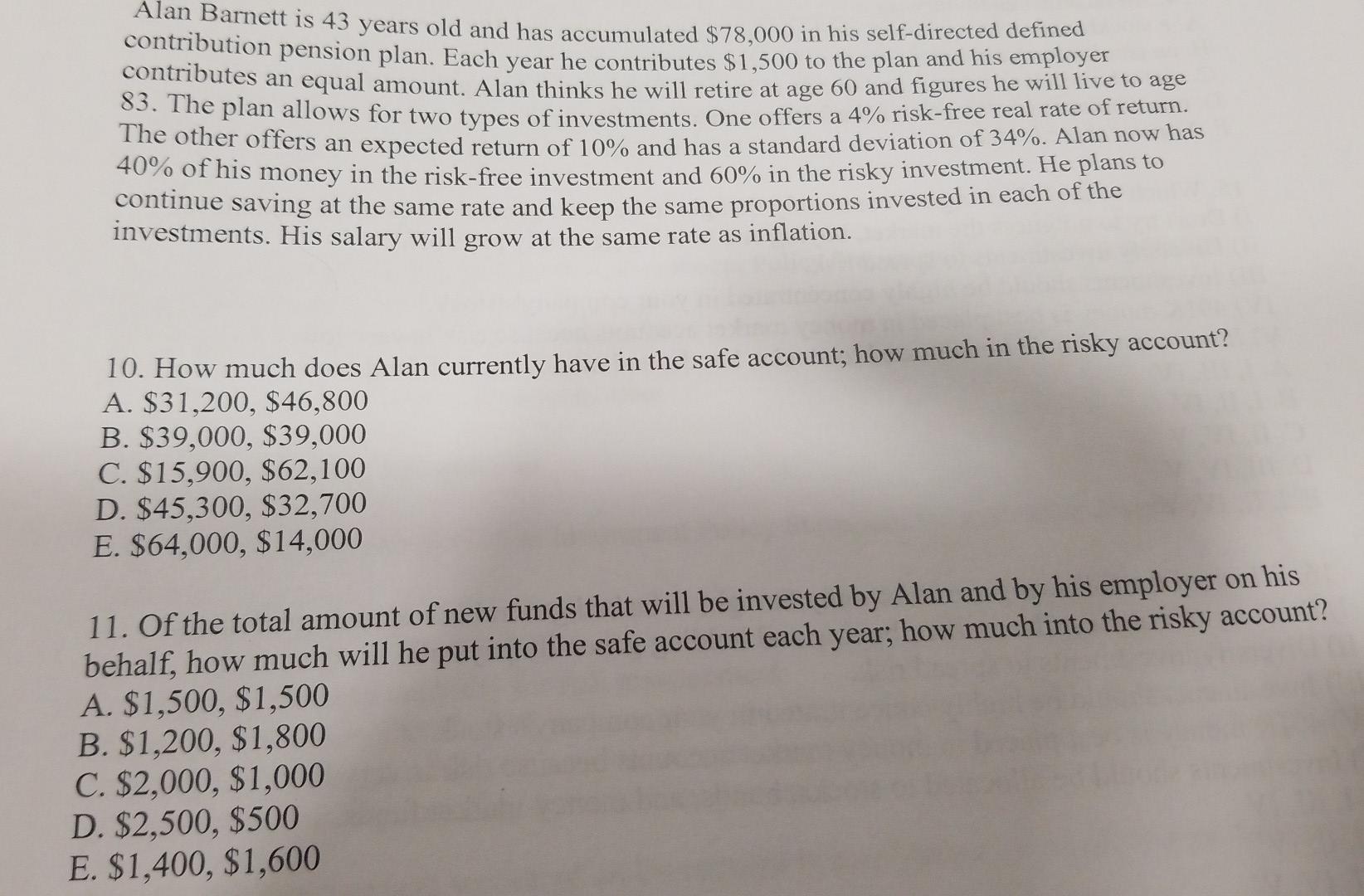

Alan Barnett is 43 years old and has accumulated $78.000 in his self-directed defined contribution pension plan. Each year he contributes $1,500 to the plan and his employer contributes an equal amount. Alan thinks he will retire at age 60 and figures he will live to age 83. The plan allows for two types of investments. One offers a 4% risk-free real rate of return. The other offers an expected return of 10% and has a standard deviation of 34%. Alan now has 40% of his money in the risk-free investment and 60% in the risky investment. He plans to continue saving at the same rate and keep the same proportions invested in each of the investments. His salary will grow at the same rate as inflation. 10. How much does Alan currently have in the safe account; how much in the risky account? A. $31,200,$46,800 B. $39,000,$39,000 C. $15,900,$62,100 D. $45,300,$32,700 E. $64,000,$14,000 11. Of the total amount of new funds that will be invested by Alan and by his employer on his behalf, how much will he put into the safe account each year; how much into the risky account? A. $1,500,$1,500 B. $1,200,$1,800 C. $2,000,$1,000 D. $2,500,$500 $1,400,$1,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started