Answered step by step

Verified Expert Solution

Question

1 Approved Answer

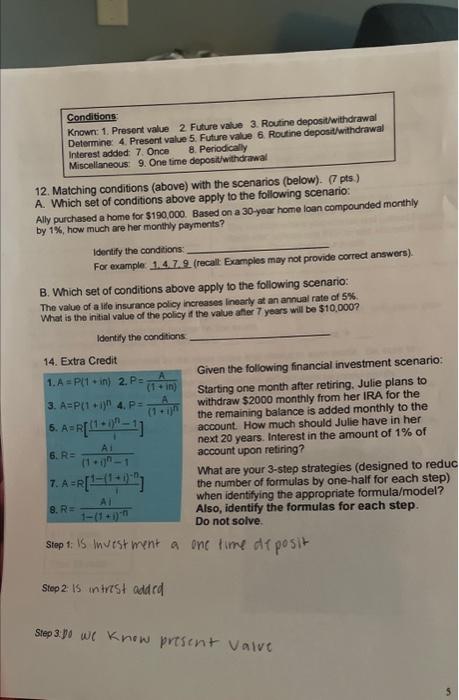

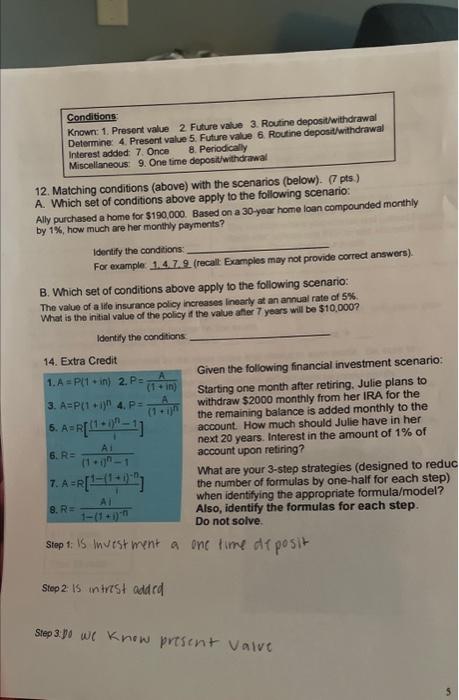

answer 12 A and B and 14 please! Known:1. Present value 2. Future value 3. Routine depositwithdrawal Conditions: Detemine: 4. Presont value 5. Future value

answer 12 A and B and 14 please!

Known:1. Present value 2. Future value 3. Routine depositwithdrawal Conditions: Detemine: 4. Presont value 5. Future value 6. Routine depost/withdrawal Interest added 7 . Once 8. Periodcally Miscelianeous: 9. One time deposithwithdrawal 12. Matching conditions (above) with the scenarios (below). (7 pts.) A. Which set of conditions above apply to the following scenario: Ally purchased a home for $190,000. Based on a 30 -year home loan compounded monthly by 1%, how much are her monthly payments? Identify the condtions: For example 1.4 .7 .2 (recall Examples moy not provide correct answers). B. Which set of conditions above apply to the following scenario: The value of a iffe insurance policy increases inearly at an annual rate of 5% What is the initial value of the policy if the value after 7 years will be $10,000 ? Identify the conditions 14. Extra Credit 1.A=P(1+in)Startingonemonthafterretiring,JulieplanstoG.P=(1+in)AGiventhefollowingfinancialinvestmentscenar 3. A=P(1+1)n4,P=(1+i)nA withdraw $2000 monthly from her IRA for the 5. A=R[1(1+1)n1] the remaining balance is added monthly to the 7. A=R[i1(1+i)n] What are your 3 -step strategies (designed to reduc 8. R= Ahen identifying the appropriate formula/model? Also, identify the formulas for each step. Do not solve. Step 1: is invest ment a one fime di posit Stop 2: is intrtst added

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started