Answered step by step

Verified Expert Solution

Question

1 Approved Answer

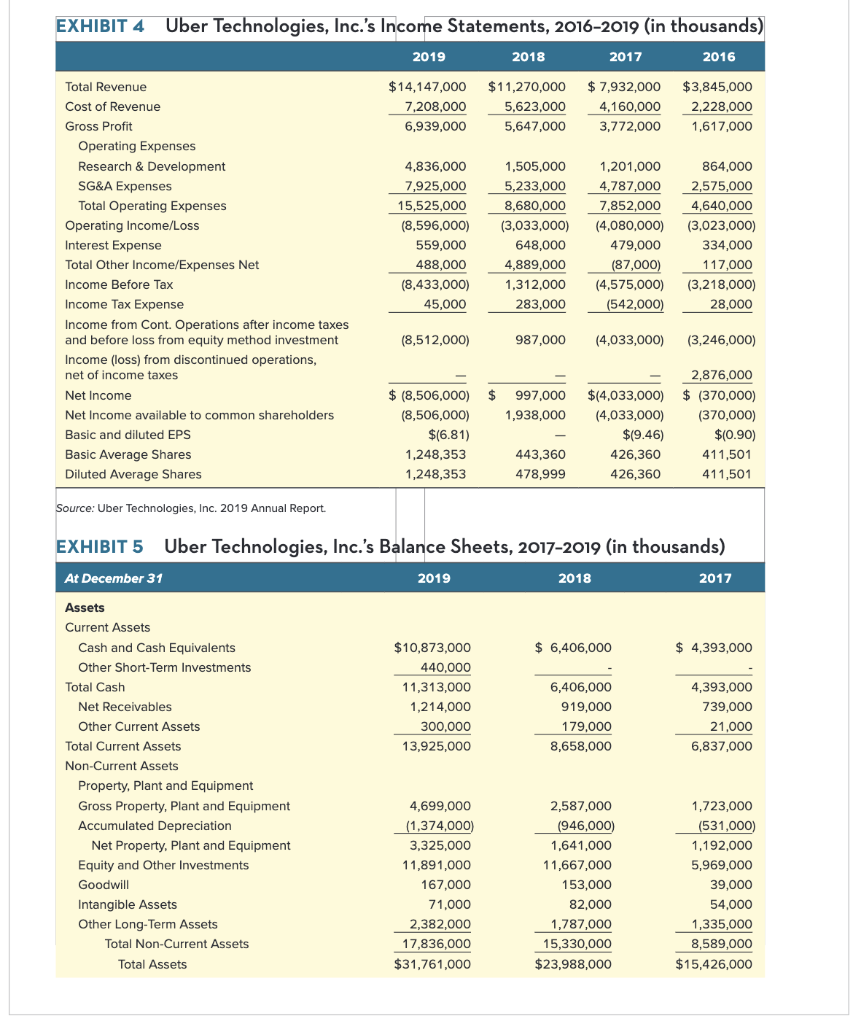

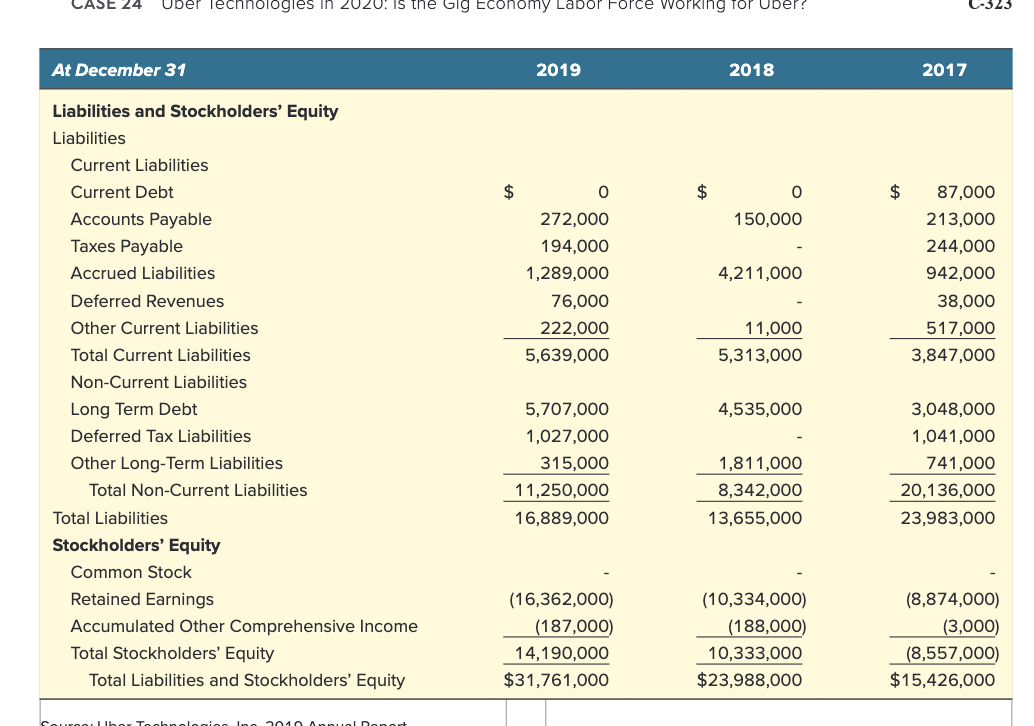

Can someone please calculate the financial ratios below based off the balance sheet/income statement 1. gross profit margin 2. operating profit margin 3. Return on

Can someone please calculate the financial ratios below based off the balance sheet/income statement

1. gross profit margin

2. operating profit margin

3. Return on equity

4. Earnings per share

EXHIBIT 4 Uber Technologies, Inc.'s Income Statements, 2016-2019 (in thousands) 2019 2018 2017 2016 $14,147,000 $11,270,000 $ 7,932,000 $3,845,000 Total Revenue Cost of Revenue 7,208,000 5,623,000 4,160,000 2,228,000 Gross Profit 6,939,000 5,647,000 3,772,000 1,617,000 Operating Expenses Research & Development 4,836,000 1,505,000 1,201,000 864,000 SG&A Expenses 7,925,000 5,233,000 4,787,000 2,575,000 Total Operating Expenses 15,525,000 8,680,000 7,852,000 4,640,000 Operating Income/Loss (8,596,000) (3,033,000) (4,080,000) (3,023,000) Interest Expense 559,000 648,000 479,000 334,000 Total Other Income/Expenses Net 488,000 4,889,000 (87,000) 117,000 Income Before Tax 1,312,000 (4,575,000) (8,433,000) 45,000 (3,218,000) 28,000 Income Tax Expense 283,000 (542,000) (8,512,000) 987,000 (4,033,000) (3,246,000) Income from Cont. Operations after income taxes and before loss from equity method investment Income (loss) from discontinued operations, net of income taxes 2,876,000 Net Income $(4,033,000) $ (8,506,000) $ 997,000 (8,506,000) $ (370,000) (370,000) Net Income available to common shareholders 1,938,000 (4,033,000) Basic and diluted EPS $(6.81) $(9.46) $(0.90) Basic Average Shares 1,248,353 443,360 426,360 411,501 Diluted Average Shares 1,248,353 478,999 426,360 411,501 Source: Uber Technologies, Inc. 2019 Annual Report. EXHIBIT 5 Uber Technologies, Inc.'s Balance Sheets, 2017-2019 (in thousands) At December 31 2019 2018 2017 Assets Current Assets Cash and Cash Equivalents $10,873,000 $6,406,000 $4,393,000 Other Short-Term Investments 440,000 Total Cash 11,313,000 6,406,000 4,393,000 Net Receivables 1,214,000 919,000 739,000 Other Current Assets 300,000 179,000 21,000 13,925,000 8,658,000 6,837,000 4,699,000 2,587,000 1,723,000 (1,374,000) (946,000) (531,000) 3,325,000 1,641,000 1,192,000 11,891,000 11,667,000 5,969,000 167,000 153,000 39,000 71,000 82,000 54,000 2,382,000 1,787,000 1,335,000 17,836,000 15,330,000 8,589,000 $31,761,000 $23,988,000 $15,426,000 Total Current Assets Non-Current Assets Property, Plant and Equipment Gross Property, Plant and Equipment Accumulated Depreciation Net Property, Plant and Equipment Equity and Other Investments Goodwill Intangible Assets Other Long-Term Assets Total Non-Current Assets Total Assets ASE 24 Uber Technologies in 2020: Is the Gig Economy Labor Force working for Uber? At December 31 2019 2018 Liabilities and Stockholders' Equity Liabilities Current Liabilities Current Debt 0 150,000 Accounts Payable Taxes Payable Accrued Liabilities 4,211,000 Deferred Revenues Other Current Liabilities 11,000 Total Current Liabilities 5,313,000 Non-Current Liabilities Long Term Debt 4,535,000 Deferred Tax Liabilities Other Long-Term Liabilities 1,811,000 Total Non-Current Liabilities 8,342,000 Total Liabilities 13,655,000 Stockholders' Equity Common Stock Retained Earnings (10,334,000) Accumulated Other Comprehensive Income (188,000) Total Stockholders' Equity 10,333,000 Total Liabilities and Stockholders' Equity $23,988,000 2010 Annual Report $ O 272,000 194,000 1,289,000 76,000 222,000 5,639,000 5,707,000 1,027,000 315,000 11,250,000 16,889,000 (16,362,000) (187,000) 14,190,000 $31,761,000 $ $ 2017 C-323 87,000 213,000 244,000 942,000 38,000 517,000 3,847,000 3,048,000 1,041,000 741,000 20,136,000 23,983,000 (8,874,000) (3,000) (8,557,000) $15,426,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started