Answered step by step

Verified Expert Solution

Question

1 Approved Answer

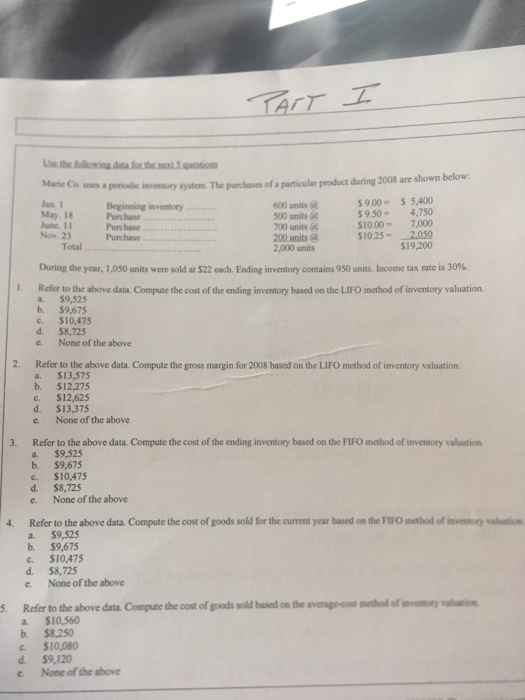

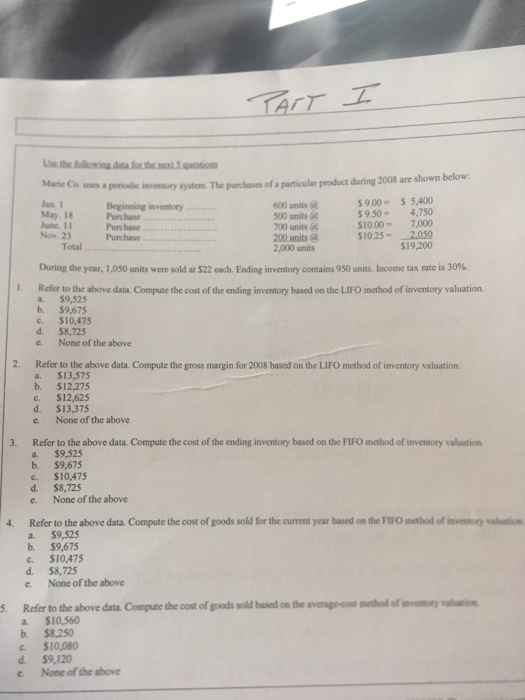

answer 1-8 the follewing data for sthe.next5 questions uses a periodic inventory system. The purchases of a particular product during 2008 are shown below: Jan

answer 1-8

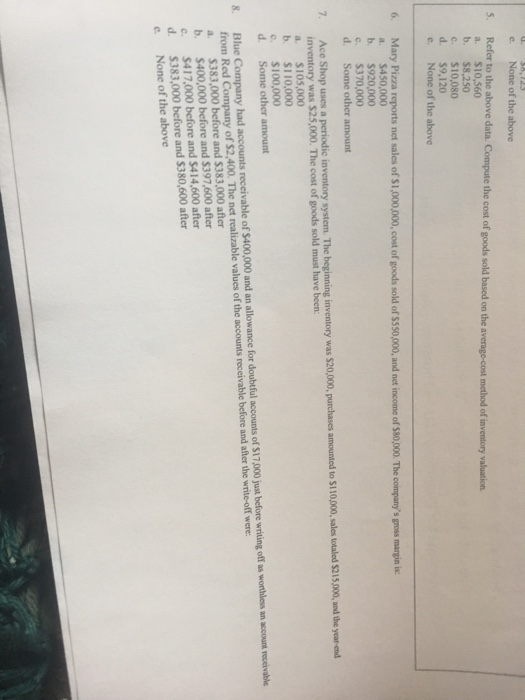

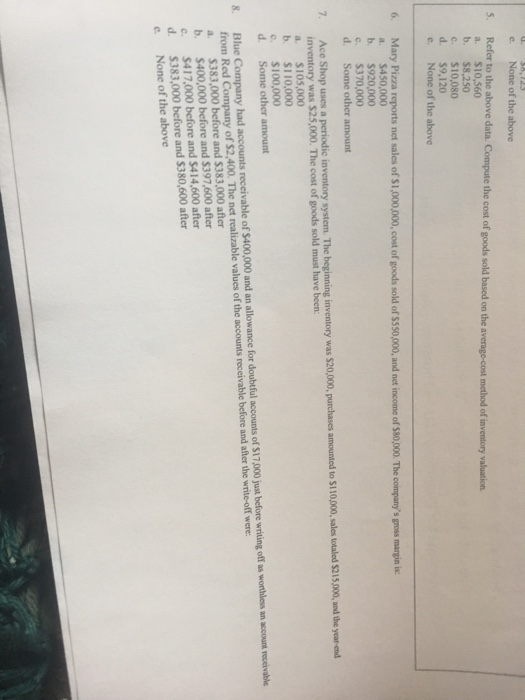

the follewing data for sthe.next5 questions uses a periodic inventory system. The purchases of a particular product during 2008 are shown below: Jan 1 May. 18 June. 11 Nov. 23 600 units G 500 units (@ 700 units (@ 200 units @ 2,000 units 59.00S 5,400 9.504,750 10.007,000 10.25-2.050 $19,200 Beginning inventory Purchase Purchase. Purchase Total During the year, 1,050 units were sold at $12 each. Ending inventory contains 950 units. Income tax rate is 30%, 1. Refer to the above data Compute the cost of the ending inventory based on the LIFO method of inventory valuation. $9,525 b. $9,675 c. $10,475 d. $8,725 e. None of the above 2. Refer to the above data. Compute the gross margin for 2008 based on the LIFO method of inventory valuation a. $13,575 b. $12,275 c. $12,625 d. $13,375 e. None of the above Refer to the above data. Compute the cost of the ending inventory based on the FIFO method of inventory valuation a, $9,525 b. $9,675 C. $10,475 d. $8,725 e. None of the above 3. 4. Refer to the above data. Compute the cost of goods sold for the current year based on the FIFO mcthod of inventory valuatice a. $9,525 b $9,675 c. $10,475 d. $8,725 e None of the above 5. Refer to the above data. Compute the cost of goods sold hased on the averago-cost method of nvny vtion a. $10,560 b. $8,250 $10,080 d $9,120 e. None of the above e. None of the above Refer to the a. $10,560 b. $8,250 c. $10,080 d. $9,120 e. None of the above S. above data. Compute the cost of goods sold based on the average-cost method of inventory valuation 6. Mary Pizza reports net sales of $1,000,000, cost of goods sold of $550,000, and net income of $80,000. The company's gross margin is: a. $450,000 b. $920,000 C. d. $370,000 Some other amount Ace Shop uses a periodic inventory system. The beginning inventory was $20,000, purchases amounted to $110,000, ales totaled $215,000, and the year-end inventory was $25,000. The cost of goods sold must have been a. $105,000 b. S110,000 c. $100,000 d. Some other amount off as worthles an account receivable from Red Company of $2,400. The net realizable values of the accounts receivable before and after the write-off were a. $383,000 before and $383,000 after b. $400,000 before and $397,600 after c. $417,000 before and $414,600 after d. $383,000 before and $380,600 after 8. Blue Company had accounts e None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started