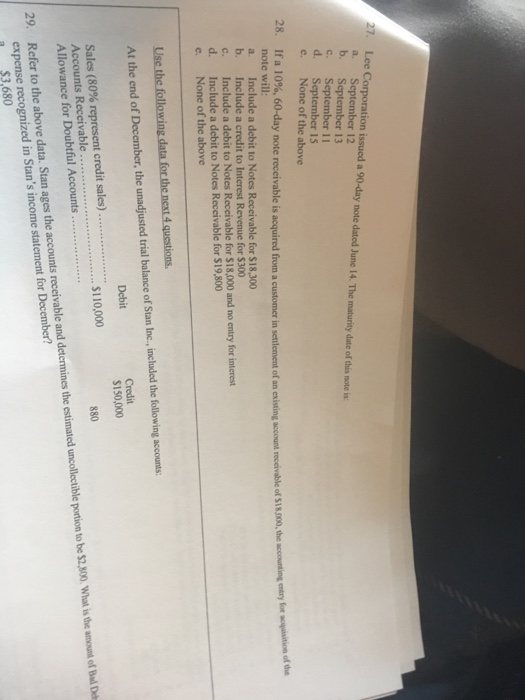

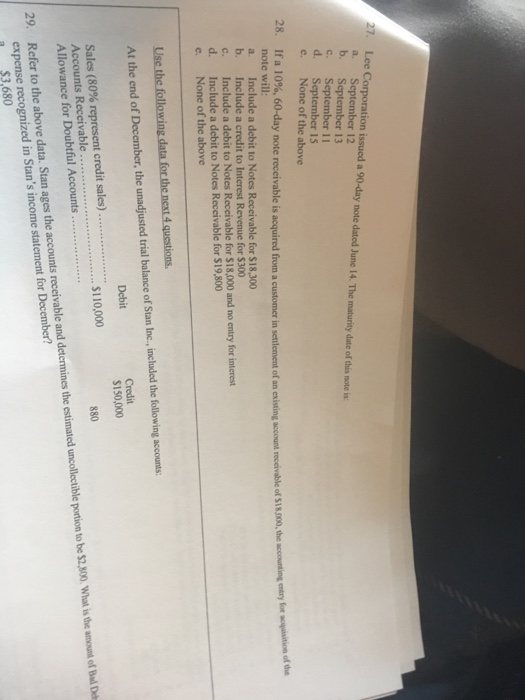

answer 27-35

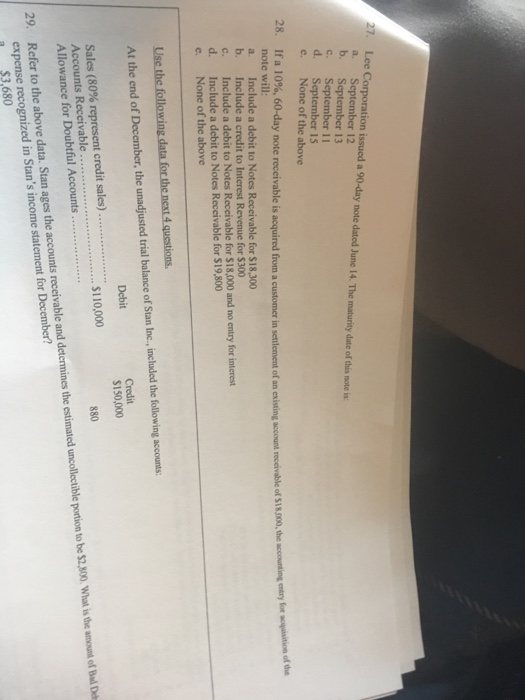

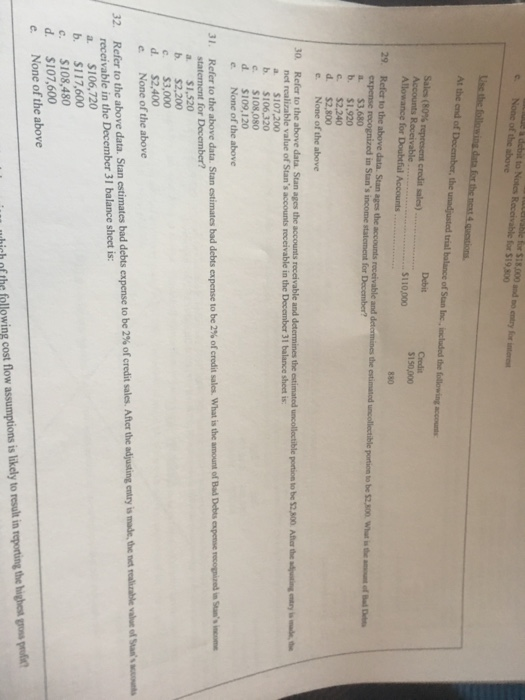

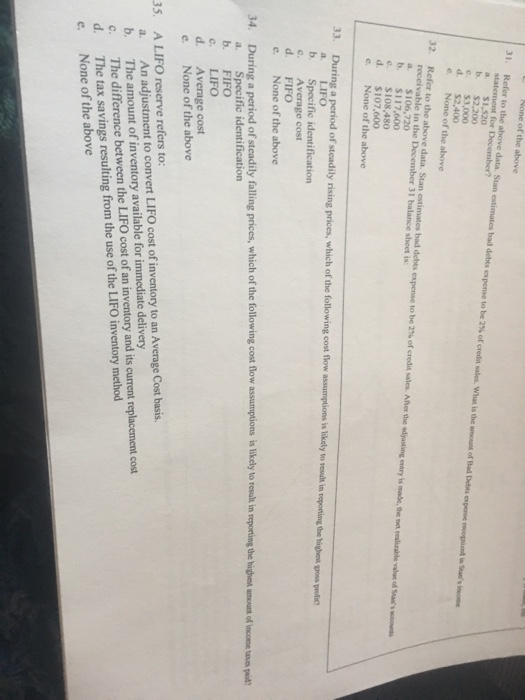

Corporation issued a 90-day note dated June 14. The maturity date of this note is a. September 12 b. September 13 c. September 11 d. September 15 e. None of the above 28. If a 10%, 60-day note recevable is acquired fo m a customer in settlement of an exitingaccount rec avalersi8,00 theac ting entry note will1: a. Include a debit to Notes Receivable for $18,300 b. Include a credit to Interest Revenue for $300 c. Include a debit to Notes Receivable for $18,000 and no entry for interest d. Include a debit to Notes Receivable for $19,800 e. None of the above At the end of December, the unadjusted trial balance of Stan Inc., inluded the following accounts: Credit S150,000 Debit Sales (80% represent credit sales) Accounts Receivable Allowance for Doubtful Accounts 110,000 880 29. Refer to the above data. Stan ages the accounts receivable and determines the estimated uncollectible portion to be $2,800, What is the amount of Bal Deh expense recognized in Stan's income statement for December? $3,680 for $19,800 Accounts Receivable Crodit $110,000 880 29. Refer to the above data. Stan ages the expense a. $3,680 b. $1,920 c. $2,240 d $2,800 e. None of the above net realizable value of Stan's accounts receivable in the December 31 balance sheet is a $107,200 b. $1 c. S108,08o d. $109,120 e None of the above Refer to the above data Stan estimates bad debts expense to be 2% oferodit sales. What is the ano unt od Bad Debts expe statement for December? 31 emp zed insane cm a. $1,520 b. $2,200 C. S3.000 d. $2,400 e None of the above Refer to the above data. Stan estimates bad debts expense to be 2% of credit sales. After the receivable in the December 31 balance sheet is a. $106,720 b. $117,600 c. $108,480 adjusting entry is made,the net realizable value of Stan'samma 32, d. $107,600 e None of the above hich of the following cost flow assumptions is likely to result in reporting the highes gross puc 31 Refer to the above data. Stan estimates bad debe, expense to be 2% of credit sales. a. $1,520 b. $2,200 What is the amount of Bad Debts espe se recopima su 'imme $3,000 . $2,400 e. None of the above 32 Refer to the above data. Stan estimates bad debts expense to be 2% of receivable in the December 31 balance sheet is a. $106,720 b. $117,600 credis sales. After the adjusting entry is mode, demet mirable value of Sarin c. $108,480 d. $107,600 e. None of the above 33. During a period of steadily rising prices, which of the following cost flow assumptions is likelyto result in reporting the ighe os a. LIFO b. Specific identification c. Average cost d. FIFO e None of the above 34. During a period of steadily falling prices, which of the following cost flow assumptions is likely to result in reporting the highest amoust of income tasues paid a. Specific identification b. FIFO c. LIFO d. Average cost e None of the above A LIFO reserve refers to: a. An adjustment to convert LIFO cost of inventory to an Average Cost basis b. The amount of inventory available for immediate delivery c. The difference between the LIFO cost of an inventory and its current replacement cost 35. d. The tax savings resulting from the use of the LIFO inventory method e. None of the above