Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER 3 4 7 A firm buys a piece of equipment for $113,959.00 and will straight-line depreciate it to zero over five years. If the

ANSWER 3 4 7

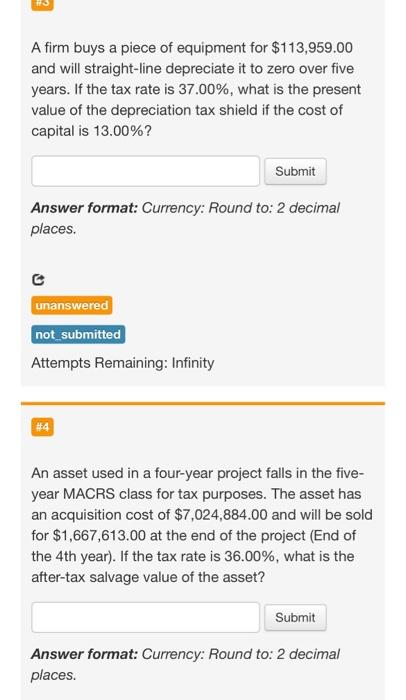

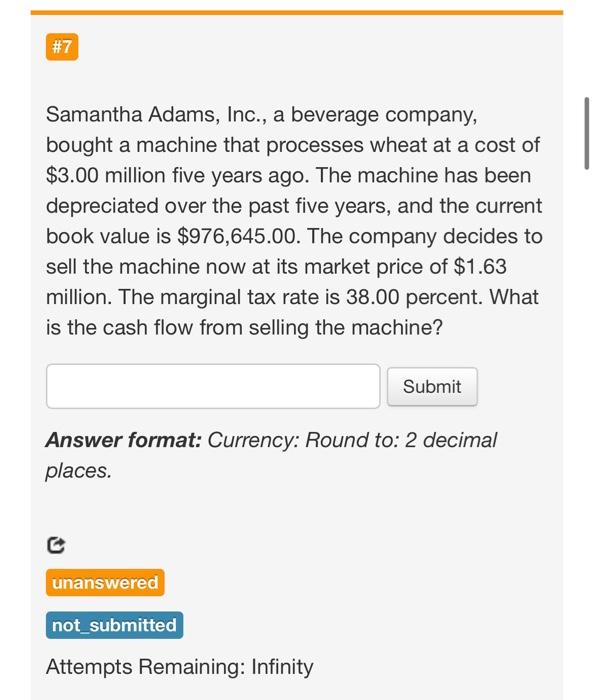

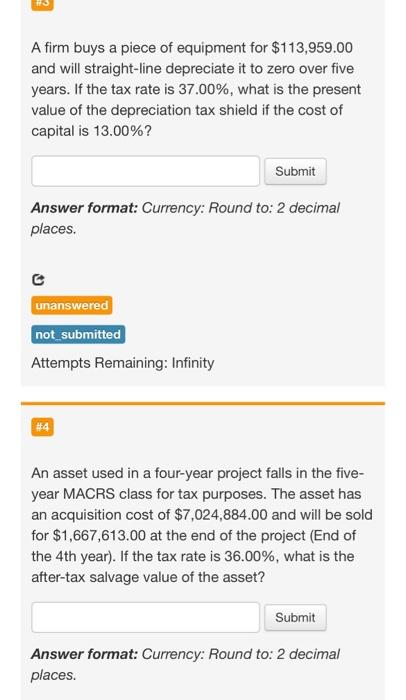

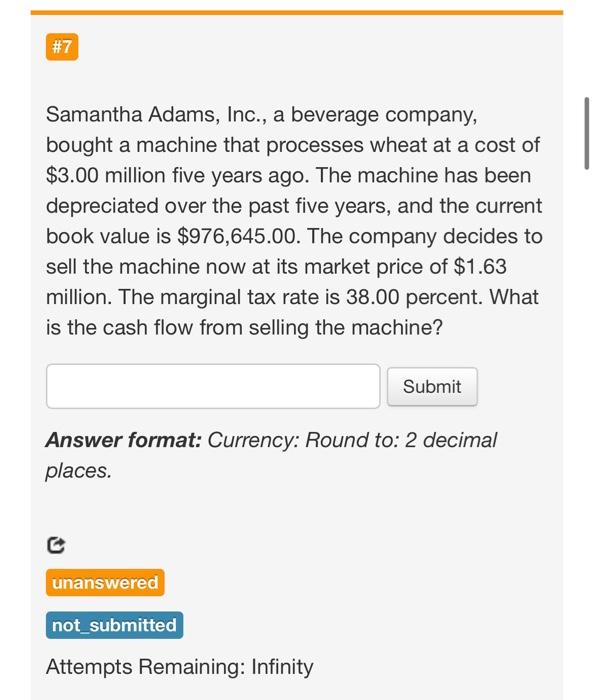

A firm buys a piece of equipment for $113,959.00 and will straight-line depreciate it to zero over five years. If the tax rate is 37.00%, what is the present value of the depreciation tax shield if the cost of capital is 13.00% ? Answer format: Currency: Round to: 2 decimal places. Attempts Remaining: Infinity An asset used in a four-year project falls in the fiveyear MACRS class for tax purposes. The asset has an acquisition cost of $7,024,884.00 and will be sold for $1,667,613.00 at the end of the project (End of the 4 th year). If the tax rate is 36.00%, what is the after-tax salvage value of the asset? Answer format: Currency: Round to: 2 decimal places. Samantha Adams, Inc., a beverage company, bought a machine that processes wheat at a cost of $3.00 million five years ago. The machine has been depreciated over the past five years, and the current book value is $976,645.00. The company decides to sell the machine now at its market price of $1.63 million. The marginal tax rate is 38.00 percent. What is the cash flow from selling the machine? Answer format: Currency: Round to: 2 decimal places. Attempts Remaining: Infinity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started