Answered step by step

Verified Expert Solution

Question

1 Approved Answer

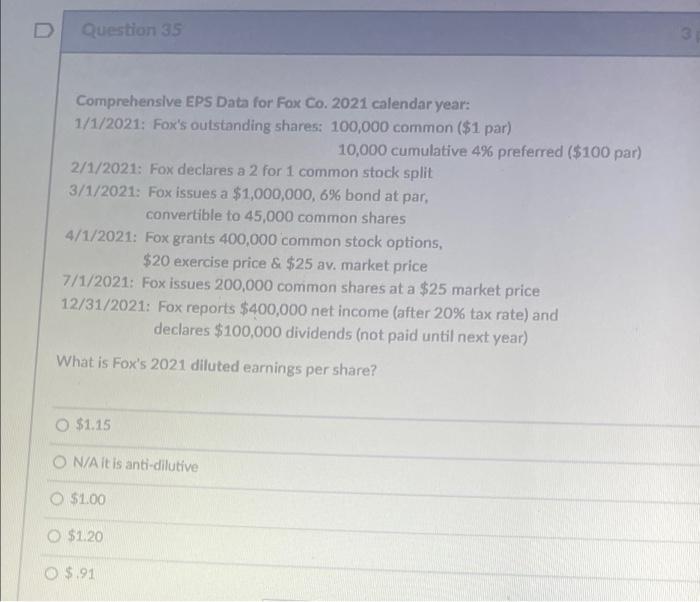

answer 35 & 36 D Question 35 3 Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par)

answer 35 & 36

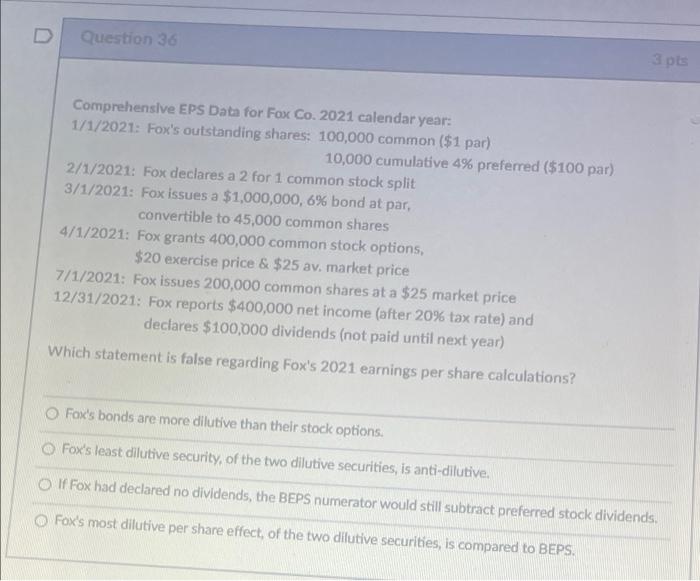

D Question 35 3 Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) What is Fox's 2021 diluted earnings per share? $1.15 O N/Altis anti-dilutive $1.00 $1.20 O $.91 D Question 30 3 pts Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) Which statement is false regarding Fox's 2021 earnings per share calculations? O Fox's bonds are more dilutive than their stock options. O Fox's least dilutive security of the two dilutive securities, is anti-dilutive If Fox had declared no dividends, the BEPS numerator would still subtract preferred stock dividends. O Fox's most dilutive per share effect of the two dilutive securities, is compared to BEPS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started