Answer 36 and 37

Answer 36 and 37

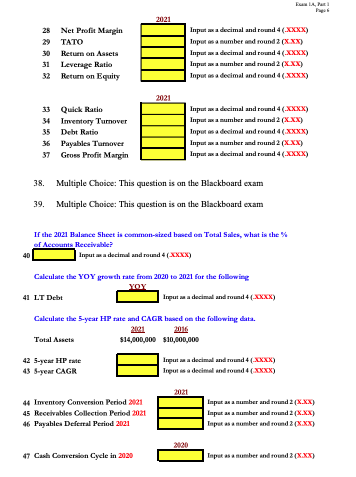

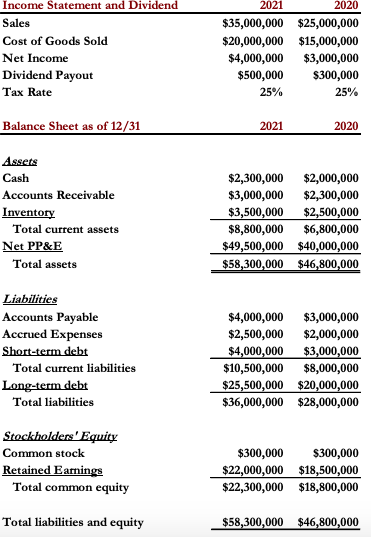

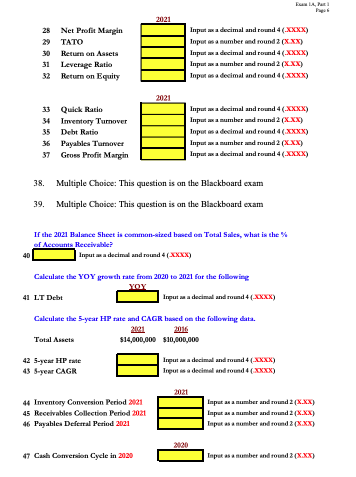

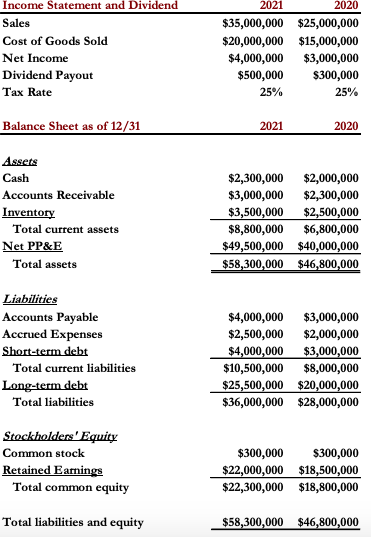

2021 28 Net Prolit Margin 29 TATO 30 Return on Assets 31 Leverage Ratio 32 Return on Equity Input a decimal and round 4 (XXXX) opet is a number and found 2 (X.XX) Input wa decimal and round 4 (.XXXX) Input wa mumber and round 2 (XXX) Input as a decimal and round 4 (XXXX) 2021 33 Quick Ratio 34 Inventory Tumover 35 Debt Ratio 36 Payables Tumover 37 Gross Profit Margin Input a decimal and round 4 (-XXXX) Input wa mumber and round 2 (XXX) Inpora a decimal and round 4 (XXXX) Input wa mumber and round 2 (XXX) Input a decimal and round 4 (-XXXX) 38. Multiple Choice: This question is on the Blackboard exam 39. Multiple Choice: This question is on the Blackboard exam If the 2021 Balance Sheet is common-sized based on Total Sales, what is the % of Accounts Receivable? Input a decimal and 4 (XXXX) 40 Caleulate the YOY growth rate from 2020 to 2021 for the following 41 LT Debt Input an a decimal and round 4 (XXXX) Calculate the 5-year HP rate and CAGR based on the following data. 2001 2016 Total Assets $14,000,000 $10,000,000 42 5-year HP rate 43 S-year CAGR Input a decimal and round 4 (XXX) liput sa decimal od tod 4.XXXX) 2021 44 Inventory Conversion Period 2021 45 Receivables Collection Period 2021 46 Payable Defesa Period 2021 Input as a number and round 2(X.XX) Input as a number and round 2(X.XX) Input as a number and found 2(X.XX) 2020 47 Cash Conversion Cycle in 2020 Input as a number and found 2(X.XX) Income Statement and Dividend Sales Cost of Goods Sold Net Income Dividend Payout Tax Rate 2021 2020 $35,000,000 $25,000,000 $20,000,000 $15,000,000 $4,000,000 $3,000,000 $500,000 $300,000 25% 25% Balance Sheet as of 12/31 2021 2020 Assets Cash Accounts Receivable Inventory Total current assets Net PP&E Total assets $2,300,000 $2,000,000 $3,000,000 $2,300,000 $3,500,000 $2,500,000 $8,800,000 $6,800,000 $49,500,000 $40,000,000 $58,300,000 $46,800,000 Liabilities Accounts Payable Accrued Expenses Short-term debt Total current liabilities Long-term debt Total liabilities $4,000,000 $3,000,000 $2,500,000 $2,000,000 $4,000,000 $3,000,000 $10,500,000 $8,000,000 $25,500,000 $20,000,000 $36,000,000 $28,000,000 Stockholders' Equity Common stock Retained Earnings Total common equity $300,000 $300,000 $22,000,000 $18,500,000 $22,300,000 $18,800,000 Total liabilities and equity $58,300,000 $46,800,000

Answer 36 and 37

Answer 36 and 37