Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 5 and 6 using the other answers provided On January 1, 2022 Elise and Marcos formed a company called Yard Rental, Inc. for the

answer 5 and 6 using the other answers provided

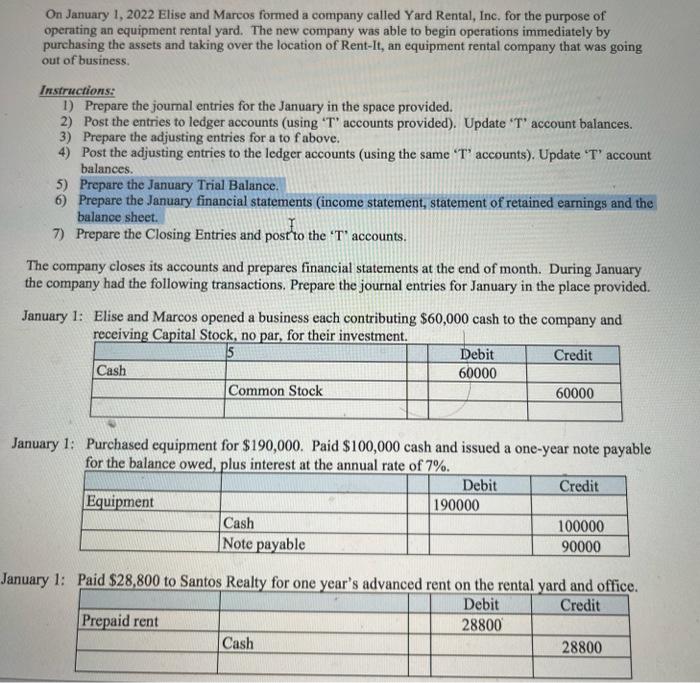

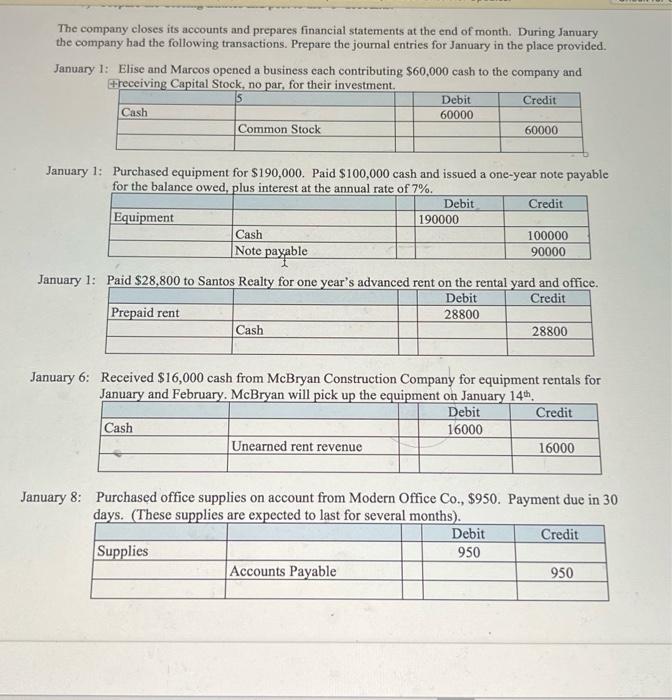

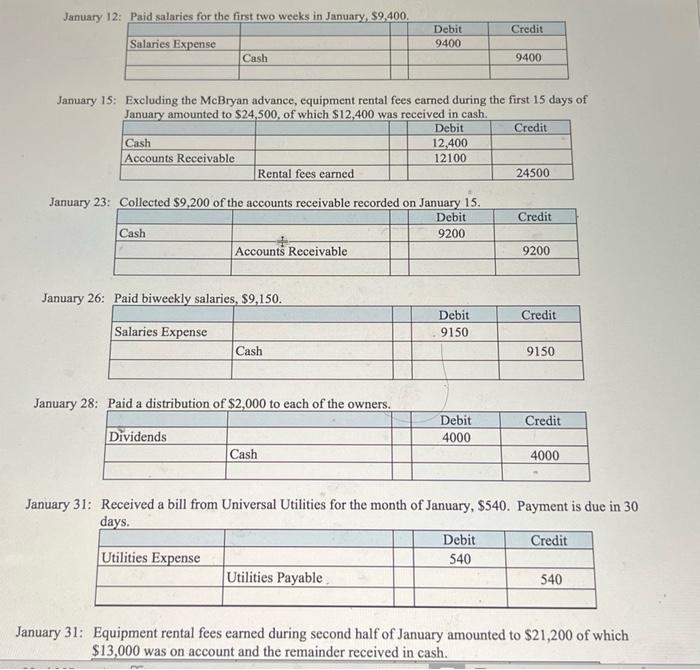

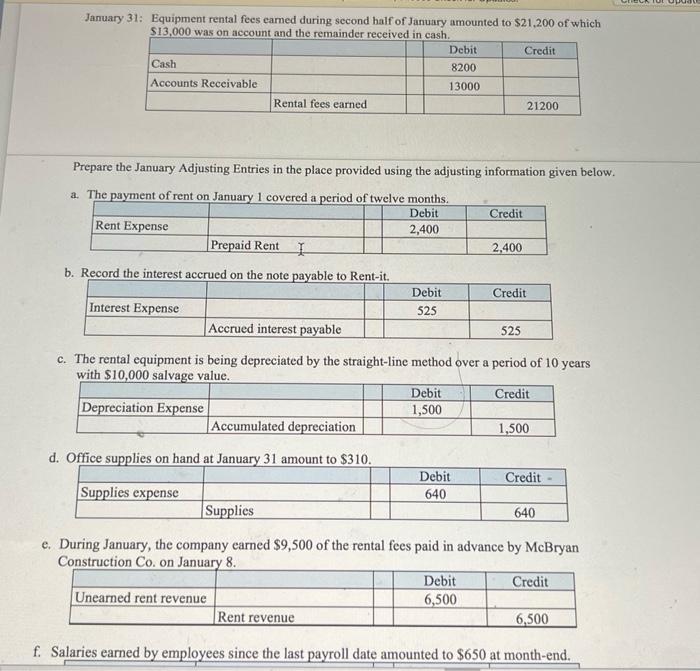

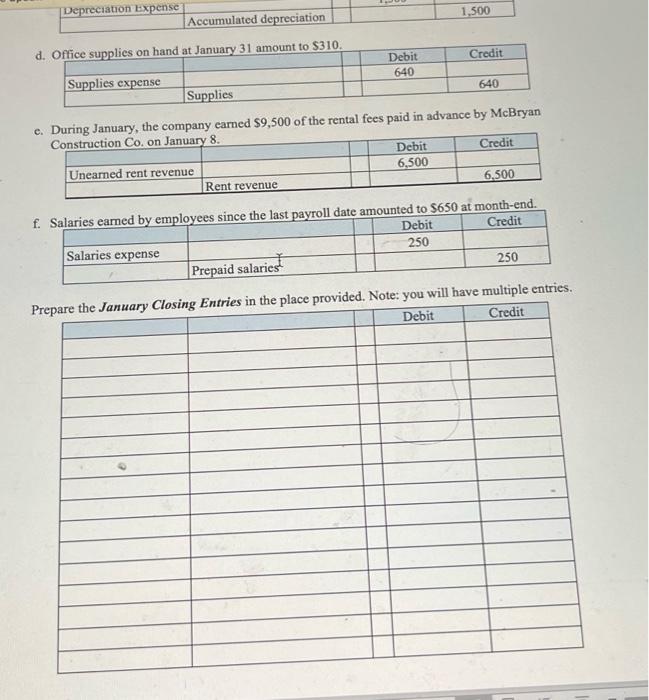

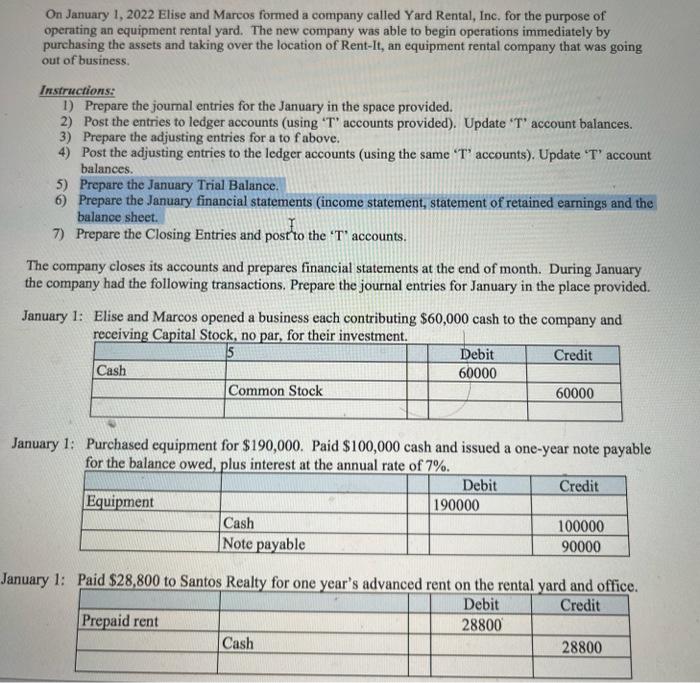

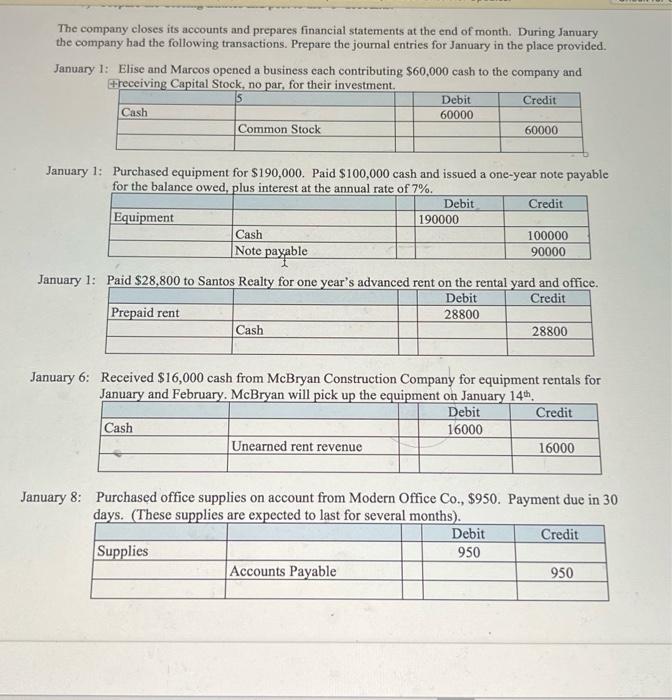

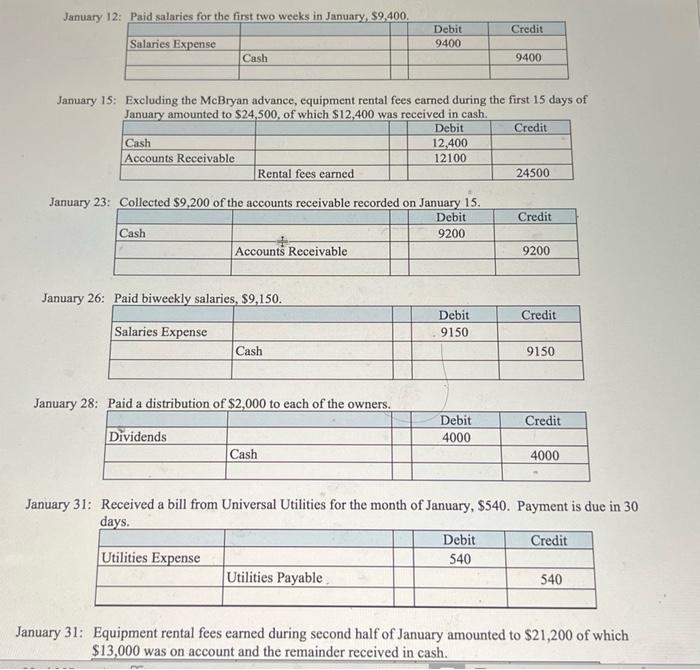

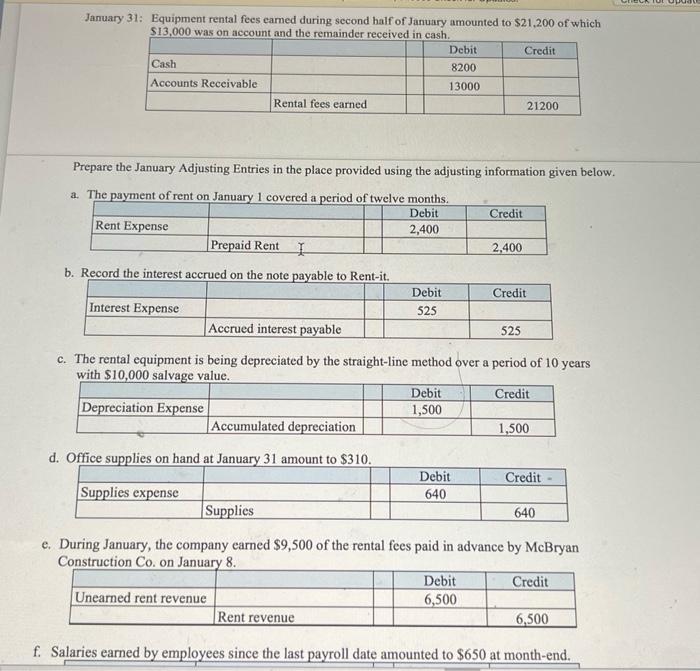

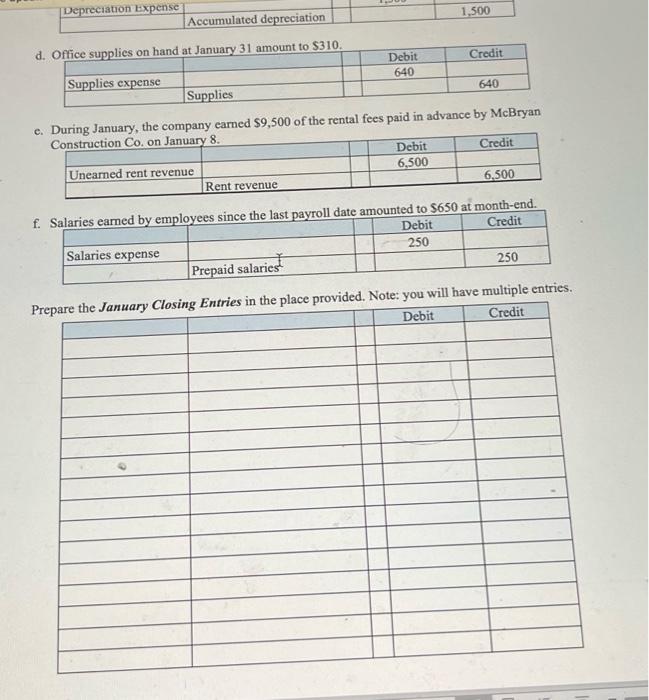

On January 1, 2022 Elise and Marcos formed a company called Yard Rental, Inc. for the purpose of operating an equipment rental yard. The new company was able to begin operations immediately by purchasing the assets and taking over the location of Rent-It, an equipment rental company that was going out of business. Instructions: 1) Prepare the joumal entries for the January in the space provided. 2) Post the entries to ledger accounts (using ' T ' accounts provided). Update ' T ' account balances. 3) Prepare the adjusting entries for a to fabove. 4) Post the adjusting entries to the ledger accounts (using the same 'T' accounts). Update 'T" account balances. 5) Prepare the January Trial Balance. 6) Prepare the January financial statements (income statement, statement of retained earnings and the balance sheet. 7) Prepare the Closing Entries and post'to the ' T ' accounts. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and receiving Canital Stock. no nar. for their investment anuary 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. uary 1: Paid $28,800 to Santos Realty for one year's advanced rent on the rental vard and office. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business cach contributing $60.000 cash to the company and wheceivino Canital Strak nn nar fir thair inuerwan. January 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. January 1: Paid \$28,800 to Santos Realty for one year's advanced rent on the rental yard and office. anuary 6: Received $16,000 cash from McBryan Construction Company for equipment rentals for January and Februarv. McBrvan will pick un the eauinment on Januarv 14 th nuary 8: Purchased office supplies on account from Modern Office Co., \$950. Payment due in 30 days. (These supplies are expected to last for several months). January 15: Excluding the McBryan advance, equipment rental fees carned during the first 15 days of Januarv amounted to $24.500. of which $12.400 was received in cash. January 23: Collected $9.200 of the accounts receivahle recorded on Januarv 15. January 28: Paid a distribution of $2.000 to each of the owners. January 31: Received a bill from Universal Utilities for the month of January, $540. Payment is due in 30 davs January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13,000 was on account and the remainder received in cash. January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13,000 was on account and the remainder received in eash Prepare the January Adjusting Entries in the place provided using the adjusting information given below. a. The pavment of rent on Iannary 1 onverad a nariod of wholwa manthen b. Record the interest accrued on the note navahle to Rant_it c. The rental equipment is being depreciated by the straight-line method over a period of 10 years with $10.000 salvage value. e. During January, the company earned $9,500 of the rental fees paid in advance by McBryan Construction C an Ianuaru 8 f. Salaries earned by employees since the last payroll date amounted to $650 at month-end. d. C e. Durino January, the company earned $9,500 of the rental fees paid in advance by McBryan f

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started