Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer 5-10 Present Value of an Annuity Finding the present value of an annuity is taking a number of equal payments from the future and

Answer 5-10

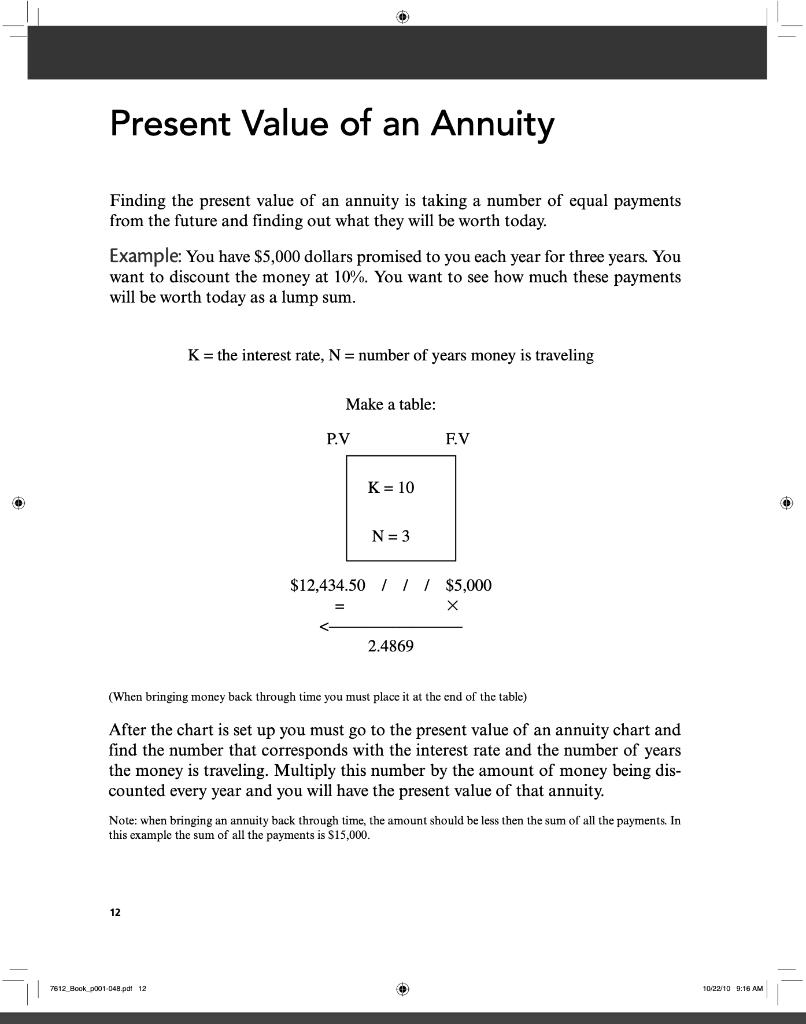

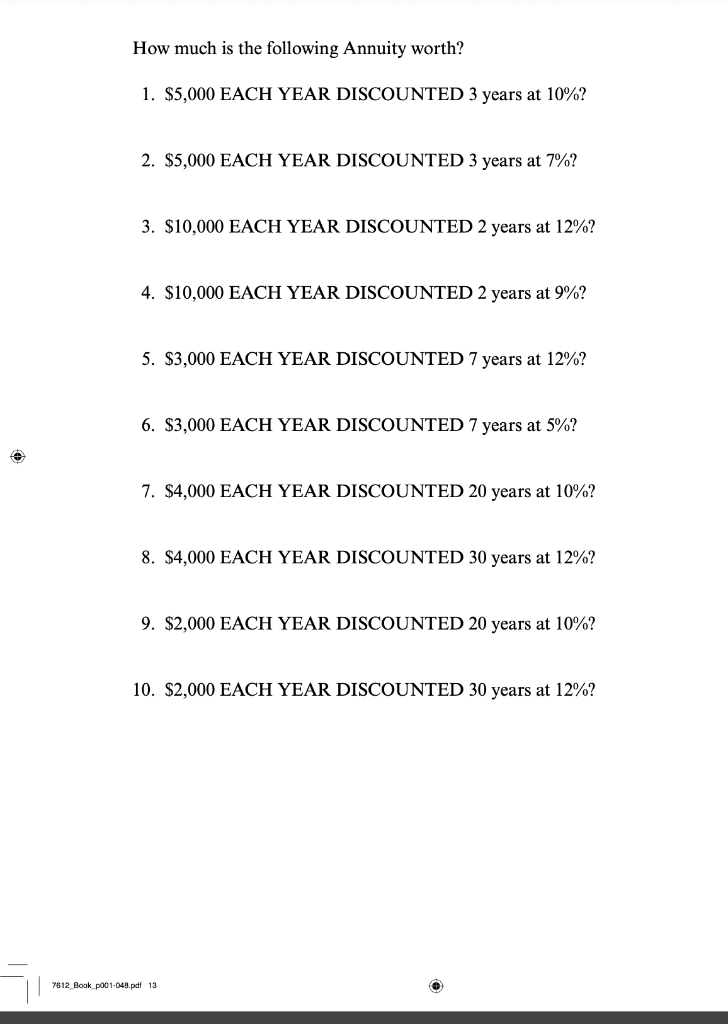

Present Value of an Annuity Finding the present value of an annuity is taking a number of equal payments from the future and finding out what they will be worth today. Example: You have $5,000 dollars promised to you each year for three years. You want to discount the money at 10%. You want to see how much these payments will be worth today as a lump sum. K = the interest rate, N = number of years money is traveling Make a table: P.V F.V K= 10 0 N = 3 $12,434.50 1 1 1 $5,000 x 2.4869 (When bringing money back through time you must place it at the end of the table) After the chart is set up you must go to the present value of an annuity chart and find the number that corresponds with the interest rate and the number of years the money is traveling. Multiply this number by the amount of money being dis- counted every year and you will have the present value of that annuity. Note: when bringing an annuity back through time, the amount should be less then the sum of all the payments. In this example the sum of all the payments is $15,000. 12 7612_Book_0001-04.pdf 12 10:23/10 9:16 AM How much is the following Annuity worth? 1. $5,000 EACH YEAR DISCOUNTED 3 years at 10%? 2. $5,000 EACH YEAR DISCOUNTED 3 years at 7%? 3. $10,000 EACH YEAR DISCOUNTED 2 years at 12%? 4. $10,000 EACH YEAR DISCOUNTED 2 years at 9%? 5. $3,000 EACH YEAR DISCOUNTED 7 years at 12%? 6. $3,000 EACH YEAR DISCOUNTED 7 years at 5%? 7. $4,000 EACH YEAR DISCOUNTED 20 years at 10%? 8. $4,000 EACH YEAR DISCOUNTED 30 years at 12%? 9. $2,000 EACH YEAR DISCOUNTED 20 years at 10%? 10. $2,000 EACH YEAR DISCOUNTED 30 years at 12%? 7612 Book po01-049.pdf 13Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started