Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 5-9 Use the following to answer questions 4 - 7 (Round answers to the nearest dollar) R Corp issues 4.4%, 10-year bonds with a

answer 5-9

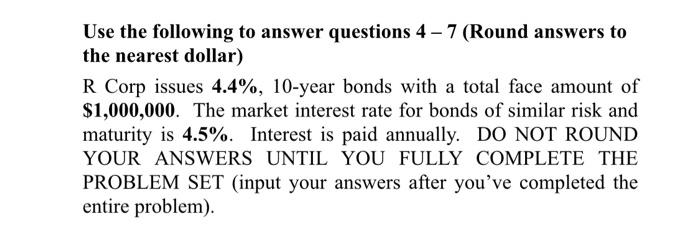

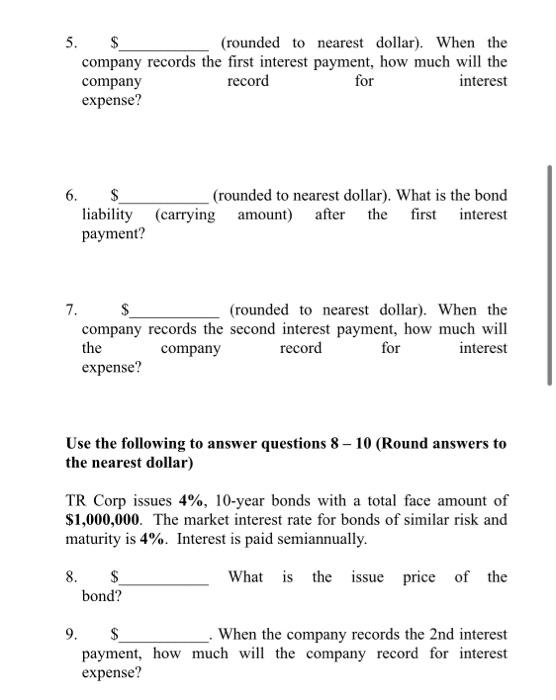

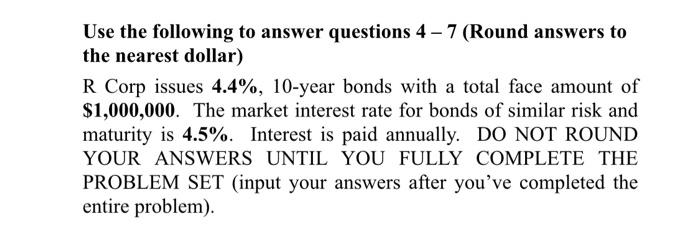

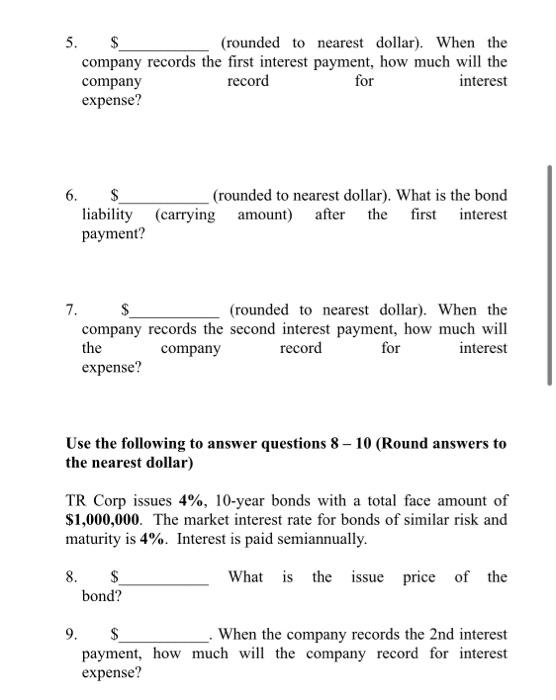

Use the following to answer questions 4 - 7 (Round answers to the nearest dollar) R Corp issues 4.4%, 10-year bonds with a total face amount of $1,000,000. The market interest rate for bonds of similar risk and maturity is 4.5%. Interest is paid annually. DO NOT ROUND YOUR ANSWERS UNTIL YOU FULLY COMPLETE THE PROBLEM SET (input your answers after you've completed the entire problem). 5. $ (rounded to nearest dollar). When the company records the first interest payment, how much will the company record for interest expense? 6. $ (rounded to nearest dollar). What is the bond liability (carrying amount) after the first interest payment? 7. $ (rounded to nearest dollar). When the company records the second interest payment, how much will the company record for interest expense? Use the following to answer questions 8-10 (Round answers to the nearest dollar) TR Corp issues 4%, 10-year bonds with a total face amount of $1,000,000. The market interest rate for bonds of similar risk and maturity is 4%. Interest is paid semiannually. 8. $ What is the issue price of the bond? 9. $ When the company records the 2nd interest payment, how much will the company record for interest expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started