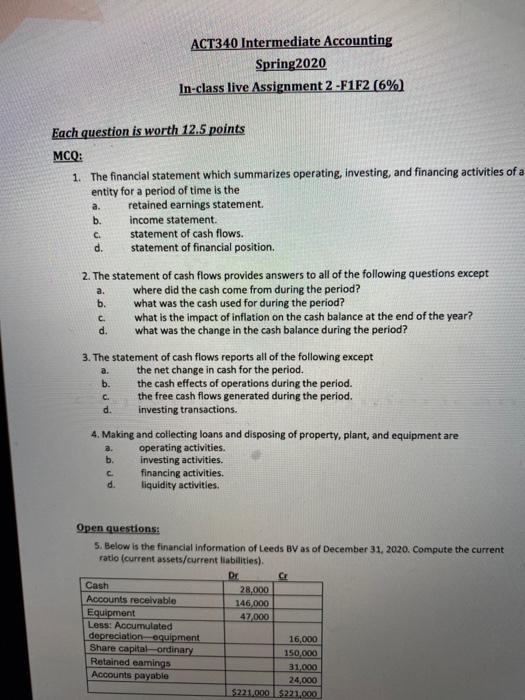

Answer: 6. Assuming that the Net cash provided by operating activities is $57,000, capital expenditures $21,500, dividends paid $13,000, compute free cash flow of Leeds BV for 2020. Answer: 7. Assuming that the Net cash provided by operating activities is $28,000, Current liabilities at the beginning of the year are $17,000, Current liabilities at the end of the year are $21,000, compute current cash Debt coverage ratio of Leeds BV in 2020 (Net Cash Provided by Operating Activities/Average Current Liabilities). Answer: 8. Cash balance at the beginning of the year was $148,000 and at the end of the year, it was $408,900. What was the net increase/decrease in cash? Answer: ACT340 Intermediate Accounting Spring2020 In-class live Assignment 2 -F1F2 (6%) C a. Each question is worth 12.5 points MCQ: 1. The financial statement which summarizes operating, investing, and financing activities of a entity for a period of time is the a. retained earnings statement. b. income statement statement of cash flows. d. statement of financial position. 2. The statement of cash flows provides answers to all of the following questions except where did the cash come from during the period? b. what was the cash used for during the period? c. what is the impact of inflation on the cash balance at the end of the year? d. what was the change in the cash balance during the period? 3. The statement of cash flows reports all of the following except the net change in cash for the period. the cash effects of operations during the period. the free cash flows generated during the period. d. investing transactions. 4. Making and collecting loans and disposing of property, plant, and equipment are operating activities b. investing activities. financing activities d. liquidity activities. a. b. C a. C Open questions: S. Below is the financial information of Leeds BV as of December 31, 2020. Compute the current ratio (current assets/current liabilities). Dr Cash 28,000 Accounts receivable 146,000 Equipment 47,000 Less: Accumulated depreciation equipment 16,000 Share capital ordinary 150,000 Retained earings 31.000 Accounts payable 24,000 $221.000 $221.000