Answered step by step

Verified Expert Solution

Question

1 Approved Answer

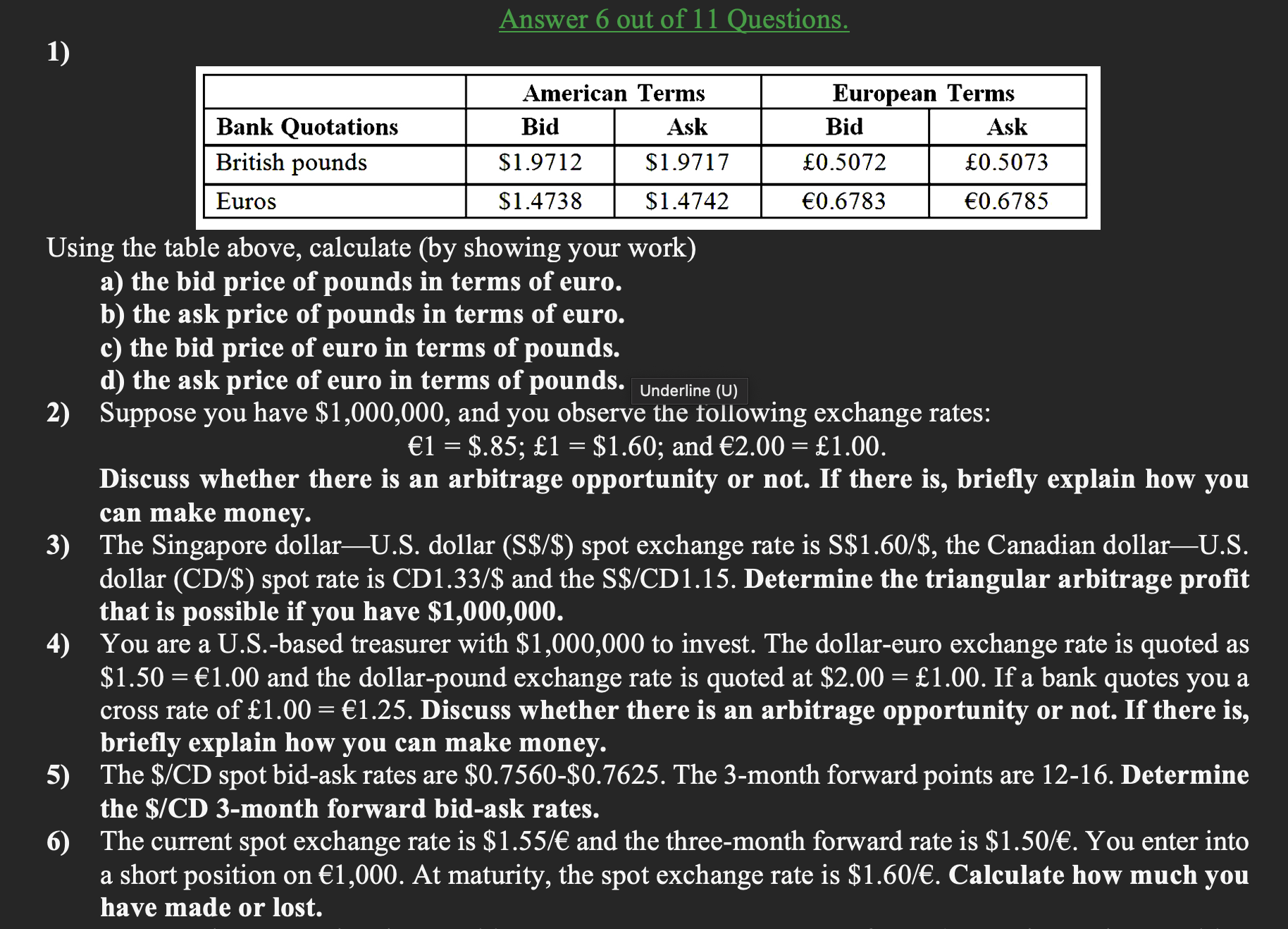

Answer 6 out of 11 Questions. 1) Using the table above, calculate (by showing your work) a) the bid price of pounds in terms of

Answer 6 out of 11 Questions. 1) Using the table above, calculate (by showing your work) a) the bid price of pounds in terms of euro. b) the ask price of pounds in terms of euro. c) the bid price of euro in terms of pounds. d) the ask price of euro in terms of pounds. Underline (U) 2) Suppose you have $1,000,000, and you observe the following exchange rates: 1=$.85;1=$1.60;and2.00=1.00. Discuss whether there is an arbitrage opportunity or not. If there is, briefly explain how you can make money. 3) The Singapore dollar-U.S. dollar (S\$/\$) spot exchange rate is S$1.60/$, the Canadian dollar-U.S. dollar (CD/\$) spot rate is CD1.33/\$ and the $/CD1.15. Determine the triangular arbitrage profit that is possible if you have $1,000,000. 4) You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as $1.50=1.00 and the dollar-pound exchange rate is quoted at $2.00=1.00. If a bank quotes you a cross rate of 1.00=1.25. Discuss whether there is an arbitrage opportunity or not. If there is, briefly explain how you can make money. 5) The $/CD spot bid-ask rates are $0.7560 - $0.7625. The 3-month forward points are 12 -16. Determine the \$/CD 3-month forward bid-ask rates. 6) The current spot exchange rate is $1.55/ and the three-month forward rate is $1.50/. You enter into a short position on 1,000. At maturity, the spot exchange rate is $1.60/. Calculate how much you have made or lost

Answer 6 out of 11 Questions. 1) Using the table above, calculate (by showing your work) a) the bid price of pounds in terms of euro. b) the ask price of pounds in terms of euro. c) the bid price of euro in terms of pounds. d) the ask price of euro in terms of pounds. Underline (U) 2) Suppose you have $1,000,000, and you observe the following exchange rates: 1=$.85;1=$1.60;and2.00=1.00. Discuss whether there is an arbitrage opportunity or not. If there is, briefly explain how you can make money. 3) The Singapore dollar-U.S. dollar (S\$/\$) spot exchange rate is S$1.60/$, the Canadian dollar-U.S. dollar (CD/\$) spot rate is CD1.33/\$ and the $/CD1.15. Determine the triangular arbitrage profit that is possible if you have $1,000,000. 4) You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as $1.50=1.00 and the dollar-pound exchange rate is quoted at $2.00=1.00. If a bank quotes you a cross rate of 1.00=1.25. Discuss whether there is an arbitrage opportunity or not. If there is, briefly explain how you can make money. 5) The $/CD spot bid-ask rates are $0.7560 - $0.7625. The 3-month forward points are 12 -16. Determine the \$/CD 3-month forward bid-ask rates. 6) The current spot exchange rate is $1.55/ and the three-month forward rate is $1.50/. You enter into a short position on 1,000. At maturity, the spot exchange rate is $1.60/. Calculate how much you have made or lost Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started