Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer #8 #9 #10 PRACTICE PROBLEMS The following information relates to Questions 1-10 Samuel & Sons is a fixed-income specialty firm that offers advisory services

Answer #8 #9 #10

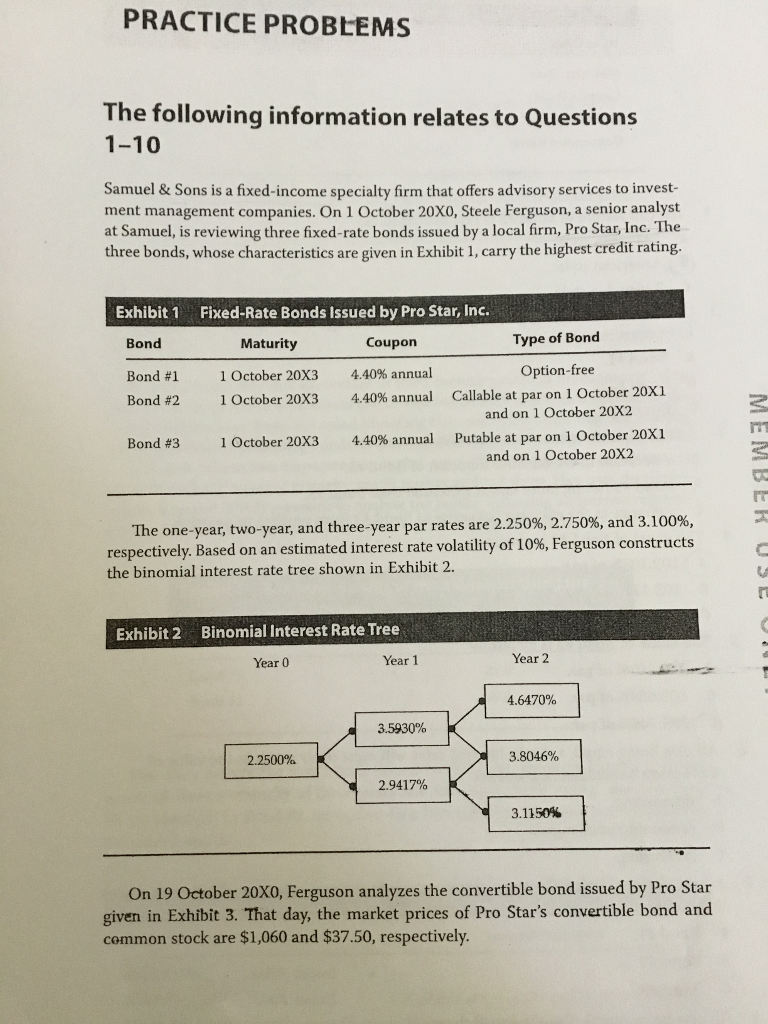

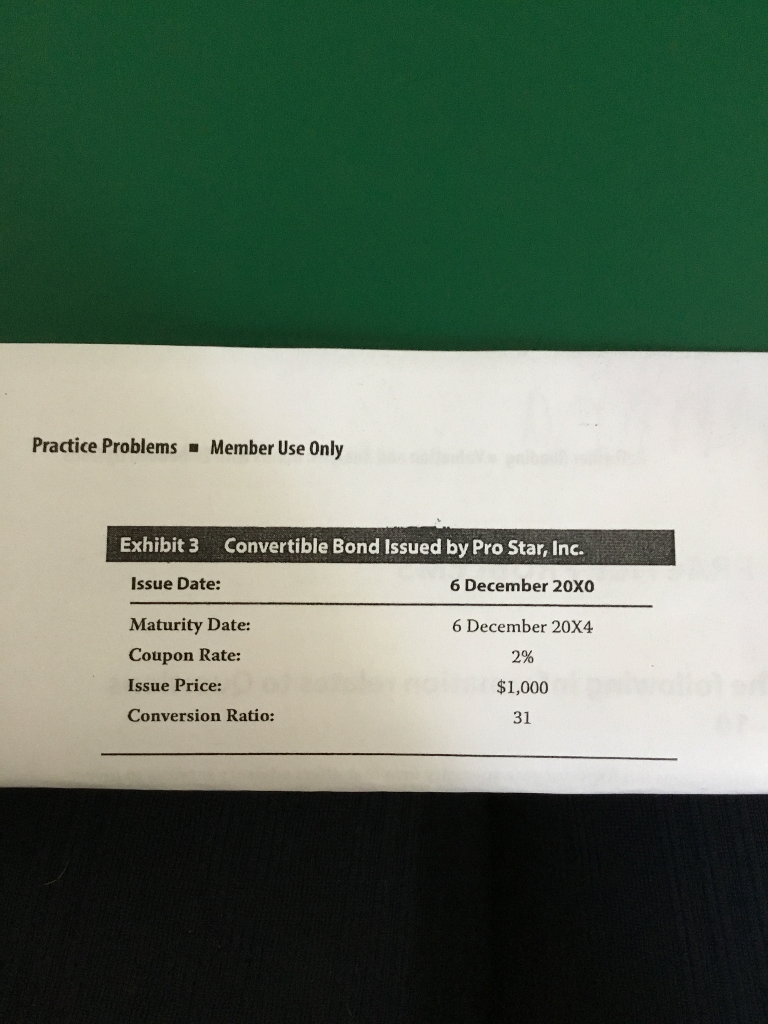

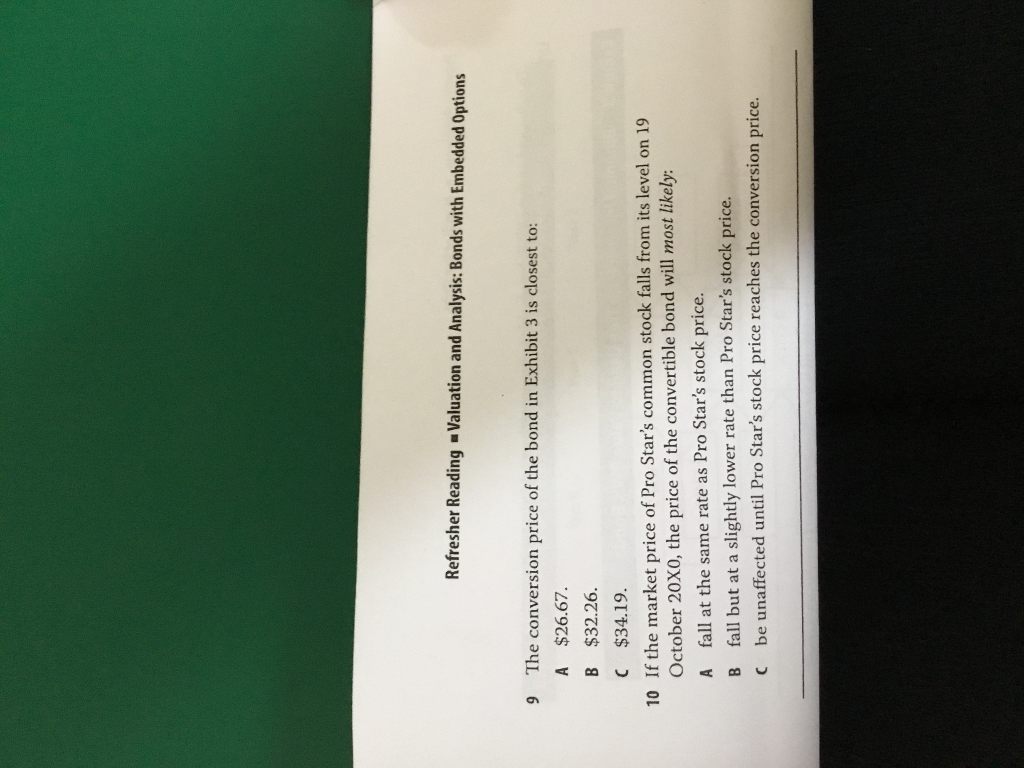

PRACTICE PROBLEMS The following information relates to Questions 1-10 Samuel & Sons is a fixed-income specialty firm that offers advisory services to invest- ment management companies. On 1 October 20XO, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating. Exhibit 1Fixed-Rate Bonds Issued by Pro Star, Inc. Bond Bond #1 Bond #2 Maturity 1 October 20X3 1 October 20X3 1 October 20X3 Coupon 440% annual 4.40% annual Type of Bond Option-free Callable at par on 1 October 20X1 and on 1 October 20X:2 4.40% annual Putable at par on 1 October 20X1 Bond #3 and on 1 October 20X2 The one-year, two-year, and three-year par rates are 2.250%, 2.750% and 3.100%, respectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the binomial interest rate tree shown in Exhibit 2. rt Exhibit 2 Binomial Interest Rate Tree Year 0 Year 1 Year 2 4.6470% 359A0% 2.2500% 3.8046% 2.9417% 3.1150% On 19 October 20X0, Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the market prices of Pro Star's convertible bond and common stock are $1,060 and $37.50, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started